Allegheny Pennsylvania Aging Accounts Payable refers to the process of tracking and managing outstanding invoices and payments owed by the residents and businesses in Allegheny County, Pennsylvania. It is an essential aspect of financial management that ensures timely collections and accurate record-keeping. In Allegheny County, there are two main types of Aging Accounts Payable: 1. Personal Accounts Payable: This category includes individuals or households residing in Allegheny County who have outstanding debts for various goods or services. These could be unpaid utility bills, medical bills, credit card debts, loans, or any other financial obligations. The Aging Accounts Payable team in the county government tracks and follows up on these debts, ensuring that individuals receive notifications and opportunities to settle their outstanding balances. 2. Business Accounts Payable: This type of Aging Accounts Payable focuses on managing the outstanding debts owed by businesses operating in Allegheny County. These may include unpaid invoices for suppliers, contractors, or vendors, as well as any other business-related financial obligations. The Aging Accounts Payable team works closely with local businesses to reconcile outstanding payments and settle any disputes regarding billing or invoicing discrepancies. The process of Allegheny Pennsylvania Aging Accounts Payable involves several key steps: 1. Invoice Generation: Invoices are generated and issued to individuals or businesses for the goods or services they have received. These invoices contain detailed information about the amount owed, payment due date, and any additional terms and conditions. 2. Payment Monitoring: The Aging Accounts Payable team closely monitors payment records to track any outstanding invoices and identify accounts that have exceeded their payment due dates. They maintain a systematic record of payment histories and aging reports to ensure accuracy and efficiency in the collection process. 3. Payment Reminders: Individuals or businesses with outstanding balances receive regular payment reminders via mail, email, or other communication channels. These reminders prompt the debtors to settle their dues promptly, preventing further delays. 4. Negotiation and Dispute Resolution: In cases where there is a dispute or disagreement regarding an invoice, the Aging Accounts Payable team facilitates communication between the debtor and the creditor to resolve the issue. They carefully investigate any billing errors, discrepancies, or payment disputes and work towards a fair resolution. 5. Debt Collection: If all attempts at reaching a resolution fail, the Aging Accounts Payable team may initiate the debt collection process. This involves employing various legal mechanisms, such as filing liens or taking legal action, to recover the unpaid amounts owed. It is crucial for Allegheny County to effectively manage Aging Accounts Payable to maintain its financial stability and ensure the smooth operation of public services. The dedicated team responsible for this process plays a crucial role in reconciling outstanding debts, managing payment collections, and safeguarding the financial interests of both individuals and businesses within the county.

Allegheny Pennsylvania Aging Accounts Payable

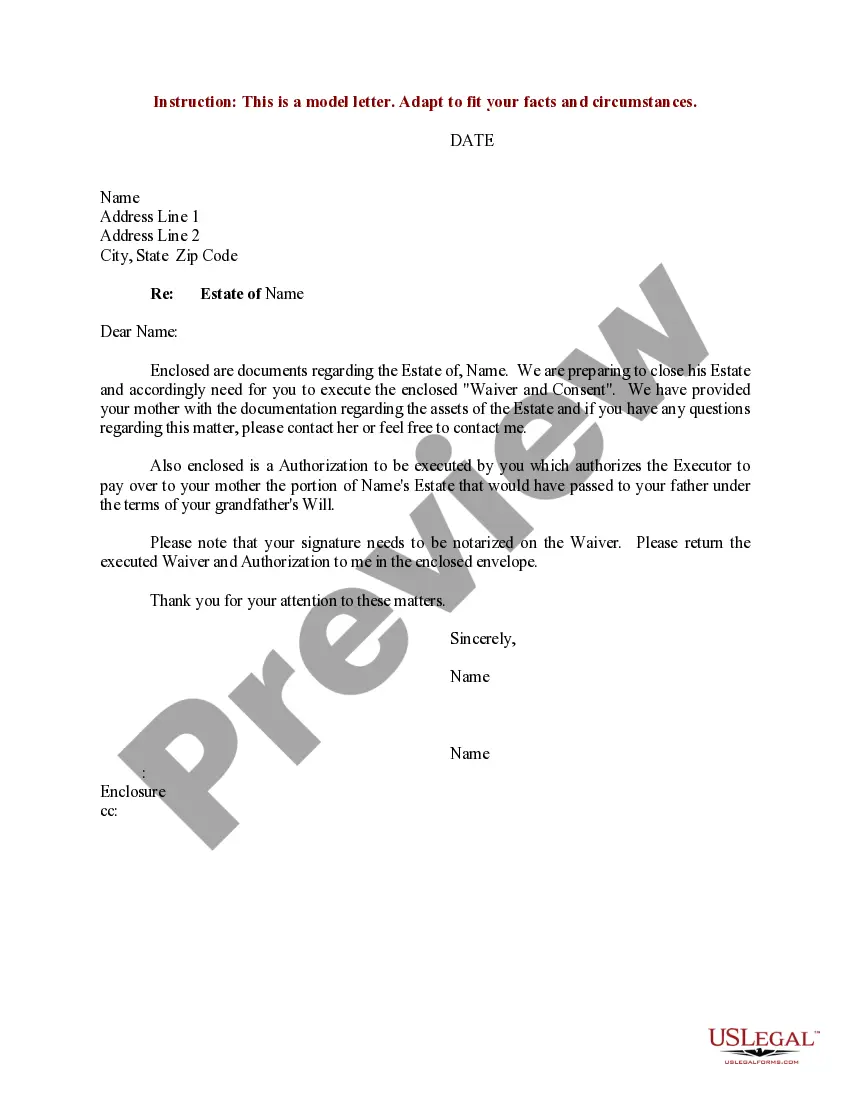

Description

How to fill out Allegheny Pennsylvania Aging Accounts Payable?

Creating forms, like Allegheny Aging Accounts Payable, to manage your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for various cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Allegheny Aging Accounts Payable form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Allegheny Aging Accounts Payable:

- Make sure that your form is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Allegheny Aging Accounts Payable isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our website and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!