Harris County, Texas Jury Instruction — Failure To File Tax Return Explained In Harris County, Texas, failing to file a tax return can lead to serious consequences. To ensure a fair trial, the court provides specific instructions to juries regarding the offense of failing to file a tax return. Known as Harris Texas Jury Instruction — Failure To File Tax Return, these guidelines help educate the jury on the nature of the offense, its elements, and potential penalties. There are various types of Harris Texas Jury Instruction — Failure To File Tax Return based on the severity of the offense or specific circumstances of the case. Some common variations include: 1. Harris Texas Jury Instruction — Failure To FilReturnerur— - General: This instruction provides a broad overview of the offense of failing to file a tax return. It outlines the elements that the prosecution must prove beyond a reasonable doubt, such as willfully and intentionally failing to file a tax return as required by law. It may also discuss the potential penalties upon conviction. 2. Harris Texas Jury Instruction — Failure To FilReturnerur— - Deficient or Fraudulent Return: This type of instruction addresses cases where a taxpayer filed a tax return that was either deficient or fraudulent. It explains that submitting an inaccurate or false return can be considered a willful failure to comply with tax laws. 3. Harris Texas Jury Instruction — Failure To FilReturnerur— - Repeated Failure: For individuals consistently failing to file tax returns over multiple years, this instruction highlights the ongoing nature of the offense. It emphasizes that a pattern of non-compliance can be indicative of willful intent. 4. Harris Texas Jury Instruction — Failure To FilReturnerur— - Willful Evasion: In instances where the prosecution alleges that the defendant willfully evaded their tax responsibilities, this instruction clarifies the additional elements required to establish this charge. It may touch upon deliberate actions taken by the defendant to hide income, assets, or manipulate financial records to avoid paying taxes. It is important for jurors to carefully consider all the evidence presented in court and apply the relevant Harris Texas Jury Instructions to come to an informed verdict. Furthermore, it should be noted that these instructions are subject to the judge's discretion and may vary from case to case. Overall, Harris Texas Jury Instruction — Failure To File Tax Return plays a vital role in shaping the jury's understanding of the offense, its different variations, and the legal implications involved.

Harris Texas Jury Instruction - Failure To File Tax Return

Description

How to fill out Harris Texas Jury Instruction - Failure To File Tax Return?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Harris Jury Instruction - Failure To File Tax Return meeting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Harris Jury Instruction - Failure To File Tax Return, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Harris Jury Instruction - Failure To File Tax Return:

- Examine the content of the page you’re on.

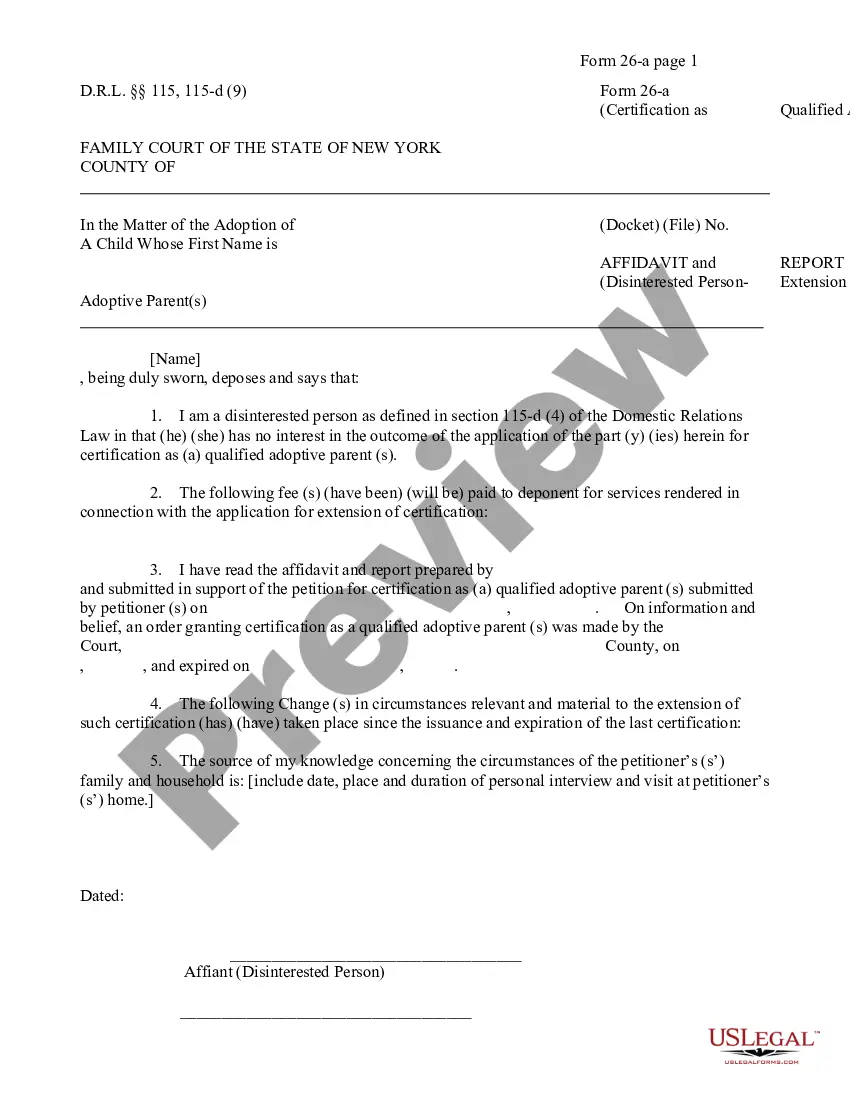

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Jury Instruction - Failure To File Tax Return.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!