Title: Clark Nevada Independent Contractor Services Agreement with Accountant Introduction: The Clark Nevada Independent Contractor Services Agreement with Accountant is a legal document that outlines the professional terms and obligations between a business entity or individual (referred to as the "Client") and an accountant (referred to as the "Contractor"). This agreement establishes a working relationship between the two parties and ensures clarity on service expectations, compensation, confidentiality, and other critical aspects required for a successful partnership. Key Features: 1. Scope of Services: This agreement delineates the specific accounting services to be provided by the accountant to the client, such as financial statement preparation, bookkeeping, tax preparation, audit assistance, and general financial consulting. 2. Compensation and Payment Terms: The document details the payment structure, including hourly rates, flat fees, or project-based pricing. It may also highlight terms relating to billing frequency, reimbursement of expenses, and any applicable penalties for late payments. 3. Term and Termination: This section specifies the duration of the agreement, which can be a fixed term or ongoing. It also outlines the conditions under which either party can terminate the agreement, including provisions related to notice periods and any penalties for early termination. 4. Intellectual Property and Confidentiality: The agreement addresses the handling of sensitive information, ensuring that the accountant will maintain strict confidentiality regarding the Client's financial data and any proprietary information obtained during the engagement. 5. Independent Contractor Status: The agreement clarifies that the accountant is an independent contractor and not an employee, implying that the contractor is solely responsible for their own taxes, insurance, and other benefits typically associated with employment. Types of Clark Nevada Independent Contractor Services Agreements with Accountant: 1. General Accounting Services Agreement: This encompasses a wide range of accounting services, including bookkeeping, financial statement preparation, and general advisory roles. 2. Tax Services Agreement: Focuses primarily on tax preparation and planning services, to help clients navigate complex tax regulations and minimize tax liabilities. 3. Audit Support Services Agreement: Pertains specifically to assisting clients during financial audits by providing relevant documentation, answering queries, and ensuring compliance with auditing standards. 4. Consulting Services Agreement: Involves providing financial advice and expertise in areas such as budgeting, forecasting, cash flow management, and financial analysis to help clients make informed business decisions. Conclusion: The Clark Nevada Independent Contractor Services Agreement with Accountant is a comprehensive legal document that outlines the relationship between a business entity or individual and an accountant. It covers crucial aspects like services, compensation, confidentiality, intellectual property, and termination. Although there may be different types of agreements based on specific accounting services, they all aim to establish a clear understanding of the responsibilities and expectations of both parties involved.

Clark Nevada Independent Contractor Services Agreement with Accountant

Description

How to fill out Clark Nevada Independent Contractor Services Agreement With Accountant?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life situation, finding a Clark Independent Contractor Services Agreement with Accountant meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Clark Independent Contractor Services Agreement with Accountant, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Clark Independent Contractor Services Agreement with Accountant:

- Check the content of the page you’re on.

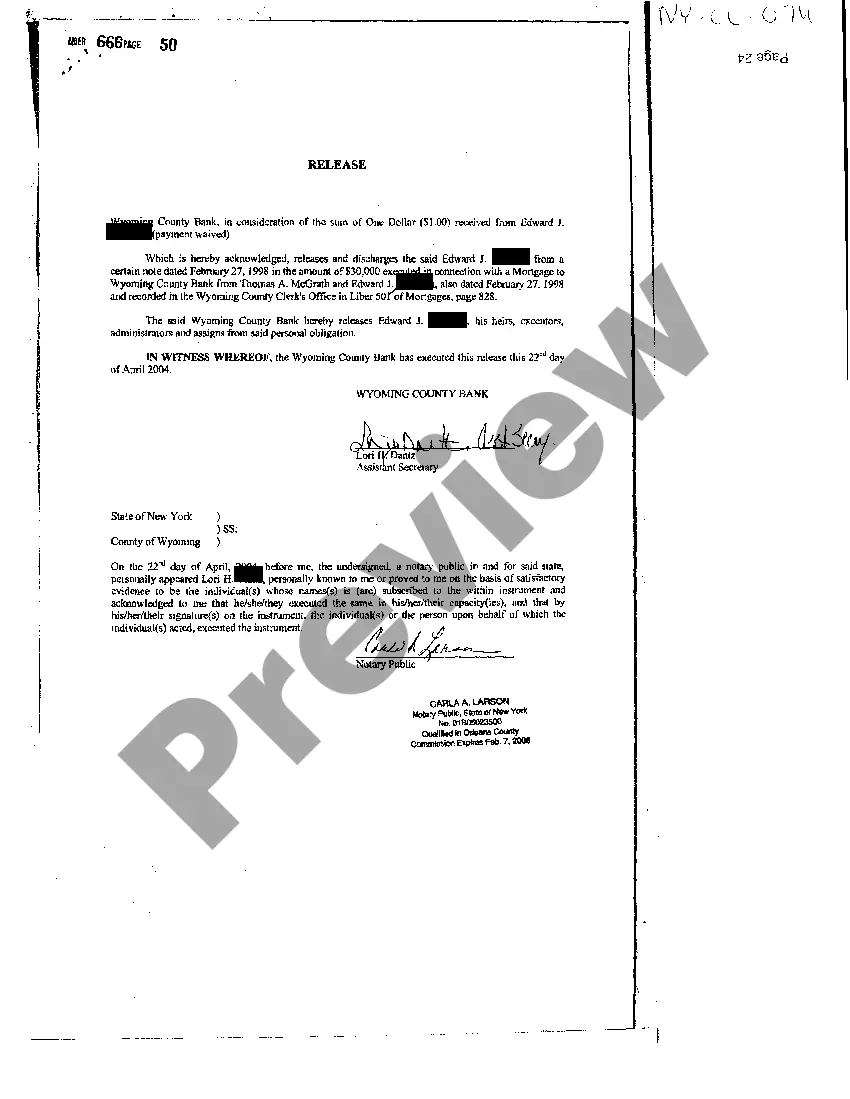

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Clark Independent Contractor Services Agreement with Accountant.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!