Orange California Balance Sheet Deposits are a crucial aspect of a financial institution's balance sheet, specifically in the context of Orange County, California. A balance sheet is a financial statement that provides a snapshot of a company's financial position at a given point in time. It presents a summary of the assets, liabilities, and shareholders' equity owned by an organization. In Orange County, California, balance sheet deposits refer to the funds deposited by individuals, businesses, and organizations into various financial institutions located in the area. These deposits serve as a valuable source of funds for banks and credit unions, which use them for lending and investment activities. Balance sheet deposits play a significant role in the local economy, as they provide a stable source of financing for businesses and individuals. These deposits are typically made into different types of accounts, offering various features and benefits to depositors. Some commonly found types of balance sheet deposits in Orange County, California include: 1. Checking Accounts: These accounts offer convenient access to funds for daily transactions. Depositors can write checks or use debit cards associated with these accounts for payments or withdrawals. 2. Savings Accounts: These accounts help individuals and organizations save money over time while earning interest on their deposits. They usually offer higher interest rates compared to checking accounts, encouraging individuals to accumulate funds for future use. 3. Money Market Accounts: Money market accounts are similar to savings accounts but typically offer higher interest rates. They often require higher minimum balance requirements while providing additional flexibility for accessing funds. 4. Certificates of Deposit (CDs): CDs are fixed-term deposits that offer a higher interest rate compared to regular savings accounts or checking accounts. Depositors commit to keeping the funds deposited for a specified amount of time, ranging from a few months to several years. 5. Negotiable Order of Withdrawal (NOW) Accounts: NOW accounts are interest-bearing accounts typically used by businesses and nonprofit organizations. These accounts combine the features of checking accounts with the interest-earning capabilities of savings accounts. In Orange County, California, financial institutions aim to attract and retain depositors by offering competitive interest rates, additional services, and convenient online banking capabilities. They also ensure the security of deposited funds through deposit insurance provided by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCAA), protecting depositors' funds up to a certain amount. Overall, Orange California Balance Sheet Deposits are a crucial component of the local financial ecosystem, facilitating economic growth and providing individuals and businesses with a secure place to deposit their funds.

Orange California Balance Sheet Deposits

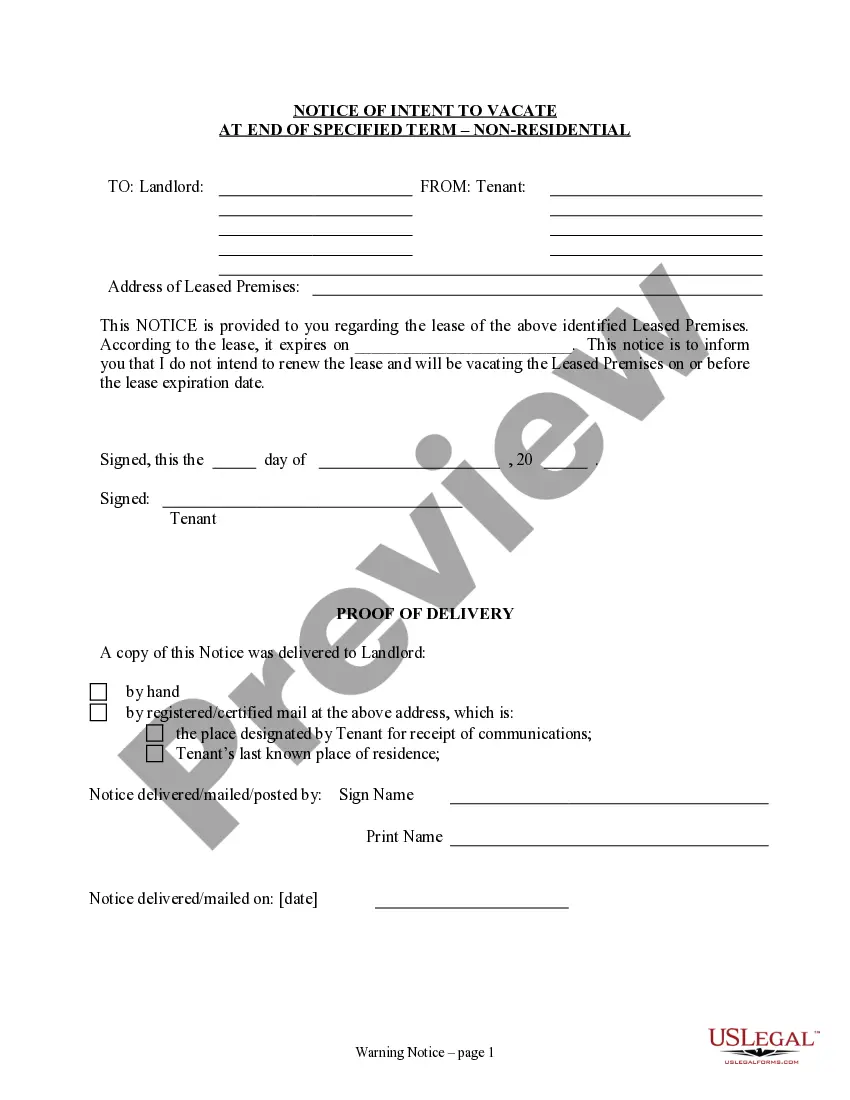

Description

How to fill out Orange California Balance Sheet Deposits?

Draftwing documents, like Orange Balance Sheet Deposits, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for various scenarios and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Orange Balance Sheet Deposits form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Orange Balance Sheet Deposits:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Orange Balance Sheet Deposits isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!