A Franklin Ohio Jury Instruction — Fraudulent Receipt of VA Benefits refers to a set of guidelines and explanations provided to a jury in Franklin, Ohio, for a legal case involving fraudulent receipt of benefits from the Department of Veterans Affairs (VA). This instruction guides the jurors on how to assess and decide the guilt or innocence of individuals accused of deliberately obtaining VA benefits through deceitful means. Keywords: Franklin Ohio, Jury Instruction, Fraudulent Receipt, VA Benefits. Different types of Franklin Ohio Jury Instructions — Fraudulent Receipt of VA Benefits may include: 1. Basic Elements: This instruction outlines the essential elements that need to be proven beyond a reasonable doubt in a conviction in a fraudulent receipt of VA benefits case. It may include elements like intentionally making false statements or concealing material information, fraudulently receiving benefits, and intent to deceive the VA. 2. Materiality: This instruction explains to the jury the significance of the false statements or concealment in relation to the VA benefits claimed. It clarifies that the false information should be material, meaning it has a direct impact on the eligibility or the amount of benefits received. 3. Standard of Proof: This instruction discusses the burden of proof required for the prosecution to secure a conviction. It explains that the jury must be convinced beyond a reasonable doubt that the defendant intentionally obtained VA benefits through fraudulent means. 4. Intent: This instruction focuses on the mental state of the defendant and emphasizes that fraudulent receipt of VA benefits must be intentional. It guides jurors to assess the evidence and determine whether the defendant had the necessary intent to deceive the VA. 5. Credibility of Witnesses: This instruction highlights the importance of assessing witness credibility. It advises the jury to evaluate the reliability and truthfulness of witnesses who testify regarding the fraudulent receipt of VA benefits, such as VA officials, medical professionals, or individuals who knew the defendant's true circumstances. 6. Expert Testimony: In complex cases involving medical or financial issues, this instruction addresses the role of expert witnesses. It provides guidance on how jurors should evaluate the credibility and weight of testimony provided by experts who offer specialized knowledge on VA benefit programs or relevant fields. 7. Presumptions and Inferences: This instruction explains the legal presumptions and permissible inferences the jury may make based on the facts presented during the trial. It clarifies that certain acts or actions may raise a presumption of fraudulent intent or a presumption of knowledge about the fraudulent nature of the benefits. 8. Penalties and Sentencing: Although not directly part of the jury instruction itself, the judge may address penalties and sentencing guidelines during the trial. These instructions may outline the potential consequences and sanctions a defendant may face if found guilty of fraudulent receipt of VA benefits. Remember, the specific content and organization of Franklin Ohio Jury Instructions for fraudulent receipt of VA benefits may vary depending on the case, legal precedents, and the judge's discretion.

Franklin Ohio Jury Instruction - Fraudulent Receipt Of VA Benefits

Description

How to fill out Franklin Ohio Jury Instruction - Fraudulent Receipt Of VA Benefits?

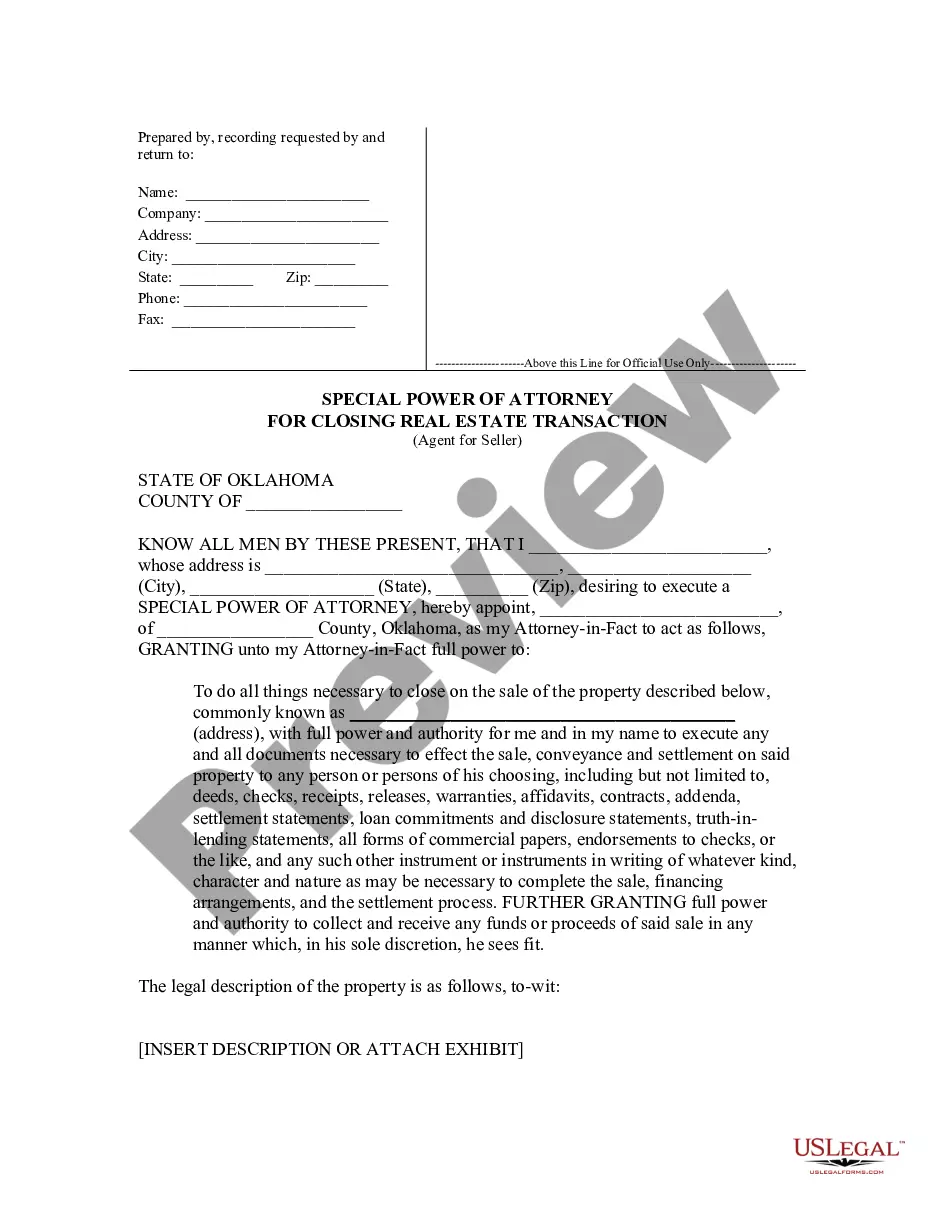

Are you looking to quickly create a legally-binding Franklin Jury Instruction - Fraudulent Receipt Of VA Benefits or maybe any other document to take control of your own or business matters? You can go with two options: contact a legal advisor to write a valid paper for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Franklin Jury Instruction - Fraudulent Receipt Of VA Benefits and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Franklin Jury Instruction - Fraudulent Receipt Of VA Benefits is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Franklin Jury Instruction - Fraudulent Receipt Of VA Benefits template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the templates we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!