Philadelphia, Pennsylvania is a bustling city that serves as the economic and cultural hub of the state. Home to a diverse population and a rich history, Philadelphia offers a variety of attractions and opportunities for residents and visitors alike. In this article, we will delve into the details of the Philadelphia Pennsylvania Jury Instruction — Aiding And Abetting Filing False Return, exploring its implications and potential variations. The Philadelphia Pennsylvania Jury Instruction — Aiding And Abetting Filing False Return is a legal instruction provided to jurors in cases involving individuals who have been charged with aiding and abetting the filing of a false tax return. This type of offense typically involves assisting another person in knowingly providing false information or misrepresenting financial records when filing their tax returns. Jurors who receive this instruction are expected to carefully consider the evidence presented in the case and determine whether the defendant actively and intentionally played a role in aiding and abetting the filing of a false return. Factors such as the defendant's knowledge of the false information, their participation in the act, and their intent to deceive the tax authorities are crucial in making a fair and informed decision. While there may not be different types of Philadelphia Pennsylvania Jury Instruction — Aiding And Abetting Filing False Return, there can be variations in specific cases based on the unique circumstances and details involved. For example, different individuals or entities may be involved in the false return, such as businesses, partnerships, or individuals acting alone. Additionally, the potential penalties and consequences may vary depending on the severity of the offense and the amount of money involved in the fraudulent activity. Cases involving the aiding and abetting filing of a false return are taken seriously by the Philadelphia legal system, as they undermine the integrity of the tax system and can result in significant financial losses for the government. Therefore, it is essential for jurors to carefully evaluate the evidence and apply the given jury instruction appropriately. In conclusion, the Philadelphia Pennsylvania Jury Instruction — Aiding And Abetting Filing False Return provides guidance to jurors when dealing with cases involving individuals who assisted in the filing of false tax returns knowingly. Understanding the implications of this instruction and considering the specific circumstances of each case is crucial for achieving a fair and just verdict.

Philadelphia Pennsylvania Jury Instruction - Aiding And Abetting Filing False Return

Description

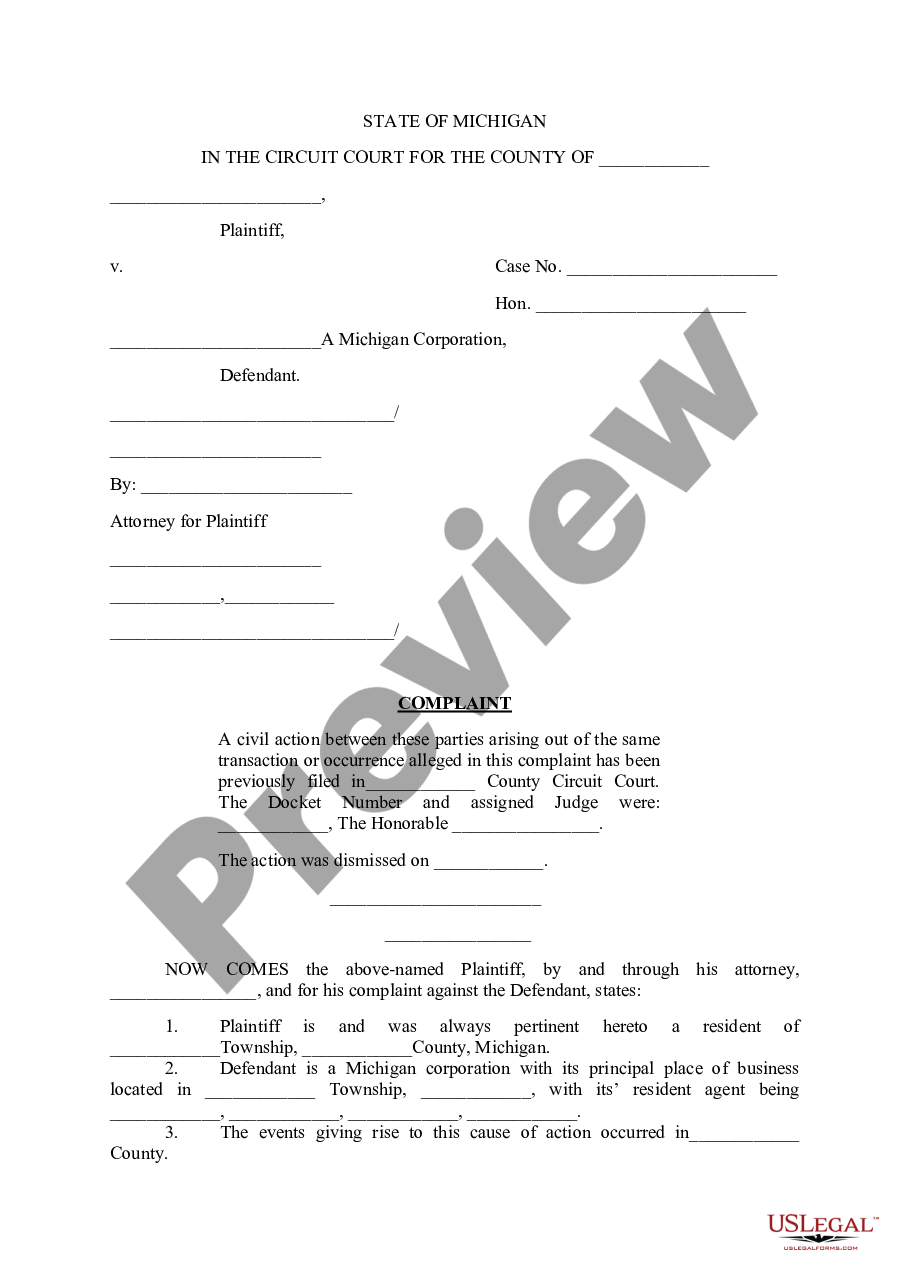

How to fill out Philadelphia Pennsylvania Jury Instruction - Aiding And Abetting Filing False Return?

Do you need to quickly create a legally-binding Philadelphia Jury Instruction - Aiding And Abetting Filing False Return or probably any other form to take control of your personal or business matters? You can go with two options: hire a professional to draft a legal paper for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Philadelphia Jury Instruction - Aiding And Abetting Filing False Return and form packages. We provide documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, carefully verify if the Philadelphia Jury Instruction - Aiding And Abetting Filing False Return is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Philadelphia Jury Instruction - Aiding And Abetting Filing False Return template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Tax evasion is a risky crime, a felony, punishable by five years imprisonment and a $250,000 fine. Incarceration may include prison time, home confinement, electronic monitoring or a combination. Some return preparers have been convicted of, or have pleaded guilty to, felony charges.

Lying on your tax returns can result in fines and penalties from the IRS, and can even result in jail time.

The Failure to File Penalty will max out after five months. After 60 days, you'll owe a minimum Failure to File Penalty of $435, or "100% of the tax required to be shown on the return, whichever is less," according to the IRS.

Under federal law, you can face up to a year in jail and up to $25,000 in fines for not filing your return. The penalties are even stricter if you commit fraud. However, you cannot go to jail just for owing taxes.

Willful failure to file a tax return is a misdemeanor pursuant to IRC 7203. In cases where an overt act of evasion occurred, willful failure to file may be elevated to a felony under IRC 7201.

You could face civil penalties. Penalties will vary based on how much your understated your tax. If you made a simple error and the IRS adjusted it, you might not have to pay any penalty.

Failing to file a tax return can be classified as a federal crime punishable as a misdemeanor or a felony. Willful failure to file a tax return is a misdemeanor pursuant to IRC 7203.

Claiming false deductions or dependents is considered tax evasion and is therefore a felony. Claiming false deductions or dependents means filing for a deduction without actually meeting its requirements.

You should be filing your tax returns when they are due, the IRS does not "allow" anyone up to two years without imposing a penalty. If you are due a refund there is no penalty for filing a late Federal return, but you have to file your return within 3 years of the original filing date of the return to claim a refund.

Filing a false return is a less serious felony than tax evasion that carries a maximum prison term of three years and a maximum fine of $100,000. (Internal Revenue Code § 7206 (1).) Failure to file a tax return. Not filing a return is the least serious tax crime.