The Suffolk New York Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions is a legally binding contract that outlines the terms and conditions under which a consultant provides financial services to a company in Suffolk, New York. This agreement ensures that both parties are aware of their rights, responsibilities, and obligations. The consultant agreement covers a wide range of financial services, including but not limited to financial reporting, bookkeeping, budgeting, forecasting, financial analysis, tax planning, and general financial management. The agreement specifies the scope of services to be provided by the consultant and the duration of the engagement. Confidentiality provisions are a crucial aspect of this agreement. They ensure that any sensitive financial information shared by the company with the consultant remains confidential and is not disclosed to any third party without prior authorization. These provisions protect the company's trade secrets, financial data, and other proprietary information. Keyword variations related to this topic: Suffolk New York financial consultant agreement, Suffolk New York financial reporting services agreement, Suffolk New York consultant agreement for financial services, Suffolk New York finance consultant contract, Suffolk New York financial reporting consultant agreement, confidentiality provisions in Suffolk New York consultant agreement, financial services agreement in Suffolk New York. Types of Suffolk New York Consultant Agreements for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions may include: 1. General Financial Services Agreement: This agreement covers a wide range of financial services, including financial reporting, analysis, and general financial management. 2. Tax Consultant Agreement: This agreement specifically focuses on tax-related services, such as tax planning, compliance, and audit support. 3. Bookkeeping Services Agreement: This agreement is tailored for consultants providing bookkeeping services, including maintaining financial records, reconciling accounts, and generating financial reports. 4. Budgeting and Forecasting Services Agreement: This agreement outlines the consultant's responsibilities in developing budgets, financial forecasts, and providing related advisory services. 5. Financial Analysis Consultant Agreement: This agreement is designed for consultants specializing in financial analysis, providing insights into the company's financial performance, investment opportunities, and risk assessment. It is important to note that the specific terms and provisions of each agreement may vary depending on the unique needs and preferences of the company and the consultant. It is advisable to consult with legal professionals while drafting or entering into such agreements to ensure compliance with local laws and regulations.

Suffolk New York Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

How to fill out Suffolk New York Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

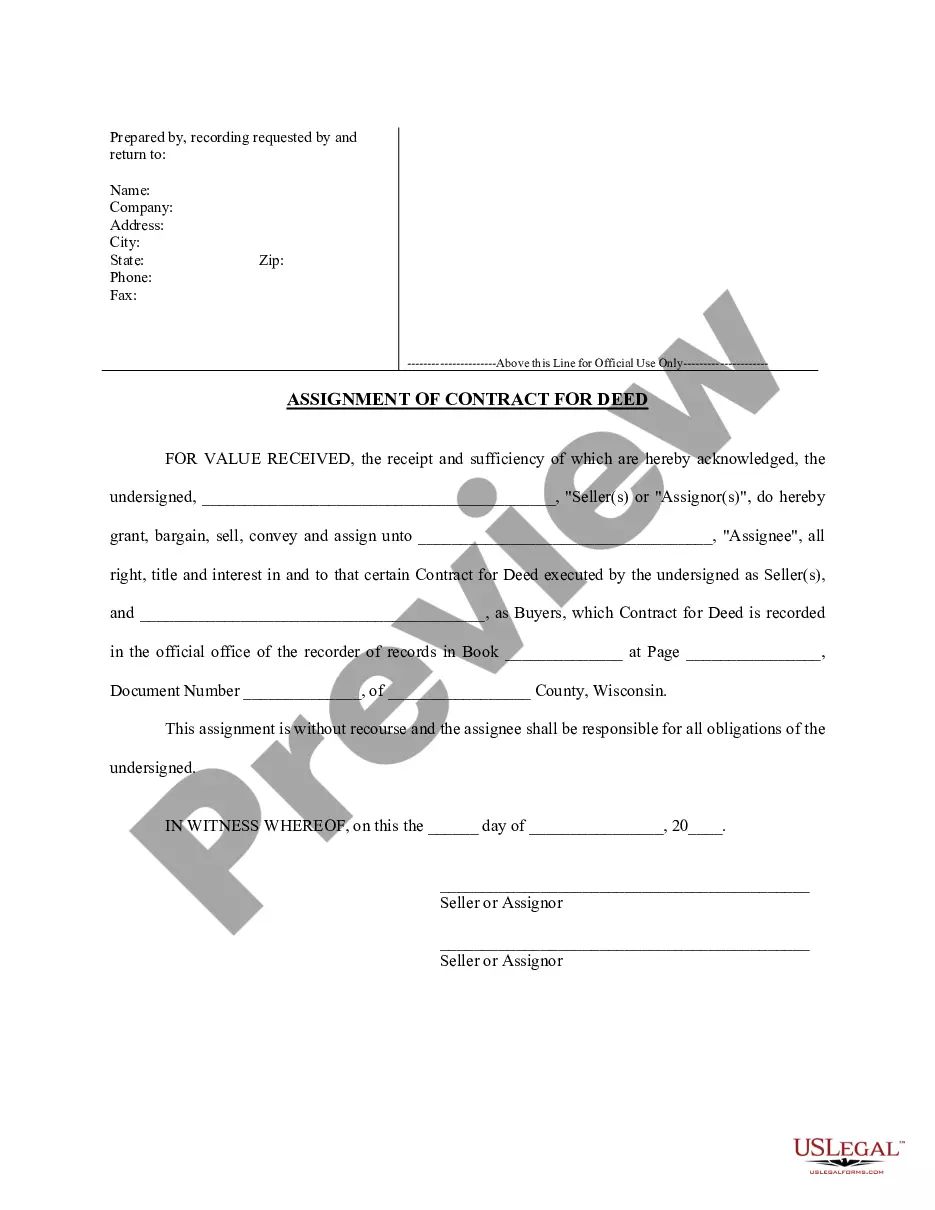

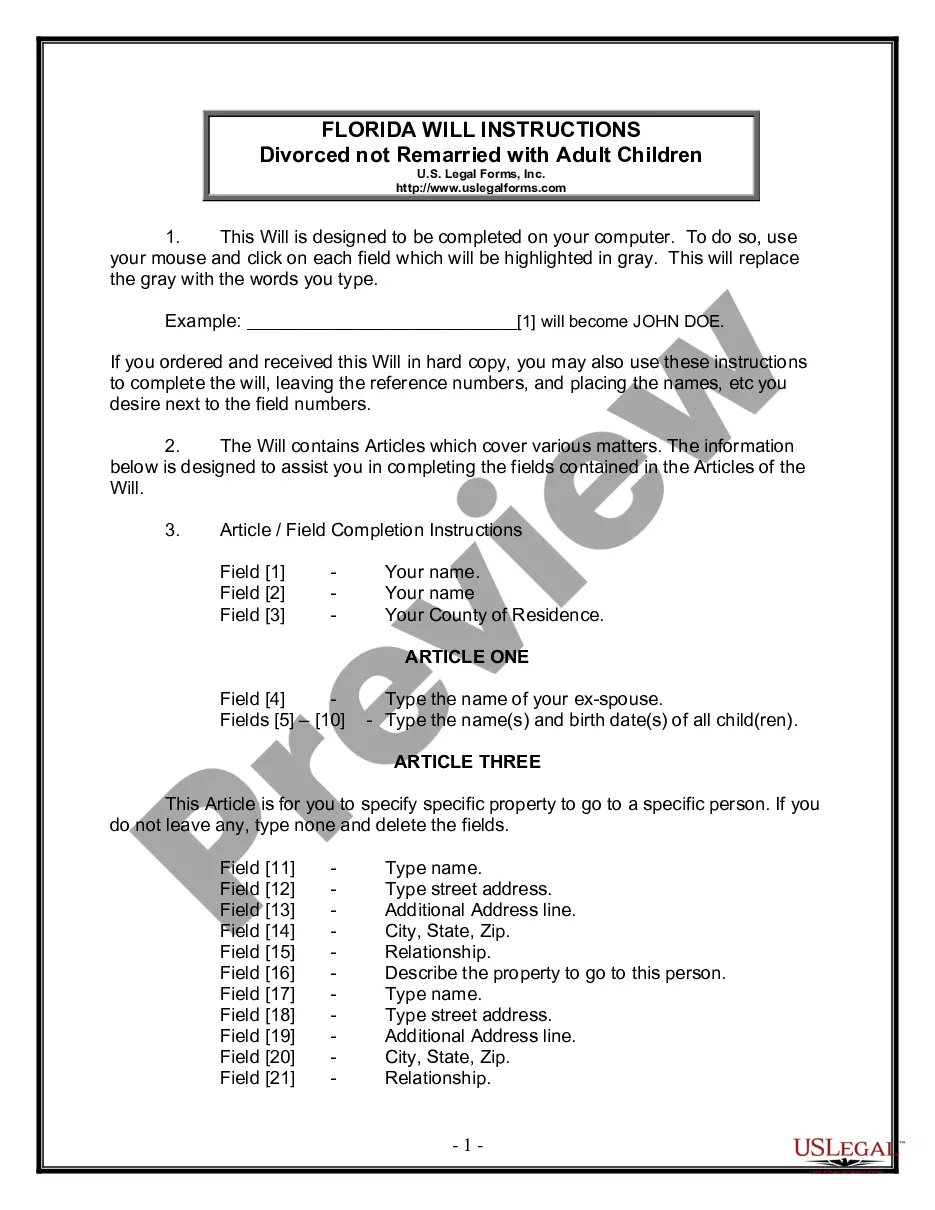

Creating documents, like Suffolk Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, to manage your legal matters is a difficult and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for different cases and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Suffolk Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Suffolk Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions:

- Make sure that your document is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Suffolk Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin using our service and download the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!