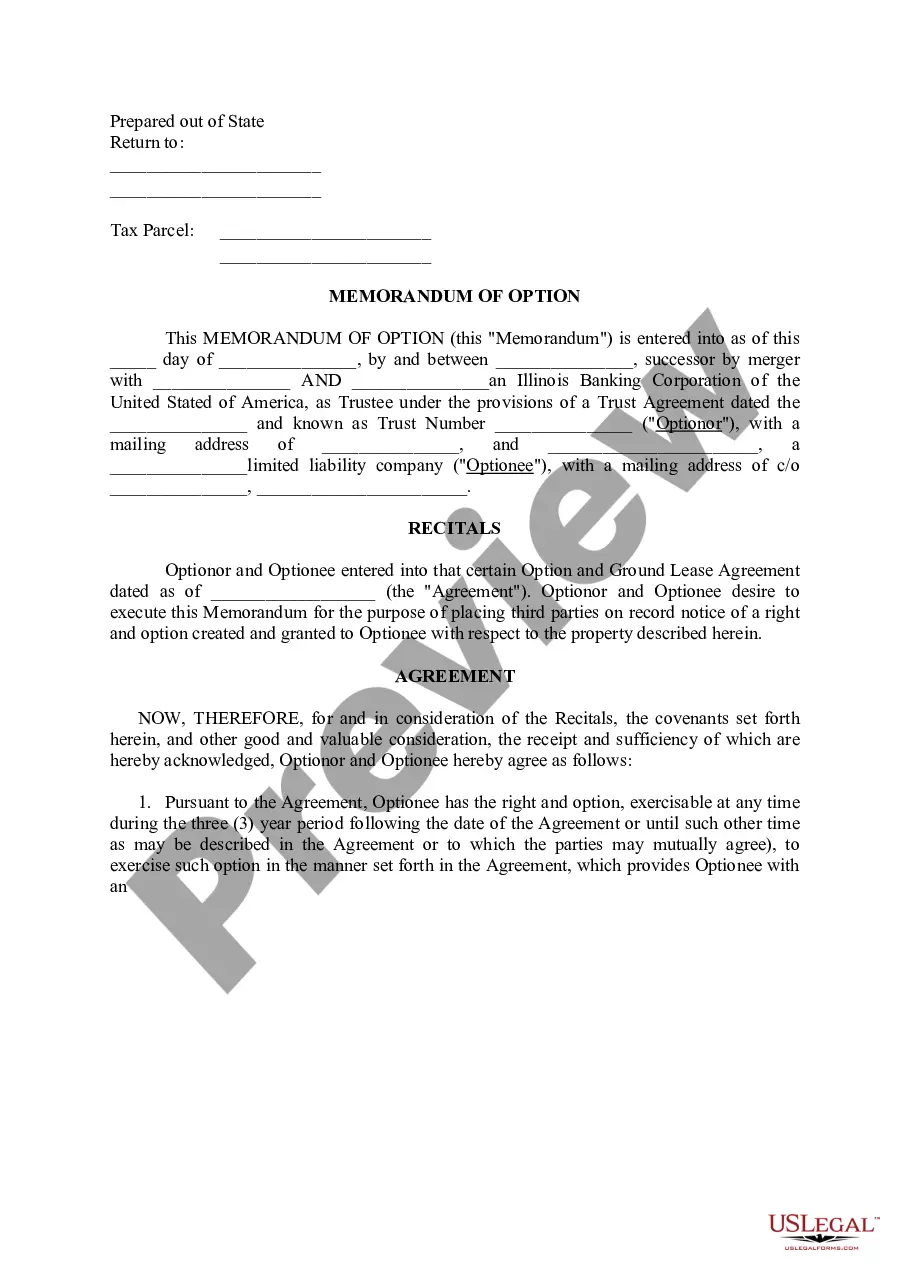

Mecklenburg North Carolina Balance Sheet Deposits are financial assets held by banks and other financial institutions in Mecklenburg County, North Carolina. These deposits are recorded on the balance sheets of these institutions as liabilities, as they represent obligations to account holders. There are several types of Mecklenburg North Carolina Balance Sheet Deposits: 1. Checking Accounts: These deposits are demand deposits that allow customers to deposit and withdraw funds at any time. Checking accounts typically do not earn significant interest and are used for daily transactions, such as paying bills, making purchases, and receiving direct deposits. 2. Savings Accounts: These deposits are interest-bearing accounts that provide individuals with a secure place to store their excess funds while earning interest. Savings accounts generally have limitations on the number of withdrawals per month and may require a minimum balance to avoid fees. 3. Money Market Accounts: These deposits are similar to savings accounts but often offer higher interest rates. Money market accounts typically have higher balance requirements and may have limited check-writing privileges. 4. Certificates of Deposit (CDs): These deposits involve individuals depositing a specific amount of money for a fixed period of time, ranging from a few months to several years. CDs generally offer higher interest rates than regular savings accounts but have penalties for early withdrawal. 5. Time Deposits: These deposits are similar to CDs and involve individuals depositing funds for a specified period. Time deposits offer a fixed interest rate and cannot be withdrawn before the maturity date without incurring penalties. 6. Individual Retirement Accounts (IRAs): These deposits are specifically designated for retirement savings. IRAs offer various tax advantages, and there are different types, such as Traditional IRAs and Roth IRAs, each with its own rules and benefits. 7. Brokerage Accounts: While not specific to balance sheet deposits, brokerage accounts can also be considered as a type of deposit. These accounts allow individuals to deposit funds for investment purposes, facilitating the buying and selling of stocks, bonds, mutual funds, and other securities. By maintaining a variety of balance sheet deposits, financial institutions provide residents and businesses in Mecklenburg County, North Carolina with convenient and secure methods to manage their funds. Each type of deposit serves a specific purpose, enabling individuals to choose the most suitable option based on their financial goals, access needs, and risk appetite.

Mecklenburg North Carolina Balance Sheet Deposits

Description

How to fill out Mecklenburg North Carolina Balance Sheet Deposits?

Do you need to quickly draft a legally-binding Mecklenburg Balance Sheet Deposits or maybe any other document to manage your own or business affairs? You can go with two options: hire a professional to write a legal paper for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant document templates, including Mecklenburg Balance Sheet Deposits and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Mecklenburg Balance Sheet Deposits is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Mecklenburg Balance Sheet Deposits template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!