Los Angeles California Independent Contractor Agreement for Accountant and Bookkeeper is a legal document that outlines the terms and conditions between an independent contractor accountant/bookkeeper and a client or company based in Los Angeles, California. This agreement is designed to establish a professional relationship and outline the responsibilities, expectations, payment terms, and confidentiality provisions. In Los Angeles, there may be different types of Independent Contractor Agreements for Accountant and Bookkeeper depending on the specific requirements and circumstances. Some variations of these agreements may include: 1. Fixed-term Contract: This agreement sets a specific duration for the engagement, indicating the exact start and end dates. It can be beneficial for short-term projects or seasonal accounting/bookkeeping needs. 2. Ongoing Contract: This type of agreement establishes a long-term relationship between the independent contractor and the client. It does not have a predefined end date and is suitable for continuous accounting/bookkeeping services. 3. Project-based Contract: This agreement is focused on a particular project or specific tasks. It clearly defines the scope of work, timelines, and deliverables expected for the completion of the project. 4. Confidentiality Agreement: This type of agreement specifically highlights the importance of maintaining the confidentiality of client information, trade secrets, and proprietary data. It includes clauses to protect sensitive information from being disclosed or used improperly. 5. Non-Compete Agreement: A Non-Compete clause restricts the independent contractor from engaging in similar accounting/bookkeeping services or working for competing clients in Los Angeles during the agreement's duration and for a specified time after termination. The main contents of a typical Los Angeles California Independent Contractor Agreement for Accountant and Bookkeeper may include: 1. Parties Involved: Clearly identify the independent contractor and the client, providing their legal names and addresses. 2. Scope of Services: Detail the specific accounting/bookkeeping services to be provided by the contractor, including the frequency, deadlines, and any other relevant details. 3. Payment Terms: Specify the payment structure, such as hourly rates, flat fees, or commission-based compensation, including the frequency and method of payment. 4. Independent Contractor Status: Acknowledge that the accountant/bookkeeper is an independent contractor, not an employee of the client, and outline the responsibilities and liabilities associated with this status. 5. Confidentiality and Non-Disclosure: Establish strict rules regarding the protection of confidential information and the prohibition of sharing or utilizing it for personal gain. 6. Duration and Termination: Indicate the start and end dates of the agreement, as well as the conditions under which either party can terminate the agreement prematurely. It is important to note that the exact terms and clauses within the agreement can vary. Therefore, it is advisable for both parties to consult with legal professionals familiar with California employment laws to ensure compliance and protection.

Los Angeles California Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Los Angeles California Independent Contractor Agreement For Accountant And Bookkeeper?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Los Angeles Independent Contractor Agreement for Accountant and Bookkeeper, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any tasks associated with document completion simple.

Here's how to purchase and download Los Angeles Independent Contractor Agreement for Accountant and Bookkeeper.

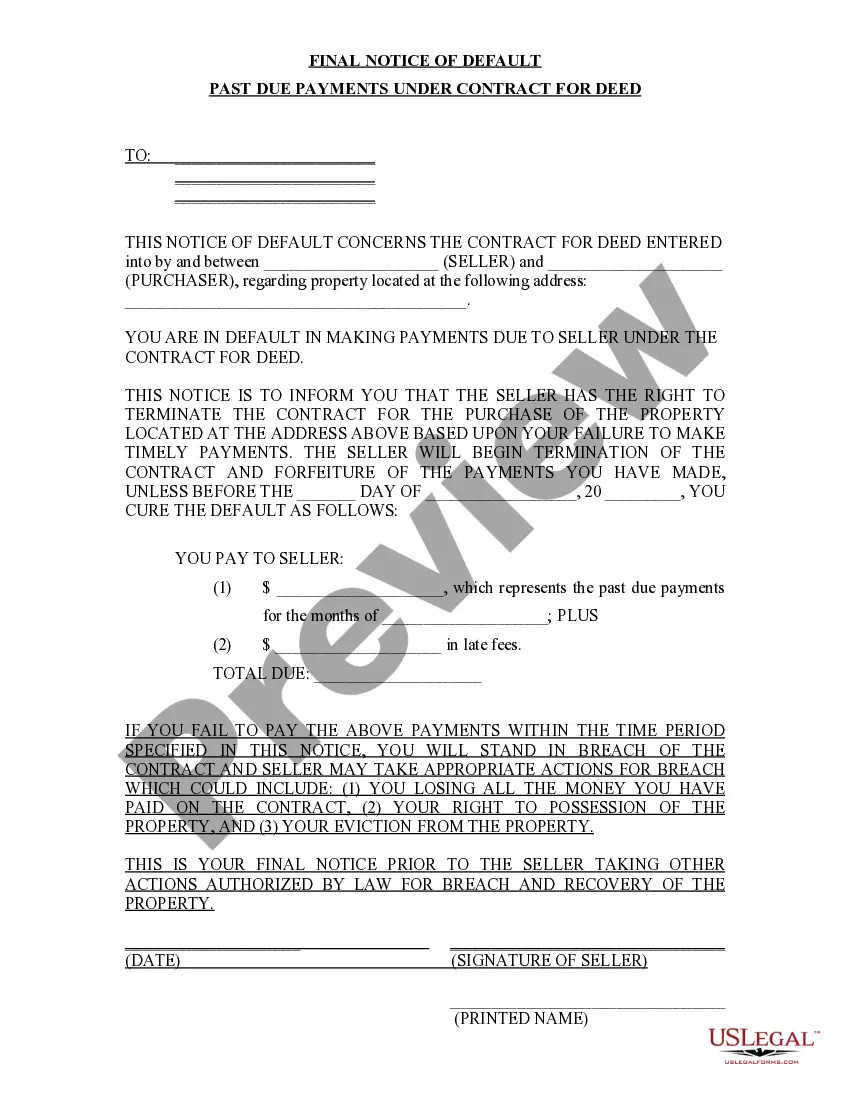

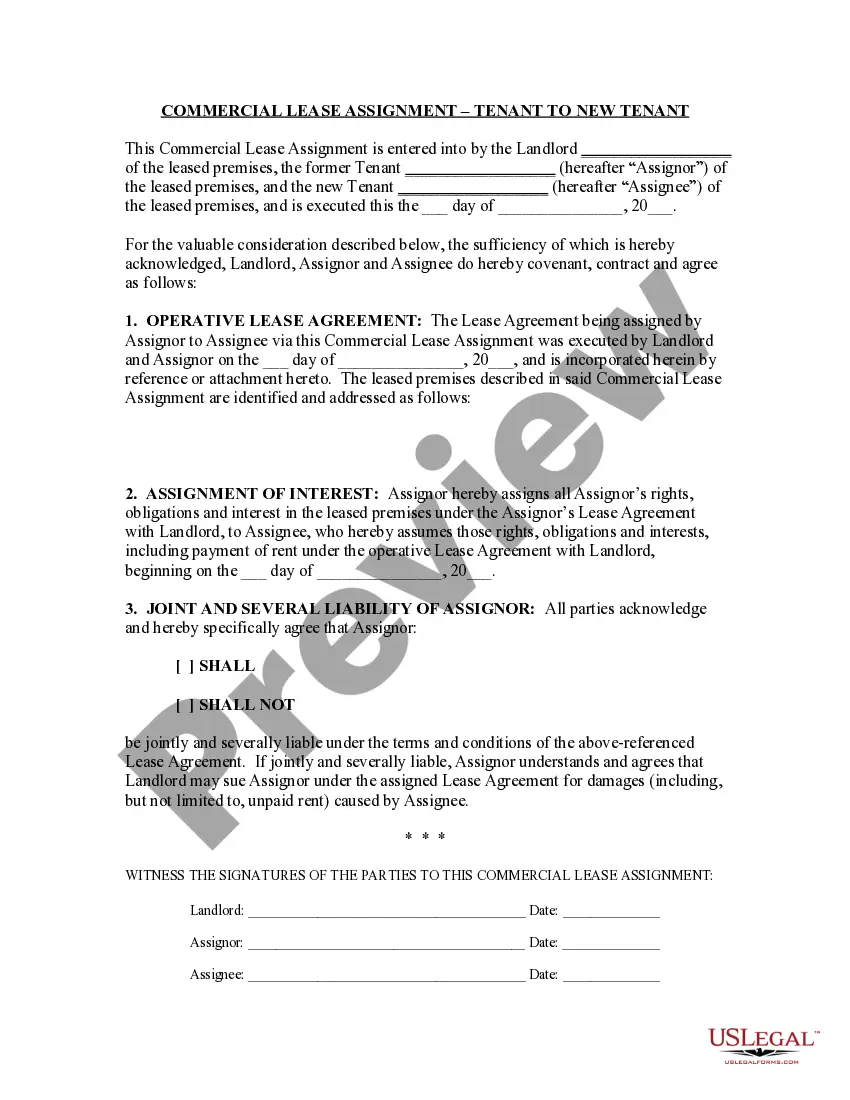

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the related document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Los Angeles Independent Contractor Agreement for Accountant and Bookkeeper.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Los Angeles Independent Contractor Agreement for Accountant and Bookkeeper, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to deal with an exceptionally challenging situation, we recommend using the services of an attorney to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!