Wayne Michigan Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction

Description

How to fill out Wayne Michigan Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Wayne Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Wayne Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Wayne Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction:

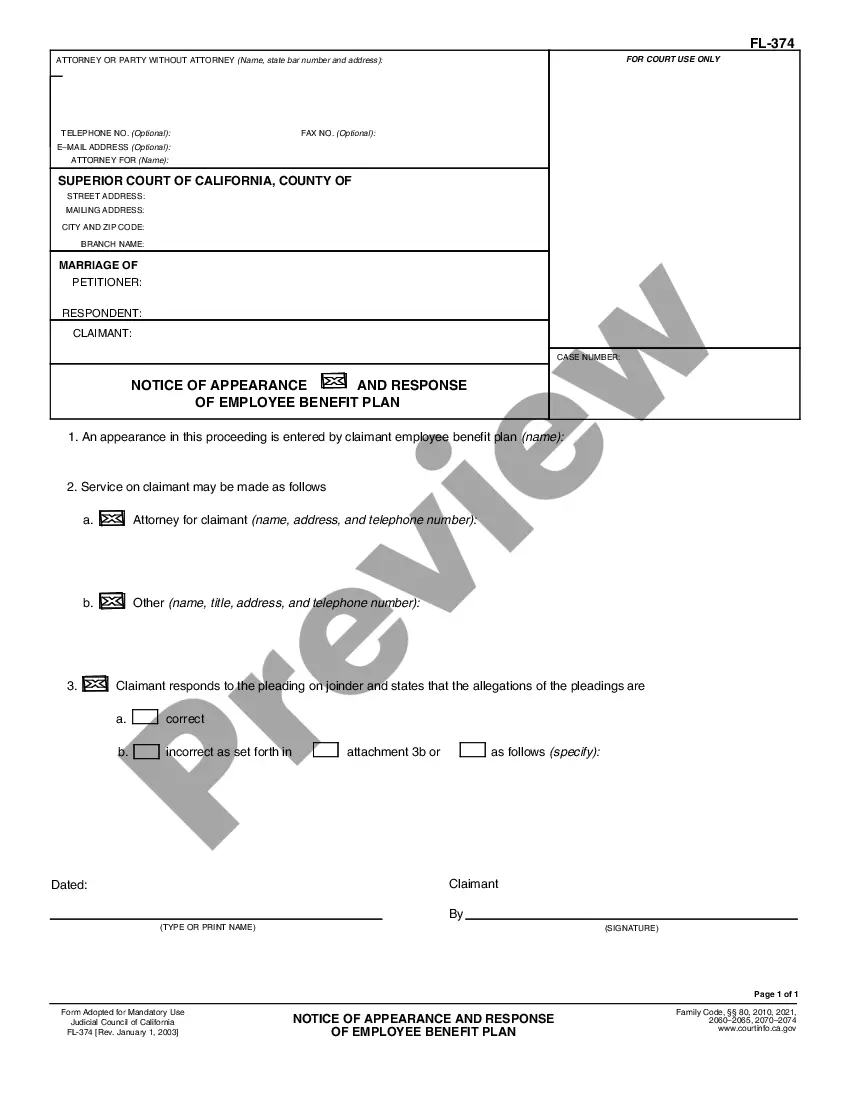

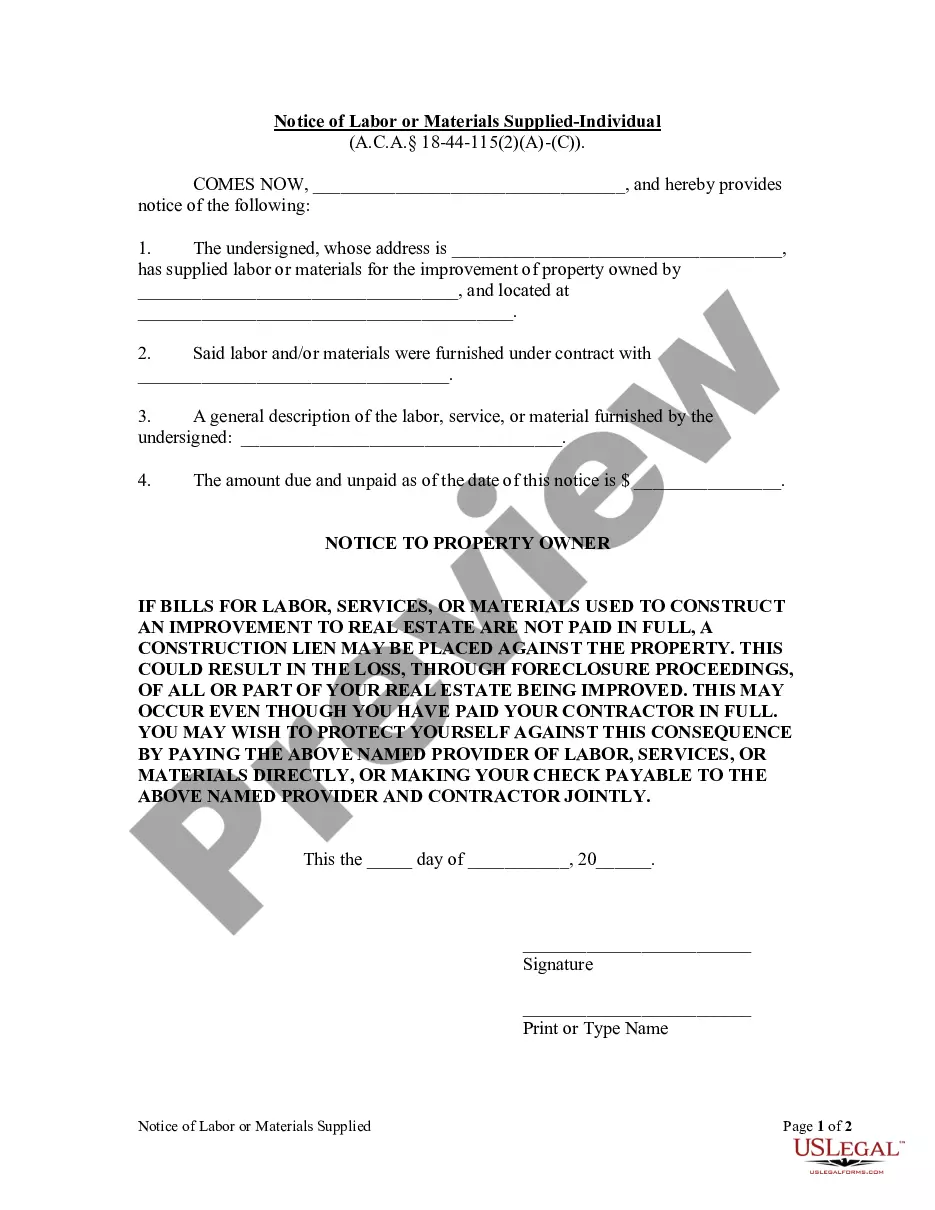

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).

In order to show that a person is guilty of structuring to avoid having a bank file a Currency Transaction Report (CTR) with the IRS, the government must prove three elements: (1) the defendant (or a claimant in a civil forfeiture case) must have engaged in acts of structuring cash desposits or withdrawals at a

A completed CTR must be electronically filed with FinCEN within 15 calendar days after the date of the transaction. 20 The bank must retain copies of CTRs for five years from the date of the report.

Structuring is a felony offense and the punishments can be severe. Penalties include monetary fines, imprisonment of up to 10 years, or both.

Structuring is illegal regardless of whether the funds are derived from legal or illegal activity. The law specifically prohibits conducting a currency transaction with a financial institution in a way to circumvent the currency transaction reporting requirements.

A financial institution and any ?nonfinancial trade or business? must file a report concerning a transaction (or series of related transactions) in excess of $10,000 in currency. FinCEN regulation 31 CFR 1010.310 requires that financial institutions file currency transaction reports (CTRs).

A currency transaction report (CTR) is a bank form used in the United States to help prevent money laundering. This form must be filled out by a bank representative whenever a customer attempts a currency transaction of more than $10,000.

IRS Definition of Structuring A person acting alone, in conjunction with others, or on behalf of others. Conducts or attempts to conduct. One or more transactions in currency. In any amount. At one or more financial institutions.

Structuring is governed by Federal Statute 31 USC 5324 and states in pertinent part that, no person shall for the purpose of avoiding a financial transaction reporting requirement, cause or attempt to cause a domestic financial institution or nonfinancial trade or business to fail to file a required financial report.

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).