Santa Clara, California Jury Instruction — Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction The Santa Clara, California jury instruction regarding evading currency transaction reporting requirement while violating another law by structuring transaction is an important legal guideline that provides direction to juries when handling cases related to money laundering and illegal financial activities in the context of structuring transactions. In cases where individuals intentionally evade the reporting requirement of substantial cash transactions while also engaging in other illegal activities, such as drug trafficking, fraud, or tax evasion, the court instructs the jury on how to evaluate the evidence and decide whether the defendant is guilty of the charges against them. This specific jury instruction emphasizes the element of intent and the requirement that the defendant knowingly attempted to evade currency transaction reporting by intentionally structuring their financial activities to avoid detection. It also highlights that the defendant's structuring activities were in conjunction with violating another law, reinforcing the gravity of the offense. The key keywords associated with this Santa Clara, California jury instruction are: Santa Clara, California, jury instruction, evading currency transaction reporting requirement, violating another law, structuring transaction, money laundering, illegal financial activities, intent, substantial cash transactions, drug trafficking, fraud, tax evasion, defendant, evidence, guilt, charges, intentional, avoidance, detection, gravity, offense. It's worth noting that while the basic framework of this jury instruction remains consistent, there may be different variations or versions of it, depending on specific circumstances, legal statutes, and the judge's discretion. However, the underlying purpose of these instructions remains the same — guiding the jury in understanding the elements required to establish guilt in cases involving the evasion of reporting requirements while also violating another law through structuring transactions.

Santa Clara California Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction

Description

How to fill out Santa Clara California Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Santa Clara Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction from the My Forms tab.

For new users, it's necessary to make some more steps to get the Santa Clara Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction:

- Take a look at the page content to make sure you found the correct sample.

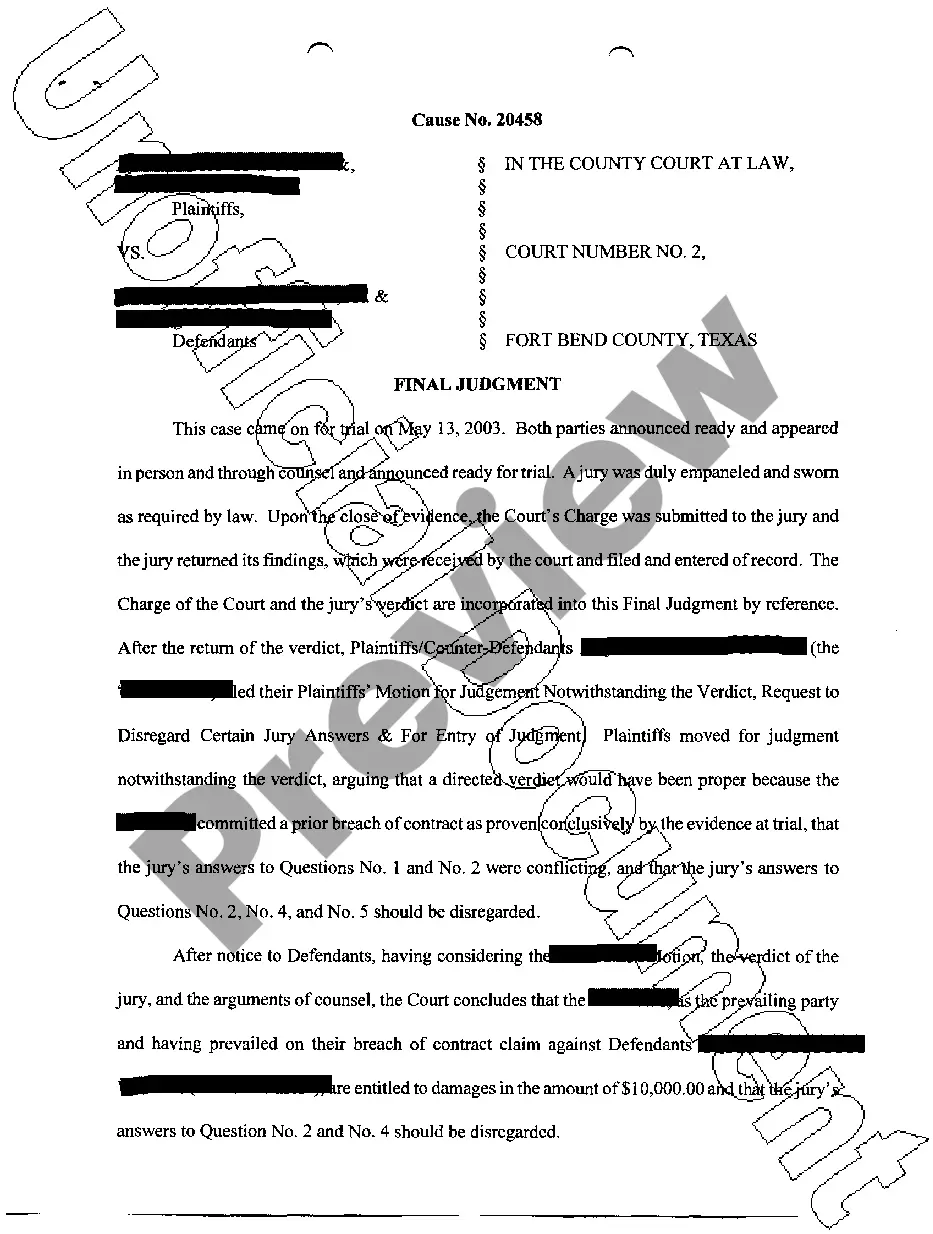

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A currency transaction report (CTR) is a bank form used in the United States to help prevent money laundering. This form must be filled out by a bank representative whenever a customer attempts a currency transaction of more than $10,000.

Multiple transactions in currency must be treated as a single transaction if the financial institution ?has knowledge that they are by or on behalf of any person and result in either cash in or cash out totaling more than $10,000 during any one business day.?

A completed CTR must be electronically filed with FinCEN within 15 calendar days after the date of the transaction.

How to Fill Out a Crew Time Report (CTR) - YouTube YouTube Start of suggested clip End of suggested clip Let's start with how a single resource needs to fill out the CTR block. One is the name of theMoreLet's start with how a single resource needs to fill out the CTR block. One is the name of the resource. This can be left blank for a single resource block. Two is the crew number.

To comply with this law, financial institutions must obtain personal identification information about the individual conducting the transaction such as a Social Security number as well as a driver's license or other government issued document.

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).

A CTR is a form used by banks or other financial institutions for any transaction greater than $10,000. The use of this form is mandatory in most cases whether the bank customer is withdrawing or depositing the funds. These CTRs are forwarded to federal regulators in their effort to combat money laundering.

FinCEN regulations have consistently maintained a regulatory requirement that CTRs be filed within 15 days.

It is further clarified that Banks should make STRs if they have reasonable ground to believe that the transaction involve proceeds of crime generally irrespective of the amount of transaction and/or the threshold limit envisaged for predicate offences in part B of Schedule of PMLA, 2002 .

FinCEN regulations have consistently maintained a regulatory requirement that CTRs be filed within 15 days.