Fairfax Virginia Jury Instruction — False Tax Return refers to a set of guidelines provided to jurors during the trial of a case involving charges related to the submission of fraudulent or false tax returns within the jurisdiction of Fairfax, Virginia. These jury instructions provide clarity and guidance to the jurors on how they should evaluate the evidence presented and how they should apply the relevant laws in order to reach a fair and just verdict. When it comes to False Tax Return cases, there might be different types of Fairfax Virginia Jury Instructions that could be given to the jury, depending on the specific circumstances and charges involved in the case. Some possible variations of these instructions could include: 1. General Instruction on False Tax Return: This instruction provides a comprehensive overview of the elements of a false tax return offense, including the knowledge or intent requirement, the importance of accurate reporting, and the potential consequences of filing fraudulent returns. 2. Instruction on Willful Intent: This instruction focuses on the element of willful intent, emphasizing that the prosecution must prove beyond a reasonable doubt that the defendant knowingly and intentionally filed a false tax return with the intention to deceive the government. 3. Instruction on Materiality: This instruction pertains to the requirement that the false information provided in the tax return must be material, meaning that it is relevant and has the potential to impact the calculation of taxes owed. 4. Instruction on Reasonable Doubt: This instruction reminds jurors that the burden of proof lies with the prosecution and that they should only convict the defendant if there is no reasonable doubt regarding their guilt. 5. Instruction on Affirmative Defenses: In some cases, the defendant may raise affirmative defenses, such as the lack of willful intent, mistake, or reliance on professional advice. This instruction informs the jury about the applicable defenses and the burden of proof on the defendant to establish their validity. 6. Instruction on Penalties: This instruction educates jurors about the potential penalties associated with a false tax return conviction, including fines, restitution, and possible imprisonment. It may also provide guidance on how these penalties should be considered during the jury's deliberations. Overall, Fairfax Virginia Jury Instruction — False Tax Return serves as a vital tool for the jury in understanding the specific legal principles and elements that must be proven beyond a reasonable doubt in order to convict a defendant of filing a false tax return.

Fairfax Virginia Jury Instruction - False Tax Return

Description

How to fill out Fairfax Virginia Jury Instruction - False Tax Return?

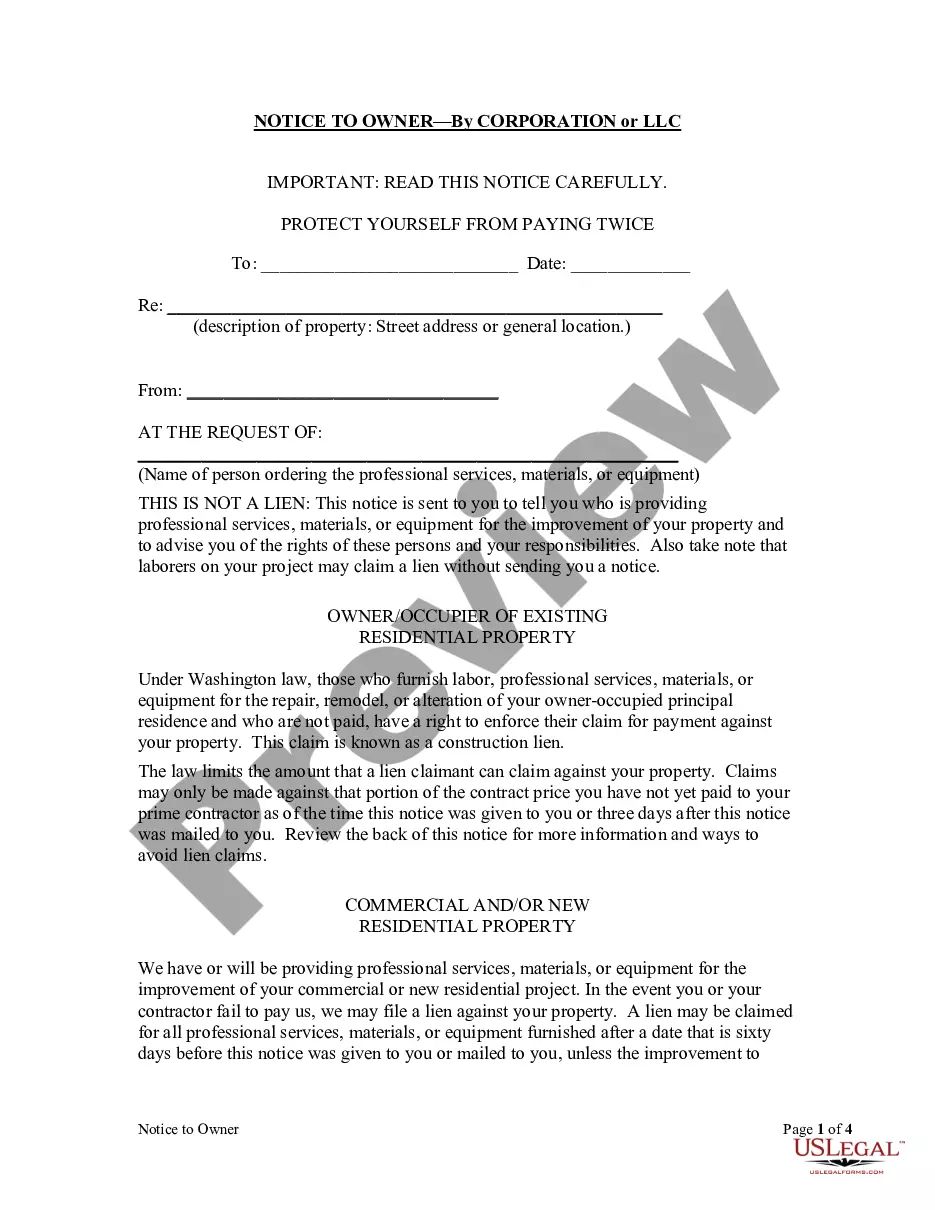

Do you need to quickly create a legally-binding Fairfax Jury Instruction - False Tax Return or probably any other document to handle your personal or business matters? You can go with two options: contact a legal advisor to write a valid paper for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Fairfax Jury Instruction - False Tax Return and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra hassles.

- First and foremost, carefully verify if the Fairfax Jury Instruction - False Tax Return is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fairfax Jury Instruction - False Tax Return template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!