Phoenix Arizona Jury Instruction — False Tax Return refers to the set of guidelines and instructions provided to a jury in a court case involving an individual or entity accused of filing a fraudulent or false tax return to Phoenix, Arizona. These instructions aim to guide the jury members in understanding the specifics of the case, the relevant laws, and their responsibilities in reaching a fair verdict. The jury instruction will typically cover various aspects related to false tax returns, such as the elements that must be proven to establish guilt, the burden of proof required for the prosecution, and the importance of considering the evidence presented during the trial. Additionally, the instructions may outline the potential penalties and consequences associated with a conviction for filing a false tax return to Phoenix, Arizona. Different types of Phoenix Arizona Jury Instruction — False Tax Return may include: 1. Intent: This instruction focuses on the requirement of proving that the defendant knowingly and willfully intended to submit a false tax return. It may explain the different forms of intent, such as purposeful evasion or deliberate misrepresentation of financial information. 2. Materiality: This instruction clarifies that the false statement or information provided in the tax return must be material, meaning it has the potential to impact the amount of taxes owed or influence the Internal Revenue Service (IRS) in determining the taxpayer's liability. 3. Willfulness: This instruction addresses the element of willfulness, emphasizing that the government must demonstrate that the defendant intentionally and voluntarily committed the act of filing a false tax return. It may further explain that mistakes or unintentional errors do not constitute a willful violation. 4. Reasonable Doubt: This instruction emphasizes the jury's duty to apply the "beyond a reasonable doubt" standard when evaluating the evidence presented. It guides the jury in considering whether the prosecution has provided sufficiently convincing evidence to establish guilt. 5. Lesser Charges: In cases where the evidence may not fully support a charge of filing a false tax return, the instruction may inform the jury about alternative charges to consider, such as tax negligence or unintentional errors. It is crucial to note that the specific instructions provided to a jury in Phoenix, Arizona, for false tax return cases may vary depending on the details of the case, the applicable laws, and the judge's discretion. Therefore, jury members must carefully consider the instructions provided by the court before deliberating and reaching a verdict.

Phoenix Arizona Jury Instruction - False Tax Return

Description

How to fill out Phoenix Arizona Jury Instruction - False Tax Return?

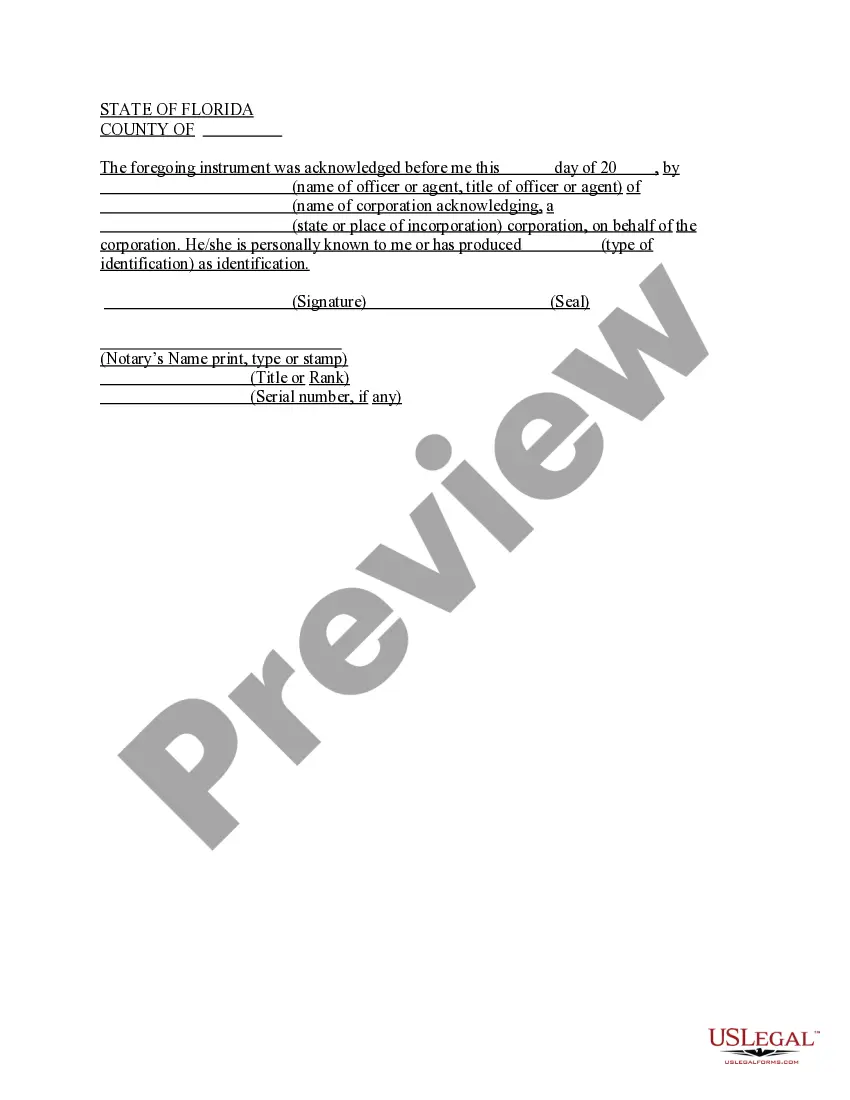

Are you looking to quickly create a legally-binding Phoenix Jury Instruction - False Tax Return or maybe any other form to handle your own or corporate affairs? You can go with two options: hire a professional to draft a legal document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific form templates, including Phoenix Jury Instruction - False Tax Return and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Phoenix Jury Instruction - False Tax Return is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Phoenix Jury Instruction - False Tax Return template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the documents we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!