One of the significant aspects of financial management for any organization is maintaining an accurate and up-to-date record of accounts payable. Cook Illinois Aging Accounts Payable is a term used to describe the process of tracking and managing outstanding invoices and bills that are unpaid by Cook Illinois, a prominent transportation company. This particular system is designed to monitor and categorize the aging of these unpaid invoices based on their respective due dates. Cook Illinois Aging Accounts Payable allows the company to have a clear overview of its financial liabilities, ensuring that bills are paid promptly to maintain positive relationships with vendors and suppliers. By effectively managing aging accounts payable, Cook Illinois can also avoid late payment penalties and maintain a healthy cash flow. There are different types of Cook Illinois Aging Accounts Payable distinguished based on the time period since the invoice due date. These categories can include: 1. Current Accounts Payable: This includes invoices that are within the agreed payment terms and are not yet due or are slightly past the due date. 2. 30-Day Aging Accounts Payable: This category comprises invoices that are 30 days past their due dates. It indicates a slight delay in payment but still falls within an acceptable window. 3. 60-Day Aging Accounts Payable: This category represents invoices that are 60 days past their due dates. At this stage, the company needs to address these bills promptly to avoid further complications. 4. 90-Day Aging Accounts Payable: In this category, invoices are 90 days past their due dates. It signifies a significant delay in payment, and immediate attention is required to settle these outstanding bills. 5. Over 90-Day Aging Accounts Payable: This last category contains invoices that are more than 90 days past their due dates. These unpaid bills require urgent attention as they may negatively impact the company's credit score and relationships with vendors. Cook Illinois Aging Accounts Payable provides the company's financial department with a clear snapshot of its outstanding payments and assists in prioritizing settlement based on urgency. By closely monitoring and managing these aging accounts, Cook Illinois can effectively maintain its financial stability and reputation within the industry.

Cook Illinois Aging Accounts Payable

Description

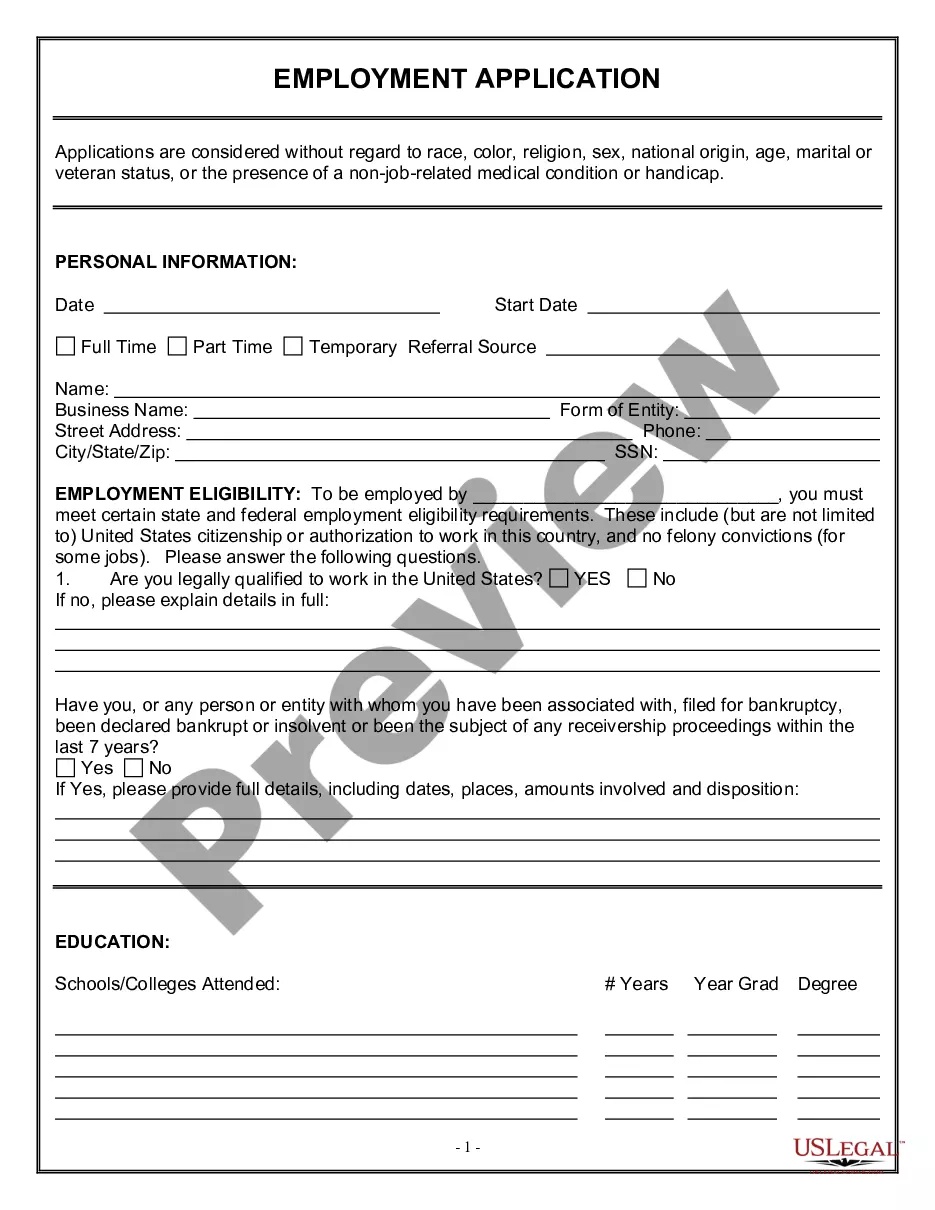

How to fill out Cook Illinois Aging Accounts Payable?

Preparing papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Cook Aging Accounts Payable without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Cook Aging Accounts Payable by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Cook Aging Accounts Payable:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!