Orange California Jury Instruction — Failure To File Tax Return is a legal instruction given to the jury in a court case that involves a defendant who has been charged with the crime of failing to file a tax return to Orange, California. This instruction provides guidance to the jury regarding the elements of the offense, the burden of proof, and the potential penalties associated with this crime. In Orange, California, there may be different types of jury instructions related to failure to file tax returns, each addressing specific circumstances or aspects of the offense. Some of these instructions may include: 1. "Simple Failure To File Tax Return": This instruction is used when the defendant is accused of intentionally and willfully failing to file their tax return within the prescribed timeframe, without any additional allegations or complicating factors. 2. "Failure To File Tax Return with Intent to Evade Taxes": This instruction applies when the prosecution alleges that the defendant not only failed to file their tax return but also did so with the specific intent to evade paying taxes owed. It requires the jury to consider the defendant's state of mind and their deliberate actions to avoid fulfilling their tax obligations. 3. "Conspiracy to Fail To File Tax Return": This instruction comes into play when multiple individuals are charged with a conspiracy to commit the offense of failure to file tax returns. It guides the jury on how to evaluate the evidence and determine each defendant's culpability in the alleged conspiracy. 4. "Corporate Failure To File Tax Return": This instruction is relevant when a corporation or business entity is charged with the failure to file a tax return. It outlines the legal responsibilities of corporate entities and addresses issues unique to corporate tax obligations. The Orange California Jury Instruction — Failure To File Tax Return is vital in ensuring that the jury understands the specific legal elements and requirements of this offense. It clarifies the burden of proof on the prosecution and sets the stage for the jury to make an informed decision based on the evidence presented during the trial.

Orange California Jury Instruction - Failure To File Tax Return

Description

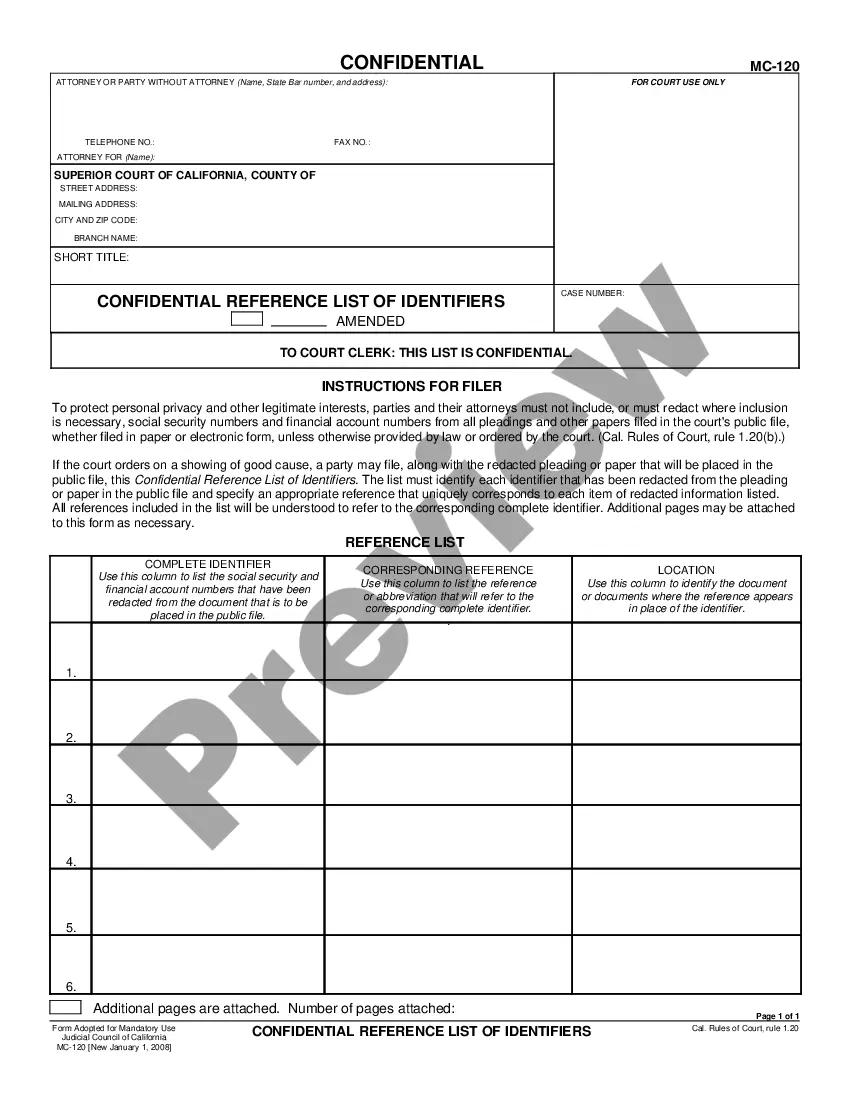

How to fill out Orange California Jury Instruction - Failure To File Tax Return?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Orange Jury Instruction - Failure To File Tax Return, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the current version of the Orange Jury Instruction - Failure To File Tax Return, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Jury Instruction - Failure To File Tax Return:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Orange Jury Instruction - Failure To File Tax Return and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!