Los Angeles California Jury Instruction — False Tax Return is a set of instructions provided to jurors in the Los Angeles County Superior Court when a defendant is being tried for the offense of filing a false tax return. These instructions guide jurors on the legal principles and elements of the crime, ensuring a fair and impartial trial. Keywords: Los Angeles California, jury instruction, false tax return, trial, jurors, legal principles, elements, crime, offense, trial. Types of Los Angeles California Jury Instruction — False Tax Return: 1. General Instructions: These instructions provide an overview of the legal framework surrounding the offense of filing a false tax return, including the standard of proof, burden of proof, and key elements required for a conviction. 2. Elements of the Crime: This set of instructions outlines the specific elements that the prosecution must prove beyond a reasonable doubt to establish the defendant's guilt. It may include elements such as willful intent to defraud, knowingly making false statements, and filing a tax return with false or fraudulent information. 3. Evidence Consideration: These instructions advise jurors on how to evaluate and weigh the evidence presented during the trial. They provide guidance on assessing witness credibility, considering circumstantial evidence, and properly applying the law when reaching a verdict. 4. Defenses and Exemptions: This category of instructions discusses potential defenses the defendant may raise, such as lack of willfulness, honest mistake, or reliance on professional advice. Jurors are instructed to consider these defenses and determine their applicability based on the evidence presented. 5. Jury Deliberation: These instructions outline the procedures and responsibilities for jury deliberation. They highlight the importance of discussing the evidence, reaching a unanimous verdict, and avoiding bias or prejudice during deliberations. 6. Sentencing Considerations: In some cases, instructions related to sentencing may be included. These instructions inform jurors of the potential penalties associated with the offense of filing a false tax return and any relevant factors to consider when determining an appropriate punishment. In conclusion, Los Angeles California Jury Instruction — False Tax Return comprises a range of instructions that ensure jurors understand the legal principles surrounding the offense. The specific instructions provided depend on the nature of the case and the evidence presented during the trial.

Los Angeles California Jury Instruction - False Tax Return

Description

How to fill out Los Angeles California Jury Instruction - False Tax Return?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Los Angeles Jury Instruction - False Tax Return is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Los Angeles Jury Instruction - False Tax Return. Follow the instructions below:

- Make certain the sample meets your personal needs and state law regulations.

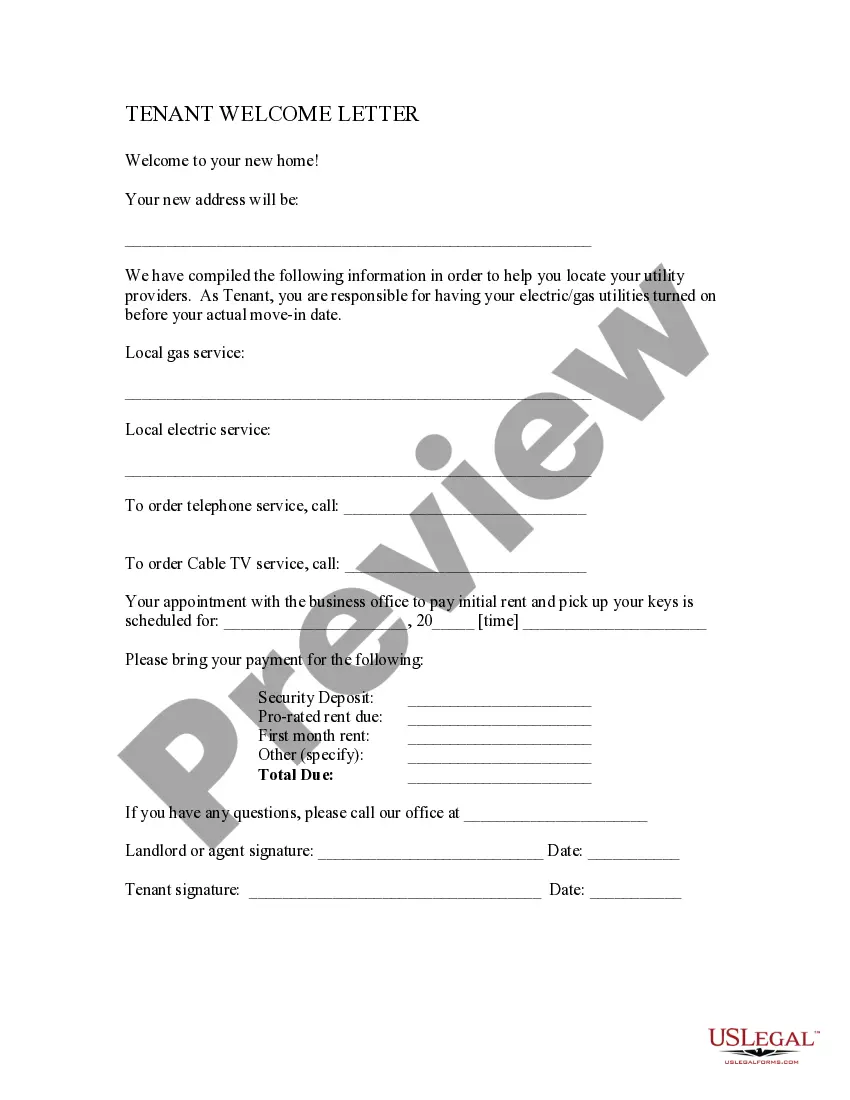

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Jury Instruction - False Tax Return in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!