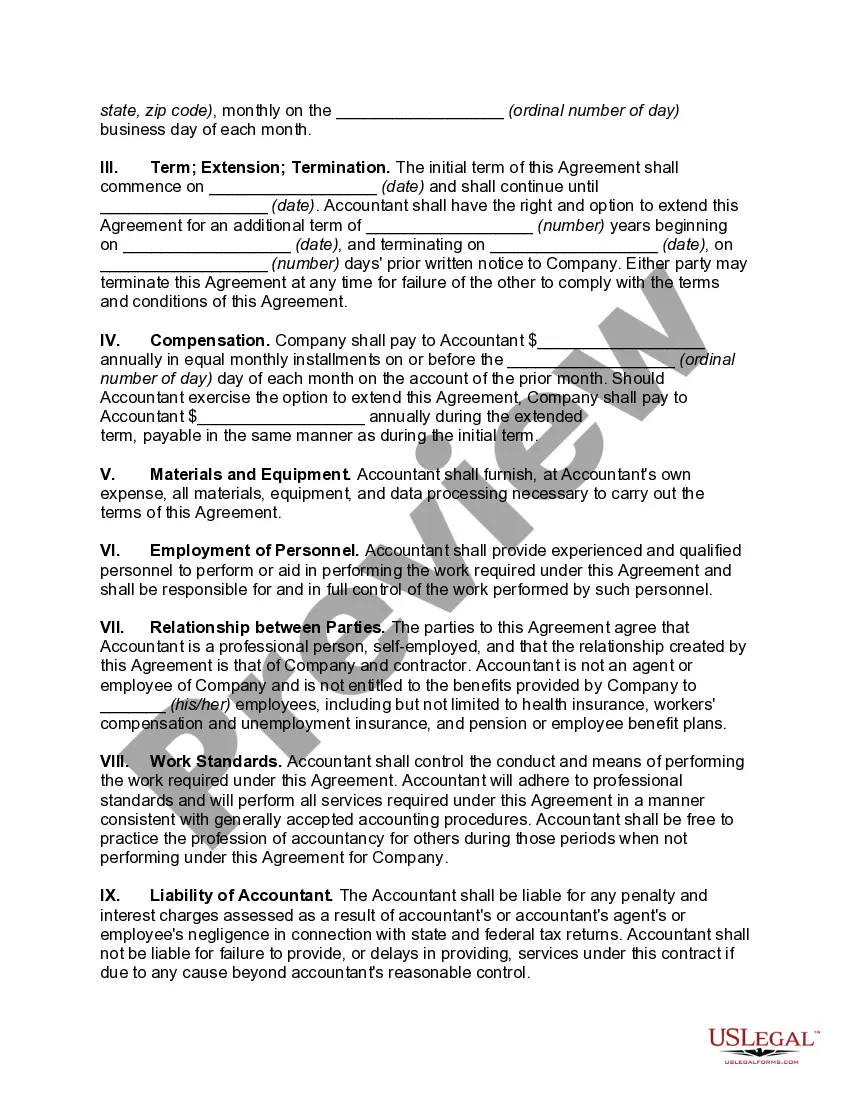

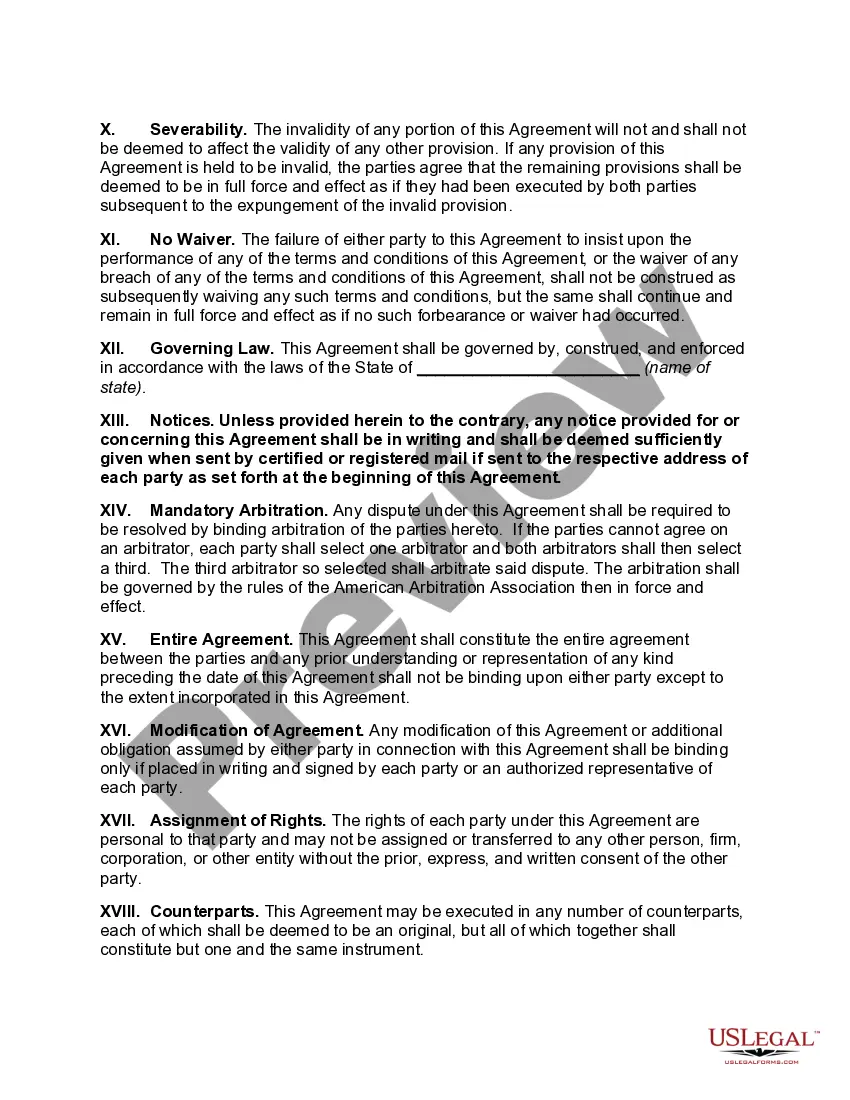

A Houston Texas Independent Contractor Agreement for Accountant and Bookkeeper is a legally binding contract that outlines the terms and conditions of the professional relationship between an independent accountant or bookkeeper and a client based in Houston, Texas. This agreement is crucial for ensuring a clear understanding of the rights and responsibilities of both parties involved. The primary purpose of this agreement is to define the scope of work, compensation details, and other relevant provisions to protect the interests of both the accountant/bookkeeper and the client. By signing this document, the accountant/bookkeeper acknowledges that they are an independent contractor, not an employee, and agree to carry out the agreed-upon services in a professional and timely manner. Some common elements found in a Houston Texas Independent Contractor Agreement for Accountant and Bookkeeper include: 1. Identification of Parties: The agreement starts by clearly identifying the names and addresses of the contracting parties, i.e., the accountant/bookkeeper and the client. 2. Scope of Services: This section describes in detail the specific services the accountant/bookkeeper will provide, such as bookkeeping, payroll management, financial statement preparation, tax planning, or general accounting services. 3. Compensation: It outlines the fee structure, payment terms (e.g., hourly rate, fixed fee, or retainer), and any additional expenses that the client may be responsible for. 4. Term and Termination: This section specifies the length of the agreement, whether it is a one-time project or a recurring engagement. It also outlines the termination rights and conditions for both parties. 5. Confidentiality and Non-Disclosure: This provision ensures that the accountant/bookkeeper maintains the confidentiality of the client's financial information and trade secrets. 6. Ownership of Work: It clarifies that the accountant/bookkeeper does not retain any ownership rights to the work product produced during the engagement and that the client holds exclusive rights. 7. Independent Contractor Relationship: This section strengthens the understanding that the accountant/bookkeeper is an independent contractor and not an employee, acknowledging that the client will not provide benefits typically associated with an employment relationship. 8. Governing Law and Jurisdiction: This clause determines the jurisdiction whose laws will govern the agreement and where any disputes will be resolved. There may be different variations or types of Houston Texas Independent Contractor Agreements for Accountant and Bookkeeper, depending on factors such as project length, specific services rendered, or any additional clauses required by either party. These variations could include project-based agreements, retainer agreements, or agreements with specific terms tailored to the unique needs of the parties involved.

Houston Texas Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Houston Texas Independent Contractor Agreement For Accountant And Bookkeeper?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Houston Independent Contractor Agreement for Accountant and Bookkeeper.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Houston Independent Contractor Agreement for Accountant and Bookkeeper will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Houston Independent Contractor Agreement for Accountant and Bookkeeper:

- Make sure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Houston Independent Contractor Agreement for Accountant and Bookkeeper on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!