Nassau New York Independent Contractor Agreement for Accountant and Bookkeeper is a legally binding contract that outlines the terms and conditions between an independent accountant or bookkeeper and a client in Nassau County, New York. This agreement is designed to establish a professional relationship, define the scope of work, and protect the rights and responsibilities of both parties involved. Keywords: Nassau New York, Independent Contractor Agreement, Accountant, Bookkeeper, Contract, Scope of Work, Professional Relationship, Rights, Responsibilities, Terms and Conditions, Legal, Client. Different types of Nassau New York Independent Contractor Agreement for Accountant and Bookkeeper may include: 1. General Independent Contractor Agreement: This type of agreement is a standard contract that covers the basic terms and conditions between an independent accountant or bookkeeper and a client. It includes clauses regarding payment terms, confidentiality, termination, and dispute resolution. 2. Project-Specific Independent Contractor Agreement: In cases where an accountant or bookkeeper is hired for a specific project or assignment, a project-specific agreement may be used. This type of agreement clearly outlines the project's details, including the deliverables, timeline, milestones, and compensation. 3. Non-Disclosure Independent Contractor Agreement: A non-disclosure agreement (NDA) is often included as part of an independent contractor agreement for accountants and bookkeepers. This agreement ensures that any confidential or proprietary information shared between the parties remains protected and cannot be disclosed to third parties. 4. Hourly Rate Independent Contractor Agreement: This type of agreement specifies that the accountant or bookkeeper will be compensated based on an hourly rate for the services provided. It outlines the agreed-upon rate, the number of hours expected for each task, and procedures for timesheet submission and payment. 5. Retainer Independent Contractor Agreement: In some cases, a client may choose to retain the services of an accountant or bookkeeper on an ongoing basis. A retainer agreement clearly defines the retainer fee, the duration of the arrangement, and the services to be provided throughout the retainer period. It is essential to tailor the Independent Contractor Agreement to suit the specific needs and requirements of the business relationship between the accountant or bookkeeper and the client. Consulting with a legal professional experienced in contract law is highly recommended ensuring compliance with local regulations and to protect the interests of both parties.

Nassau New York Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Nassau New York Independent Contractor Agreement For Accountant And Bookkeeper?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Nassau Independent Contractor Agreement for Accountant and Bookkeeper, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Nassau Independent Contractor Agreement for Accountant and Bookkeeper from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Nassau Independent Contractor Agreement for Accountant and Bookkeeper:

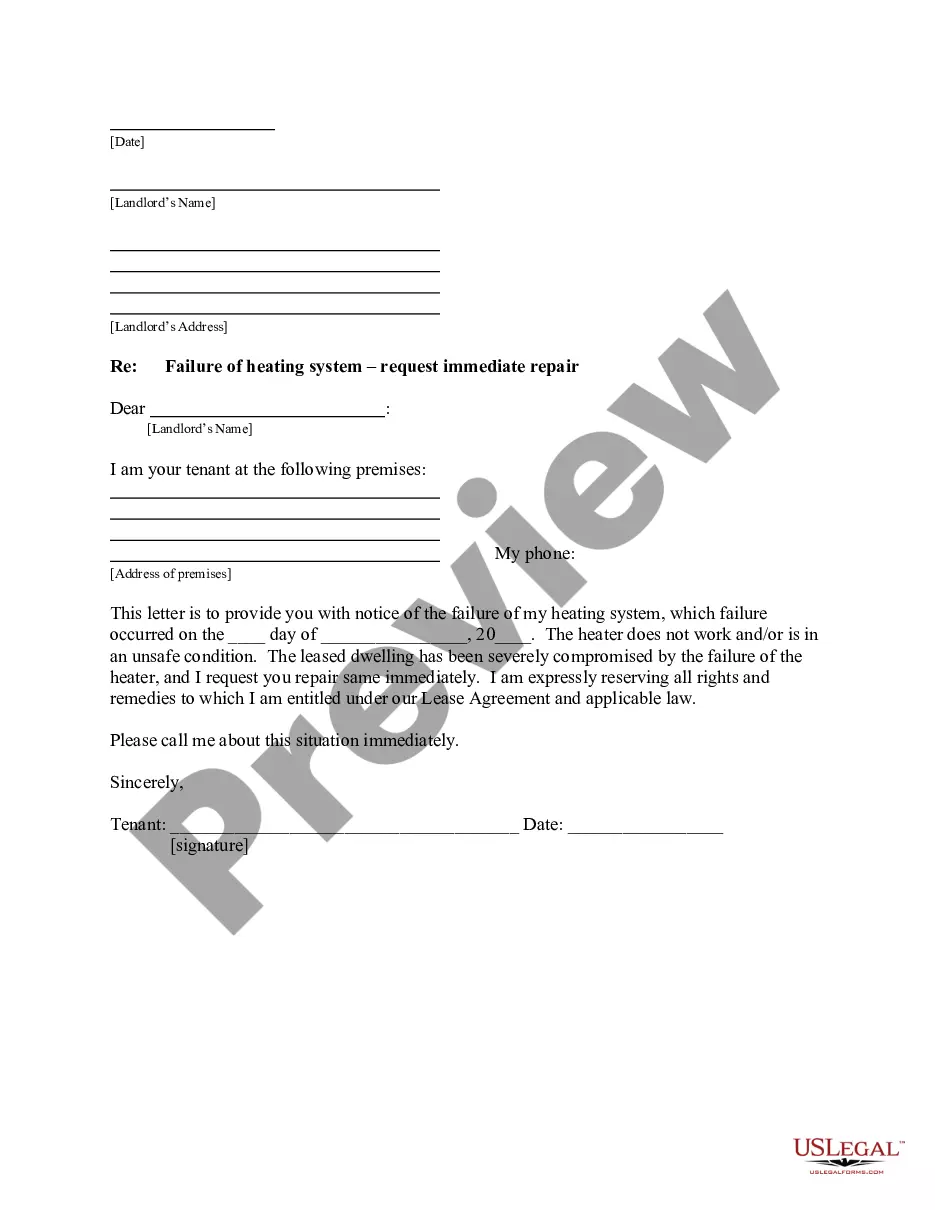

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!