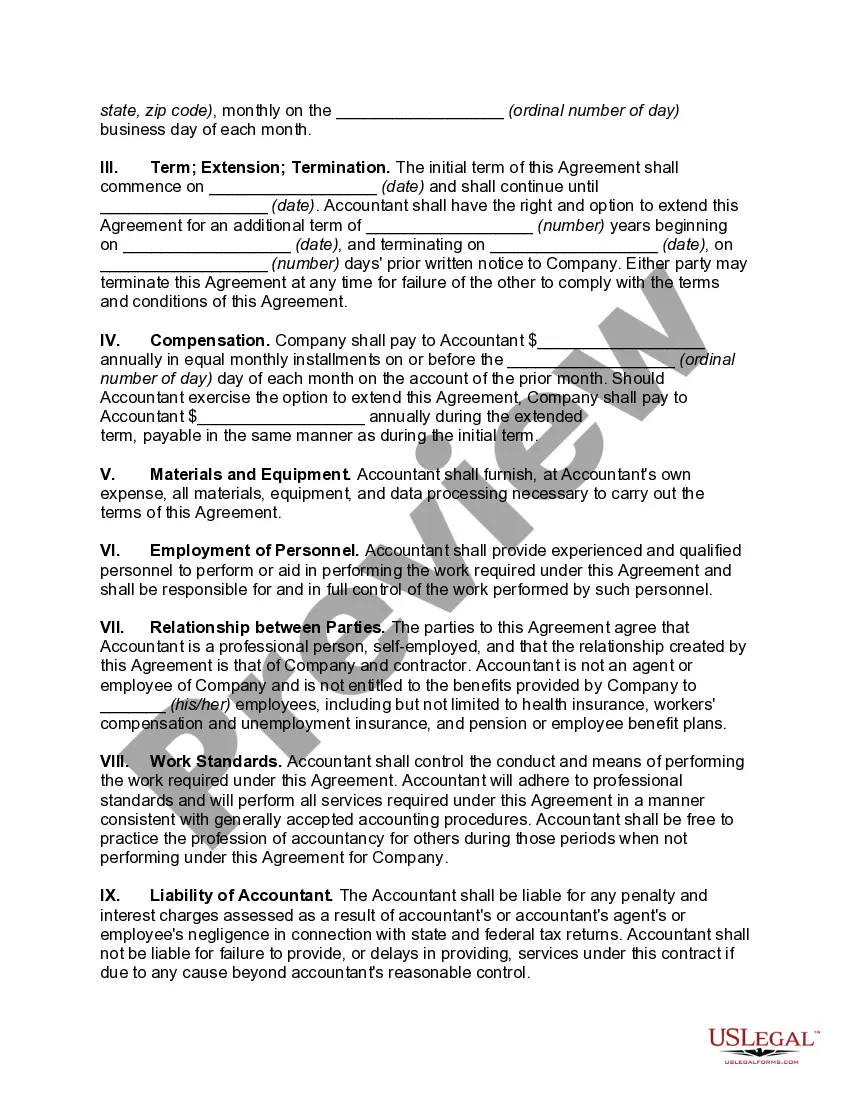

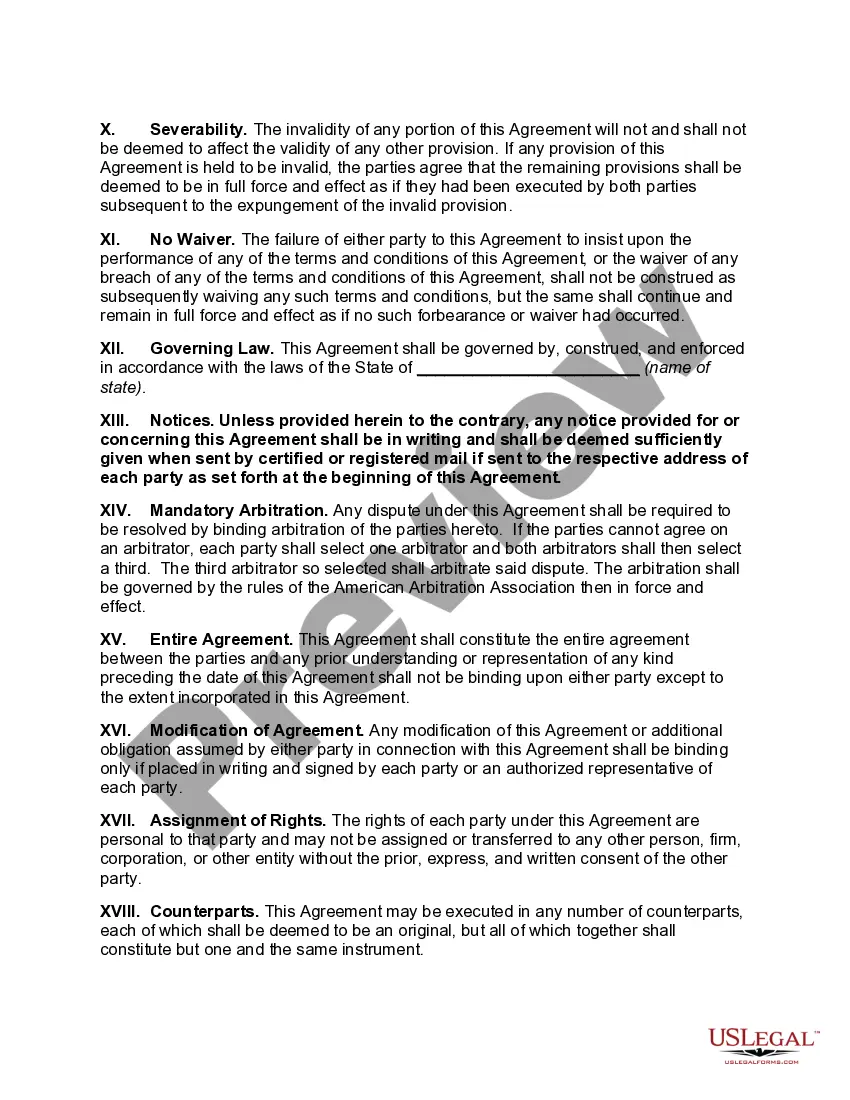

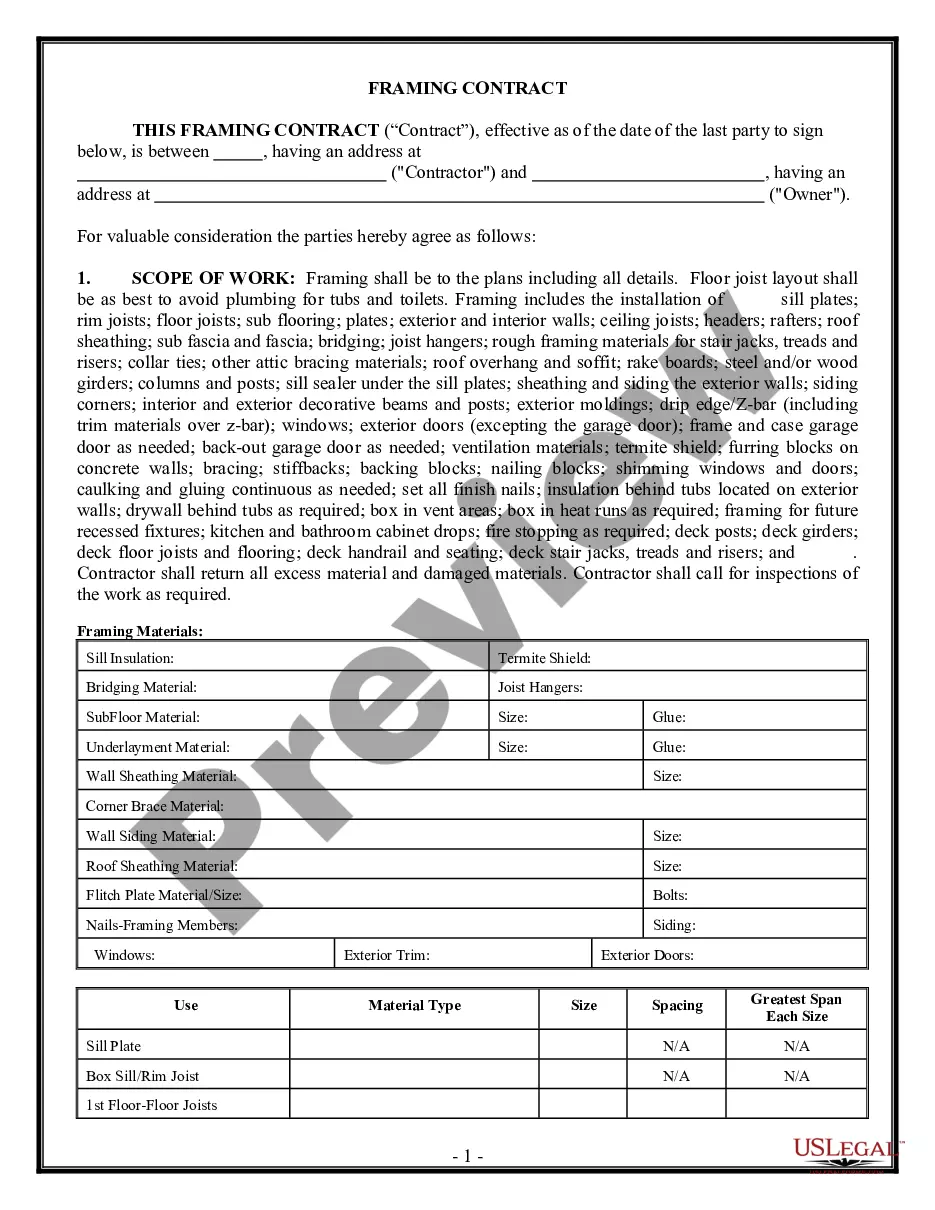

Title: Comprehensive Guide to Suffolk New York Independent Contractor Agreement for Accountants and Bookkeepers Introduction: In Suffolk County, New York, independent contractors often secure their working arrangements through an Independent Contractor Agreement. This legally binding document ensures that all parties involved clearly understand their rights, obligations, and terms of contract. In this detailed description, we will explore the key elements, benefits, and types of Independent Contractor Agreements tailored specifically for Accountants and Bookkeepers in Suffolk County. Keywords: Suffolk New York, Independent Contractor Agreement, Accountant, Bookkeeper, legal document, obligations, rights, terms of contract 1. Definition and Purpose: An Independent Contractor Agreement serves as a written contract between an Accountant/Bookkeeper and a client or business entity. It outlines the terms and conditions of the engagement, specifying the responsibilities, compensation, and other relevant aspects. Keywords: Definition, Purpose, engagement, responsibilities, compensation 2. Key Elements: a. Scope of Work: Clearly define the services, tasks, and deliverables expected from the Accountant/Bookkeeper. This section outlines the specific responsibilities to avoid any ambiguity. Keywords: Scope of Work, services, tasks, deliverables, responsibilities b. Compensation and Payment Terms: Specify the compensation structure, hourly rates, payment schedule, and any additional expenses that will be reimbursed. Keywords: Compensation, Payment Terms, hourly rates, payment schedule, expenses c. Duration and Termination: Indicate the start and end dates of the engagement, as well as the conditions for early termination by either party. Keywords: Duration, Termination, start date, end date, early termination d. Confidentiality and Non-Disclosure: Address the confidential nature of the information exchanged during the engagement and ensure the protection of sensitive data. Keywords: Confidentiality, Non-Disclosure, sensitive data e. Independent Contractor Status: Clearly define that the Accountant/Bookkeeper is an independent contractor and not an employee, highlighting the associated tax and legal implications. Keywords: Independent Contractor Status, independent contractor, tax implications, legal implications 3. Benefits of using an Independent Contractor Agreement: a. Legal Protection: An appropriately drafted agreement safeguards both parties' rights and helps establish a legally binding relationship. Keywords: Legal Protection, Agreement, relationship b. Clarity and Expectations: By outlining the scope of work and responsibilities, the Agreement sets clear expectations, minimizing potential misunderstandings. Keywords: Clarity, Expectations, potential misunderstandings c. Payment Assurance: Clearly defined compensation terms ensure timely payment and prevent payment disputes. Keywords: Payment Assurance, compensation terms, payment disputes 4. Types of Suffolk New York Independent Contractor Agreements for Accountants and Bookkeepers: While Independent Contractor Agreements may vary depending on specific circumstances, here are a few common types: a. Accountant/Bookkeeper Services Agreement: Covers general accounting or bookkeeping services for clients or businesses. b. Tax Preparation Agreement: Focuses specifically on tax-related services, including tax preparation and filing. c. Forensic Accounting Agreement: Pertains to forensic accounting services, such as investigating financial fraud or analyzing complex financial records. Conclusion: Suffolk New York Independent Contractor Agreements for Accountants and Bookkeepers are crucial documents that establish a clear contractual relationship. By encompassing all key elements, these agreements provide legal protection, clarity, and ensure payment compliance. Depending on the nature of the engagement, specific contract types such as Accountant/Bookkeeper Services Agreement, Tax Preparation Agreement, or Forensic Accounting Agreement may be utilized.

Suffolk New York Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Suffolk New York Independent Contractor Agreement For Accountant And Bookkeeper?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Suffolk Independent Contractor Agreement for Accountant and Bookkeeper.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Suffolk Independent Contractor Agreement for Accountant and Bookkeeper will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Suffolk Independent Contractor Agreement for Accountant and Bookkeeper:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Suffolk Independent Contractor Agreement for Accountant and Bookkeeper on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!