The Contra Costa California Independent Contractor Agreement for Accountant and Bookkeeper is a legally binding document that outlines the terms and conditions between an independent contractor and the client for accounting and bookkeeping services in Contra Costa County, California. This agreement ensures clarity and protect the rights and responsibilities of both parties involved in the professional relationship. The agreement typically provides a detailed description of the services to be provided by the accountant and bookkeeper, such as financial record keeping, financial statement preparation, tax preparation, and payroll services. It may also include additional services agreed upon by both parties. Keywords: Contra Costa California, independent contractor agreement, accountant, bookkeeper, services, financial record keeping, financial statement preparation, tax preparation, payroll services. Different types of Contra Costa California Independent Contractor Agreement for Accountant and Bookkeeper may include: 1. Basic Independent Contractor Agreement: This agreement outlines the general terms and conditions for accounting and bookkeeping services, including service descriptions, payment terms, and termination clauses. 2. Non-Disclosure Agreement (NDA): This agreement ensures the protection of confidential and sensitive information shared between the client and the accountant/bookkeeper. 3. Scope of Work Agreement: This type of agreement defines the specific scope of services that the independent contractor will provide and clarifies any limitations or exclusions. 4. Payment Agreement: This contract focuses on the payment terms, including rates, invoicing procedures, and reimbursement policies. 5. Partnership Agreement: In some cases, the accountant or bookkeeper may enter into a partnership with the client, and the agreement outlines the terms and conditions of their collaboration. 6. Termination Agreement: This agreement specifically deals with the process and conditions of terminating the professional relationship, including notice periods and potential penalties. Keywords: Basic Independent Contractor Agreement, Non-Disclosure Agreement, Scope of Work Agreement, Payment Agreement, Partnership Agreement, Termination Agreement.

Contra Costa California Independent Contractor Agreement for Accountant and Bookkeeper

Description

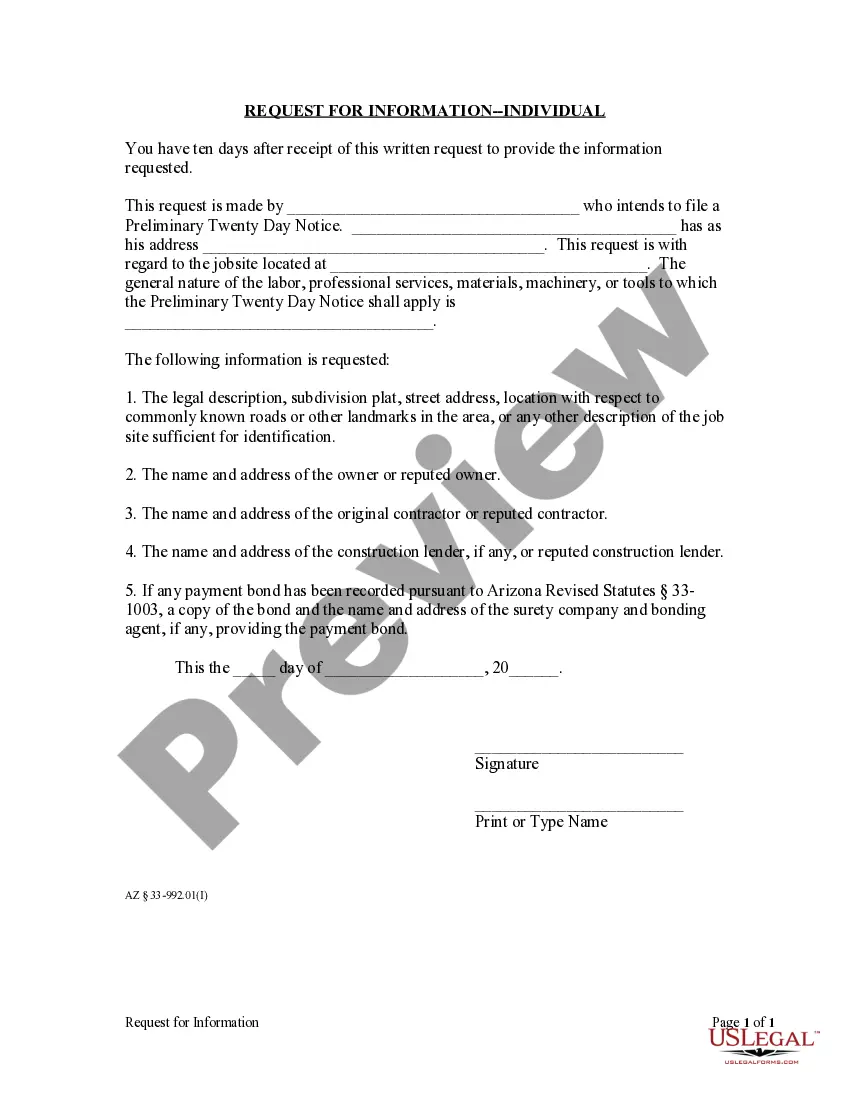

How to fill out Contra Costa California Independent Contractor Agreement For Accountant And Bookkeeper?

If you need to get a trustworthy legal paperwork provider to find the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate contract, or execute the Contra Costa Independent Contractor Agreement for Accountant and Bookkeeper - all from the convenience of your sofa.

Sign up for US Legal Forms now!