Salt Lake Utah Independent Contractor Agreement for Accountant and Bookkeeper is a legal document that outlines the terms and conditions between an accountant or bookkeeper and a business or individual who hires them as an independent contractor in Salt Lake City, Utah. This agreement provides a clear understanding of the expectations, responsibilities, and rights of both parties involved. Keywords: Salt Lake Utah, independent contractor agreement, accountant, bookkeeper, legal document, terms and conditions, responsibilities, expectations, rights. There may be different variations of Salt Lake Utah Independent Contractor Agreement for Accountant and Bookkeeper based on specific circumstances and requirements. Some possible variations may include: 1. Full-Time Independent Contractor Agreement: This type of agreement is suitable when the accountant or bookkeeper is hired on a full-time basis, typically for an extended period. 2. Part-Time Independent Contractor Agreement: This agreement is designed for accountants or bookkeepers who are hired on a part-time basis, working certain hours or days per week or month. 3. Project-based Independent Contractor Agreement: In situations where an accountant or bookkeeper is hired to complete a specific project or assignment, this type of agreement is used. It outlines the project scope, deliverables, and timelines. 4. Onsite Independent Contractor Agreement: This agreement is applicable when the accountant or bookkeeper is required to work at the client's premises, such as an office or business location, rather than remotely. 5. Remote Independent Contractor Agreement: This type of agreement is used when the accountant or bookkeeper works remotely, communicating and delivering services electronically. 6. Confidentiality Independent Contractor Agreement: In cases where sensitive or proprietary information will be shared with the accountant or bookkeeper, a confidentiality agreement can be included as an addendum to the main independent contractor agreement. Note: It is always recommended consulting with a legal professional to ensure that the drafted agreement complies with local laws and adequately protects the interests of both parties involved.

Salt Lake Utah Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Salt Lake Utah Independent Contractor Agreement For Accountant And Bookkeeper?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including Salt Lake Independent Contractor Agreement for Accountant and Bookkeeper, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any activities associated with document completion simple.

Here's how to find and download Salt Lake Independent Contractor Agreement for Accountant and Bookkeeper.

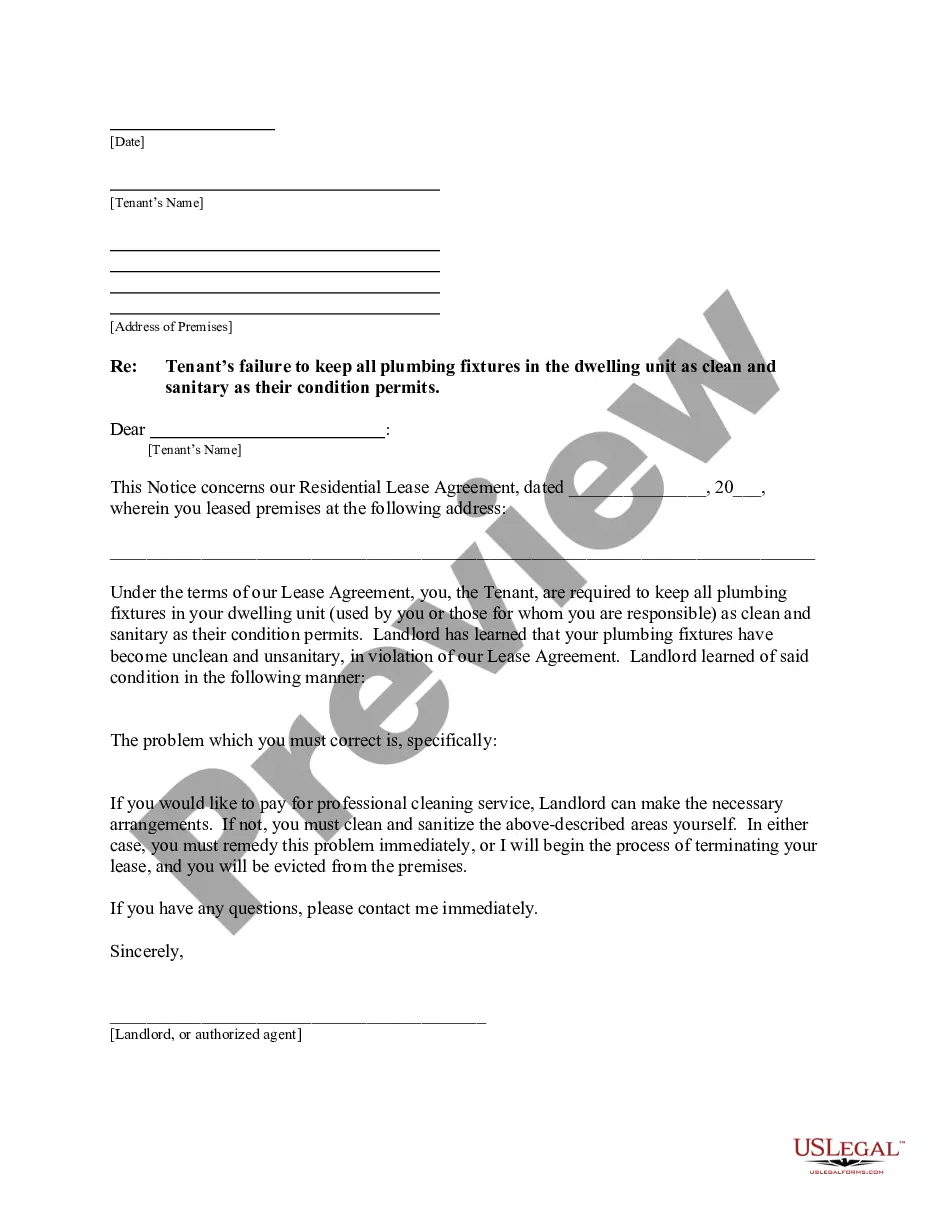

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Check the similar document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Salt Lake Independent Contractor Agreement for Accountant and Bookkeeper.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Salt Lake Independent Contractor Agreement for Accountant and Bookkeeper, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to cope with an extremely challenging case, we advise getting a lawyer to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!