Philadelphia Pennsylvania Jury Instruction — False Tax Return is a detailed set of guidelines provided to jurors during a criminal trial related to the offense of filing a false tax return. These instructions aim to inform the jury about the legal elements of the crime, the burden of proof, and the specific considerations they should take into account when deciding the defendant's guilt or innocence. Keywords: 1. Philadelphia Pennsylvania: Refers to the specific jurisdiction where the criminal trial takes place, indicating that the jury instructions are tailored to the local legal system and precedents. 2. Jury Instruction: Explains that the content is a set of instructions given to the jury, a group of citizens responsible for determining the verdict in a criminal case based on the evidence presented at trial. 3. False Tax Return: Highlights the crime being prosecuted, indicating that the defendant is alleged to have knowingly provided false or fraudulent information on their tax return. 4. Tax Fraud: Also known as tax evasion, tax fraud involves intentionally providing incorrect or misleading information to evade payment of the correct amount of taxes owed to the government. 5. Criminal Trial: Specifies that the instructions are relevant to criminal proceedings, emphasizing that the defendant is facing a potential sanction or punishment if found guilty. 6. Legal Elements: Refers to the specific conditions that must be proven beyond a reasonable doubt to establish the defendant's guilt, such as the willful intent to deceive and the materiality of the false information provided. 7. Burden of Proof: Describes the obligation of the prosecutor to present sufficient evidence to convince the jury of the defendant's guilt beyond a reasonable doubt, underscoring the high standard required for a conviction. 8. Guilt or Innocence: Emphasizes that the jury's role is to determine whether the defendant is guilty or innocent based on the evidence presented and the legal instructions provided by the court. Different types of Philadelphia Pennsylvania Jury Instruction — False Tax Return could include variations specific to different degrees of false tax return offenses, such as misdemeanor or felony charges, as well as instructions tailored to cases involving specific tax fraud schemes, such as offshore tax evasion or fraudulent deductions.

Philadelphia Pennsylvania Jury Instruction - False Tax Return

Description

How to fill out Philadelphia Pennsylvania Jury Instruction - False Tax Return?

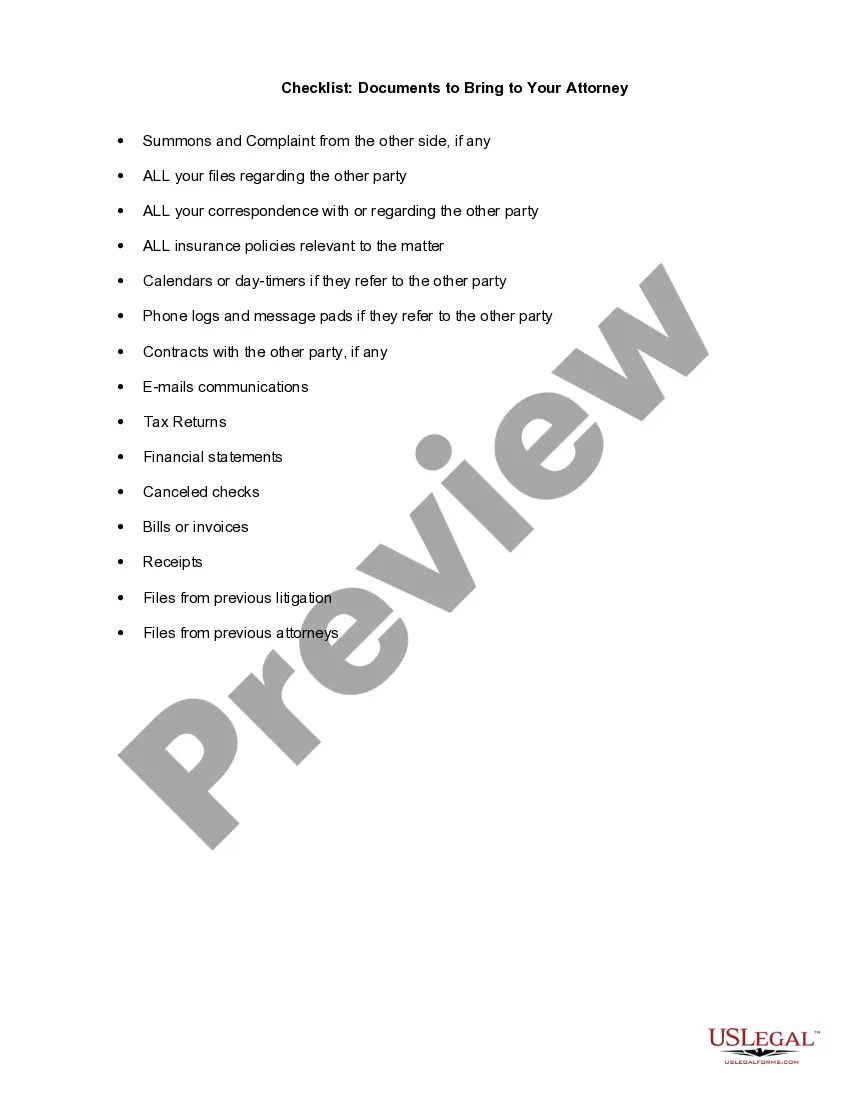

Creating documents, like Philadelphia Jury Instruction - False Tax Return, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various cases and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Philadelphia Jury Instruction - False Tax Return template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before getting Philadelphia Jury Instruction - False Tax Return:

- Make sure that your document is specific to your state/county since the rules for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Philadelphia Jury Instruction - False Tax Return isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Who pays the tax. The Net Profits Tax (NPT) is imposed on the net profits from the operation of a trade, business, profession, enterprise, or other activity by: Philadelphia residents, even if their business is conducted outside of Philadelphia. Non-residents who conduct business in Philadelphia.

Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia. The Philadelphia Department of Revenue has not changed its Wage Tax policy during the COVID-19 pandemic.

Residents of Philadelphia who are employed out-of-state may be required to file and pay a local income tax in that jurisdiction in addition to the Philadelphia Earnings Tax.

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return along with supporting and withholding documentation, such as a W-2. You must file an annual local earned income tax return even if you are: subject to employer withholding.

If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. If you fail to correct the mistake, you may be charged penalties and interest. You can file the amended return yourself or have a professional prepare it for you.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.