San Antonio, Texas is a vibrant city known for its rich culture, historical significance, and booming economy. It is home to a diverse range of industries, including finance and banking, making it an ideal location for companies seeking financial consulting services. In this thriving business environment, many companies in San Antonio Texas require the assistance of financial consultants to manage their finances and ensure accurate financial reporting. To establish a professional relationship between businesses and consultants, a Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is commonly utilized. This agreement serves as a legally binding contract between the company and the consultant, outlining the terms and conditions of their collaboration. It is designed to protect both parties' interests and ensure a smooth working relationship throughout the duration of the engagement. The Consultant Agreement typically includes various key provisions related to the scope of services, compensation, confidentiality, and non-disclosure. It defines the specific financial consulting services to be provided by the consultant, such as financial analysis, budgeting, forecasting, or tax planning. Regarding compensation, the agreement stipulates the consultant's fees, payment terms, and any additional expenses that may be reimbursed. This helps establish clarity and transparency regarding financial matters. One crucial aspect of any San Antonio Texas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is the inclusion of confidentiality clauses. These provisions ensure the protection of sensitive financial information and trade secrets shared between the parties. Confidentiality provisions may include non-disclosure agreements, which prohibit the consultant from disclosing any confidential information obtained during the engagement to third parties. It also establishes the consultant's responsibility to handle and safeguard the company's financial data securely. Different types or variations of the Consultant Agreement may exist, tailored to specific industries or specialized financial services. For instance, there might be separate agreements for financial consultants serving in the banking sector, investment firms, or accounting firms. In conclusion, the San Antonio Texas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a crucial tool for establishing a professional relationship between businesses and financial consultants. It ensures that the financial consulting services are clearly defined, compensation terms are agreed upon, and confidentiality is maintained throughout the engagement.

San Antonio Texas Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out San Antonio Texas Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including San Antonio Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any activities associated with document execution straightforward.

Here's how to locate and download San Antonio Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

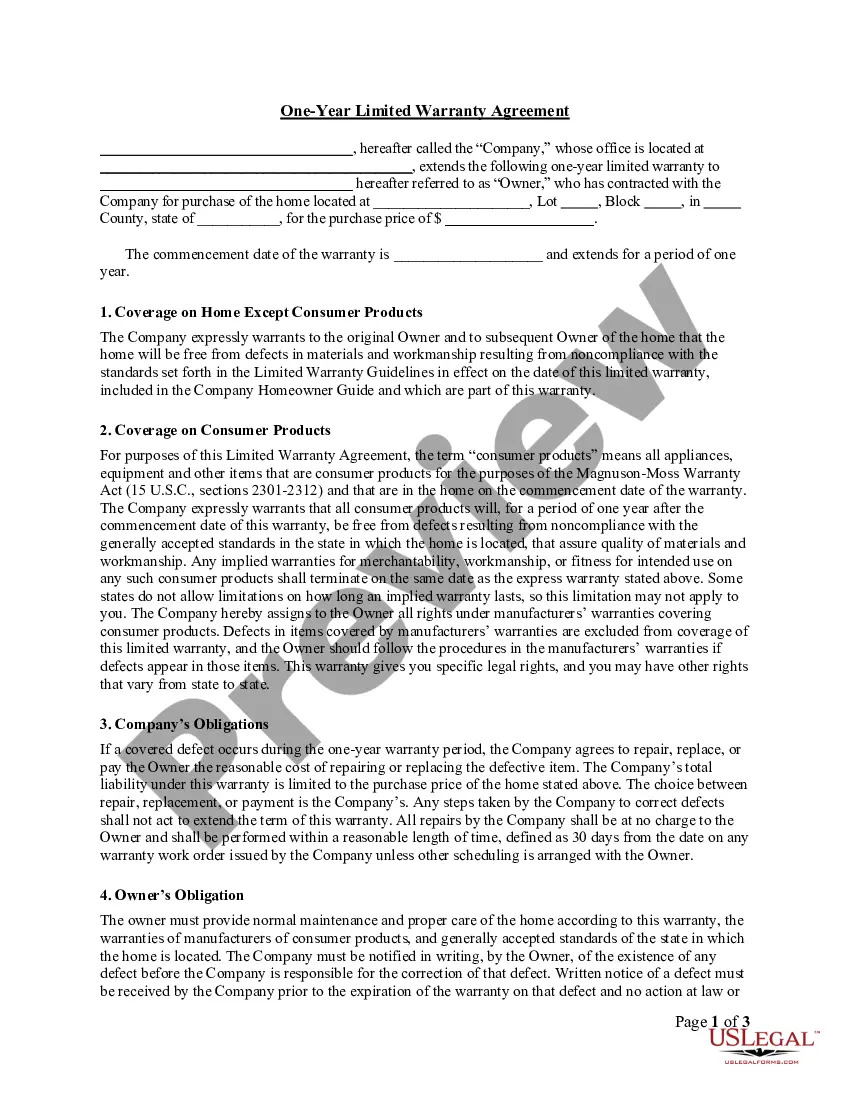

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy San Antonio Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to deal with an exceptionally challenging situation, we advise using the services of an attorney to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!