A Maricopa Arizona Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a legally binding contract entered into by a company or business entity located in Maricopa, Arizona, and a financial consultant. This agreement outlines the terms and conditions under which the consultant will provide financial services to the company, ensuring the confidentiality and privacy of sensitive financial information. This consultant agreement may have various types, depending on the specific nature of financial services required by the company. Some common types include: 1. Financial Advisory Agreement: This type of agreement is suitable when a company seeks expert advice and guidance on financial matters such as investment analysis, risk management, and strategic financial planning. The consultant, as a financial advisor, assists the company in making informed decisions to optimize financial performance and achieve specific financial goals. 2. Accounting Services Agreement: In this type of agreement, the consultant provides specialized accounting services like bookkeeping, financial statement preparation, tax compliance, and analysis of financial data. The focus here is primarily on ensuring accurate and timely financial reporting for the company. 3. Budgeting and Forecasting Agreement: Here, the consultant assists the company in developing comprehensive budgets and financial forecasts. This agreement could involve creating financial models, analyzing historical data, and identifying future financial trends to aid the company in effective financial planning and decision-making. Regardless of the specific type of consultant agreement, the primary objective of including confidentiality provisions is to protect sensitive financial information shared by the company with the consultant. Confidentiality provisions ensure that the consultant maintains strict confidentiality regarding all financial data, trade secrets, proprietary information, or any other sensitive information disclosed during the engagement. These confidentiality provisions often include non-disclosure clauses, which prevent the consultant from disseminating any confidential information to third parties without the express written permission of the company. Additionally, the agreement may outline the consultant's responsibilities concerning data storage, security, and disposal to further safeguard the company's financial information. The Maricopa Arizona Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions acts as a crucial legal document providing clarity and protection for both parties involved in the engagement. It lays out the scope of work, compensation terms, intellectual property rights, termination clauses, and dispute resolution mechanisms in addition to the confidentiality provisions.

Maricopa Arizona Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out Maricopa Arizona Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Maricopa Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

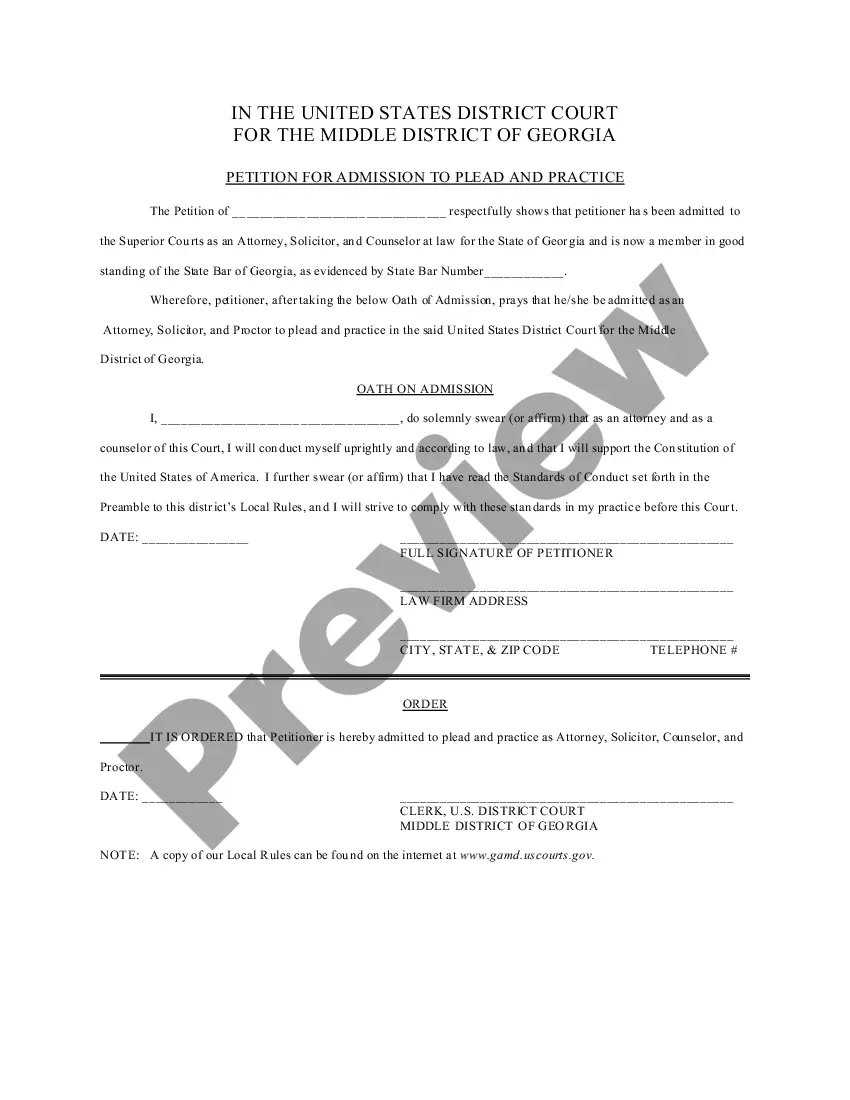

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!