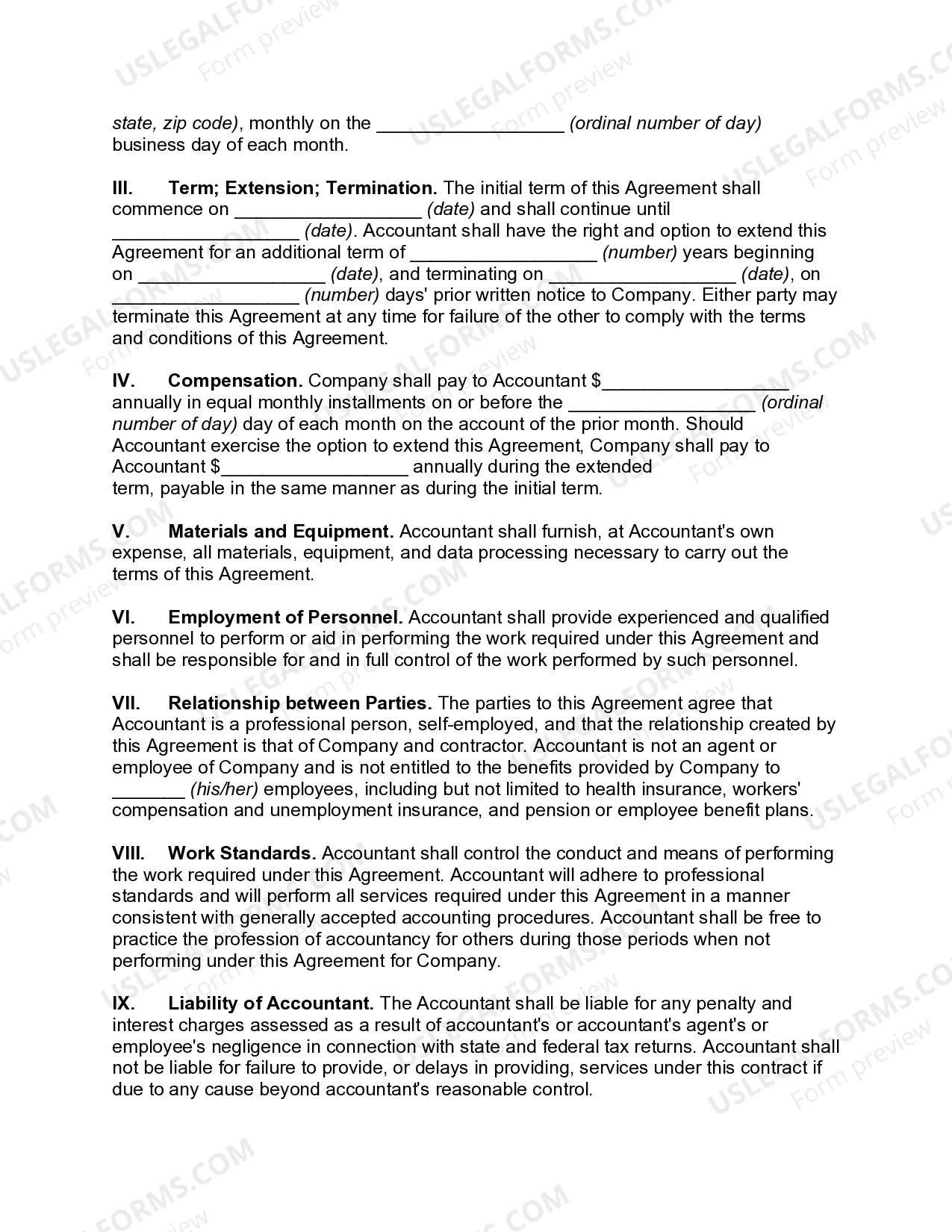

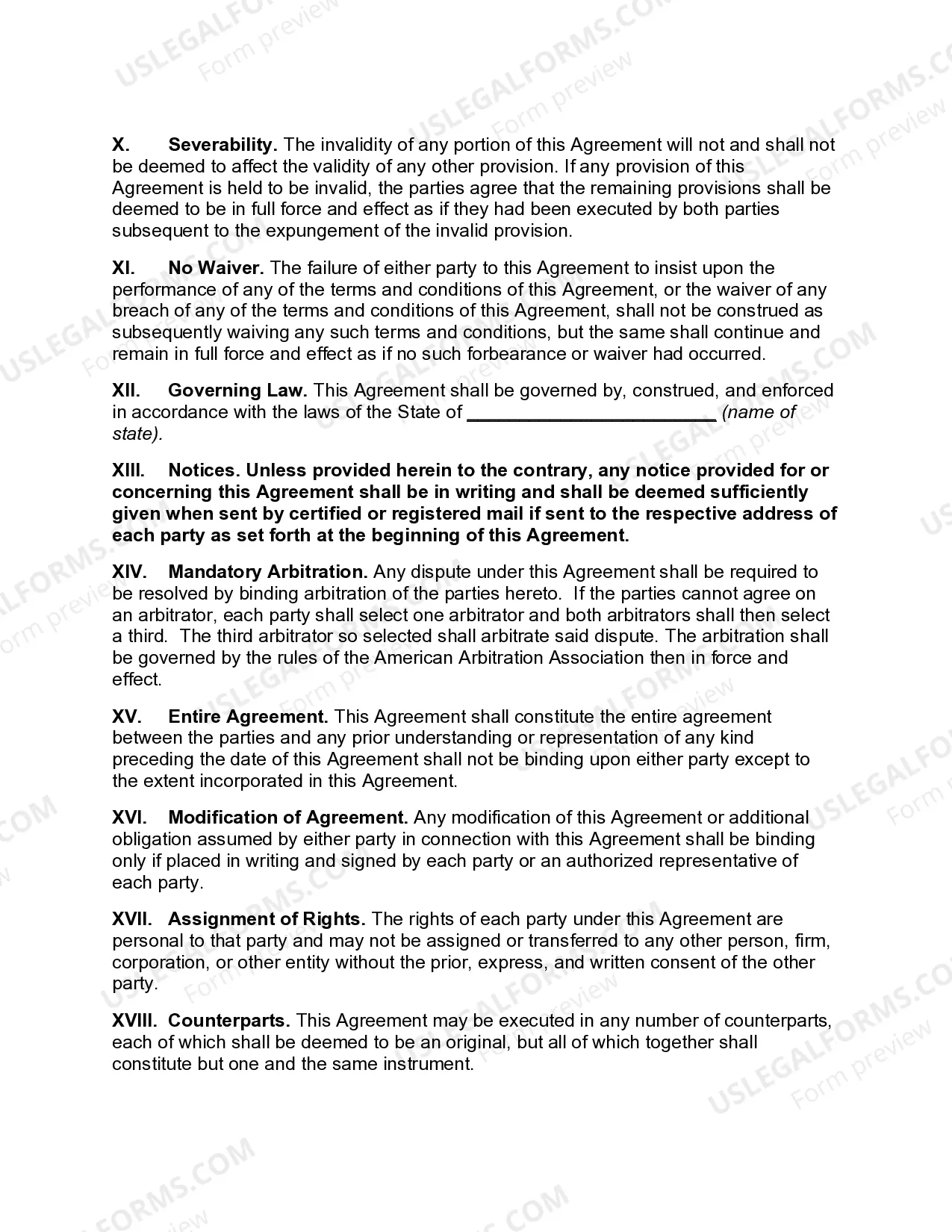

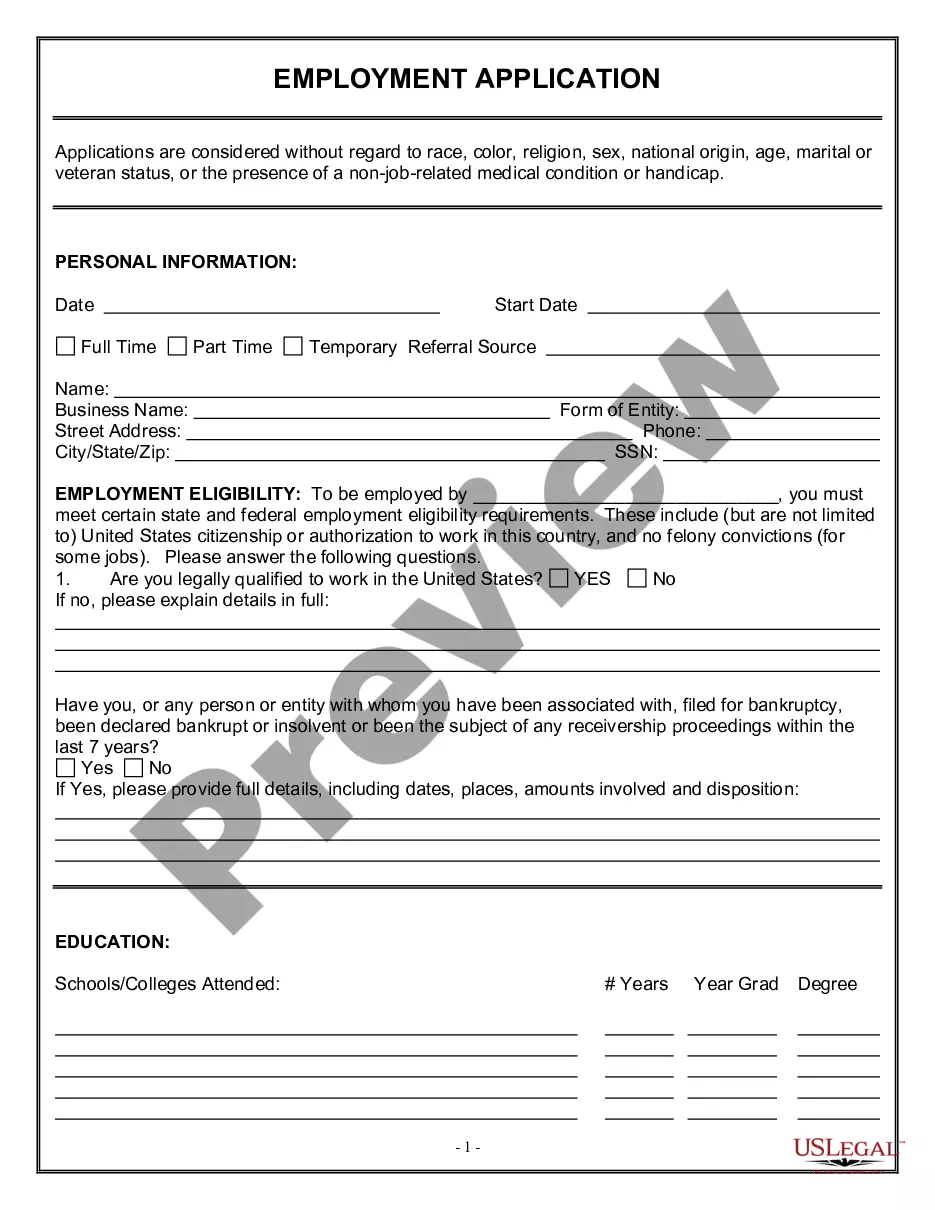

San Antonio Texas Independent Contractor Services Agreement with Accountant is a legally binding contract between an accountant and an individual or business seeking accounting services in the San Antonio, Texas area. This agreement outlines the terms and conditions under which the accountant will provide their services as an independent contractor. The primary purpose of this agreement is to clearly define the scope of the accountant's services, their responsibilities, and the expectations of both parties involved. It also serves as protection for both the accountant and the client, establishing the rights and obligations of each. The San Antonio Texas Independent Contractor Services Agreement with Accountant typically includes the following key elements: 1. Parties: Identifies the client and the accountant, including their legal names and addresses. 2. Services Provided: Clearly outlines the specific services the accountant will provide, such as bookkeeping, tax preparation, financial analysis, or any other accounting-related tasks. 3. Term: Specifies the duration of the agreement, including the start date and end date or the conditions under which the agreement can be terminated. 4. Compensation: States the fee structure, payment terms, and any additional expenses that will be reimbursed to the accountant. 5. Confidentiality: Ensures that the accountant will maintain the confidentiality of the client's sensitive financial information and prohibits them from disclosing it to any third party without prior consent. 6. Ownership of Work: Clarifies that all work performed by the accountant, including documents, reports, and other deliverables, will belong to the client. 7. Independent Contractor Status: Affirms that the accountant is an independent contractor and not an employee of the client, thus not entitled to benefits or privileges granted to regular employees. 8. Governing Law: Specifies that the agreement will be governed by the laws of the state of Texas. There are various types of San Antonio Texas Independent Contractor Services Agreements with Accountant that may be tailored to meet specific needs: 1. Basic Accounting Services Agreement: An agreement covering fundamental accounting services, such as bookkeeping, financial statement preparation, and general financial analysis. 2. Tax Services Agreement: A specialized agreement focusing solely on tax-related services, including tax planning, preparation, and filing for individuals and businesses. 3. Consulting Services Agreement: For accountants offering consulting services, this agreement outlines the scope of advisory services, project duration, and fees. 4. Financial Analysis Agreement: Designed for accountants providing in-depth financial analysis and forecasting services to assist clients in making strategic business decisions. 5. Comprehensive Accounting Services Agreement: Covers a wide range of accounting services, including bookkeeping, tax services, payroll processing, financial analysis, and consulting, providing a comprehensive solution tailored to the client's needs. In conclusion, the San Antonio Texas Independent Contractor Services Agreement with Accountant is a crucial legal document that ensures a clear understanding and agreement between the accountant and the client regarding the scope, terms, and conditions of the accounting services provided. It protects both parties' rights and ensures a professional, beneficial working relationship.

San Antonio Texas Independent Contractor Services Agreement with Accountant

Description

How to fill out San Antonio Texas Independent Contractor Services Agreement With Accountant?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including San Antonio Independent Contractor Services Agreement with Accountant, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any tasks related to paperwork execution simple.

Here's how you can locate and download San Antonio Independent Contractor Services Agreement with Accountant.

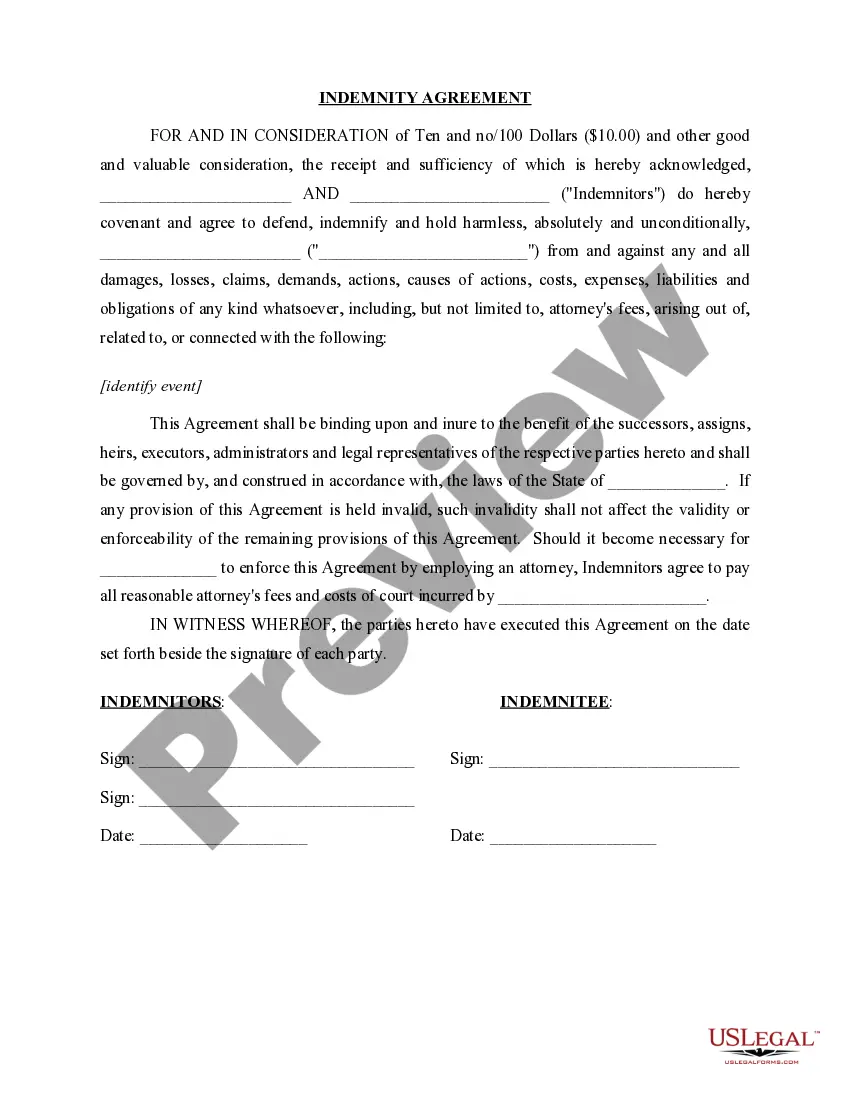

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related forms or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase San Antonio Independent Contractor Services Agreement with Accountant.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Independent Contractor Services Agreement with Accountant, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you need to cope with an exceptionally complicated situation, we advise getting a lawyer to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!