Houston, Texas Finance Lease of Equipment Overview: If you are a business owner in Houston, Texas, looking to acquire essential equipment without having to make a large upfront payment, the Houston Texas Finance Lease of Equipment can be a highly beneficial solution for your company's financial needs. By opting for this type of lease, you can overcome the burden of purchasing equipment outright and instead, manage your cash flow more effectively. The Houston Texas Finance Lease of Equipment is a financing option that enables businesses to lease equipment for a specific period, typically ranging from one to five years. Unlike an operating lease, where the lessor retains ownership of the equipment, a finance lease allows the lessee to take ownership once the lease term ends by exercising a purchase option. This feature can be advantageous if you plan to use the equipment extensively and for an extended duration. There are different types of finance leases available to businesses in Houston, Texas. Understanding these lease options is essential to make an informed decision based on your specific requirements: 1. Fair Market Value (FMV) Lease: In an FMV lease, at the end of the lease term, you have the option to purchase the equipment at its fair market value, return it to the lessor, or renew the lease. This type of lease is ideal for businesses that expect their equipment requirements to change frequently or want to upgrade to the latest technology at the end of the lease term. 2. Dollar Buyout Lease: A dollar buyout lease, also known as a capital lease, allows you to purchase the equipment for a predetermined amount (usually $1) at the end of the lease term. This type of lease is suitable for businesses that view the leased equipment as a long-term investment and intend to keep it beyond the lease duration. 3. Terminal Rental Adjustment Clause (TRACK) Lease: TRACK leases are specifically designed for commercial vehicles, enabling businesses in Houston, Texas, to finance their transportation needs. TRACK leases involve a prepared residual value for the vehicle, which can be beneficial for companies that rely heavily on trucks, trailers, or any other type of commercial vehicle. No matter which type of Houston Texas Finance Lease of Equipment you choose, it offers various advantages. First and foremost, it helps you preserve your working capital by providing a flexible financing solution. Alongside, you can enjoy tax benefits such as deducting lease payments as operating expenses, potentially reducing your overall tax liability. Additionally, as the lessee, you bear no risk of equipment obsolescence, as you can easily upgrade or renew your lease at the end of the term. In conclusion, Houston Texas Finance Lease of Equipment is a valuable financial option for businesses in Houston, Texas, looking to obtain essential equipment without the burden of significant upfront costs. Whether you opt for an FMV lease, dollar buyout lease, or TRACK lease, this type of financing offers flexibility, tax benefits, and reduced risk of equipment obsolescence. Consider exploring these lease options to enhance your company's productivity and profitability.

Houston Texas Finance Lease of Equipment

Description

How to fill out Houston Texas Finance Lease Of Equipment?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Houston Finance Lease of Equipment, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Houston Finance Lease of Equipment from the My Forms tab.

For new users, it's necessary to make some more steps to get the Houston Finance Lease of Equipment:

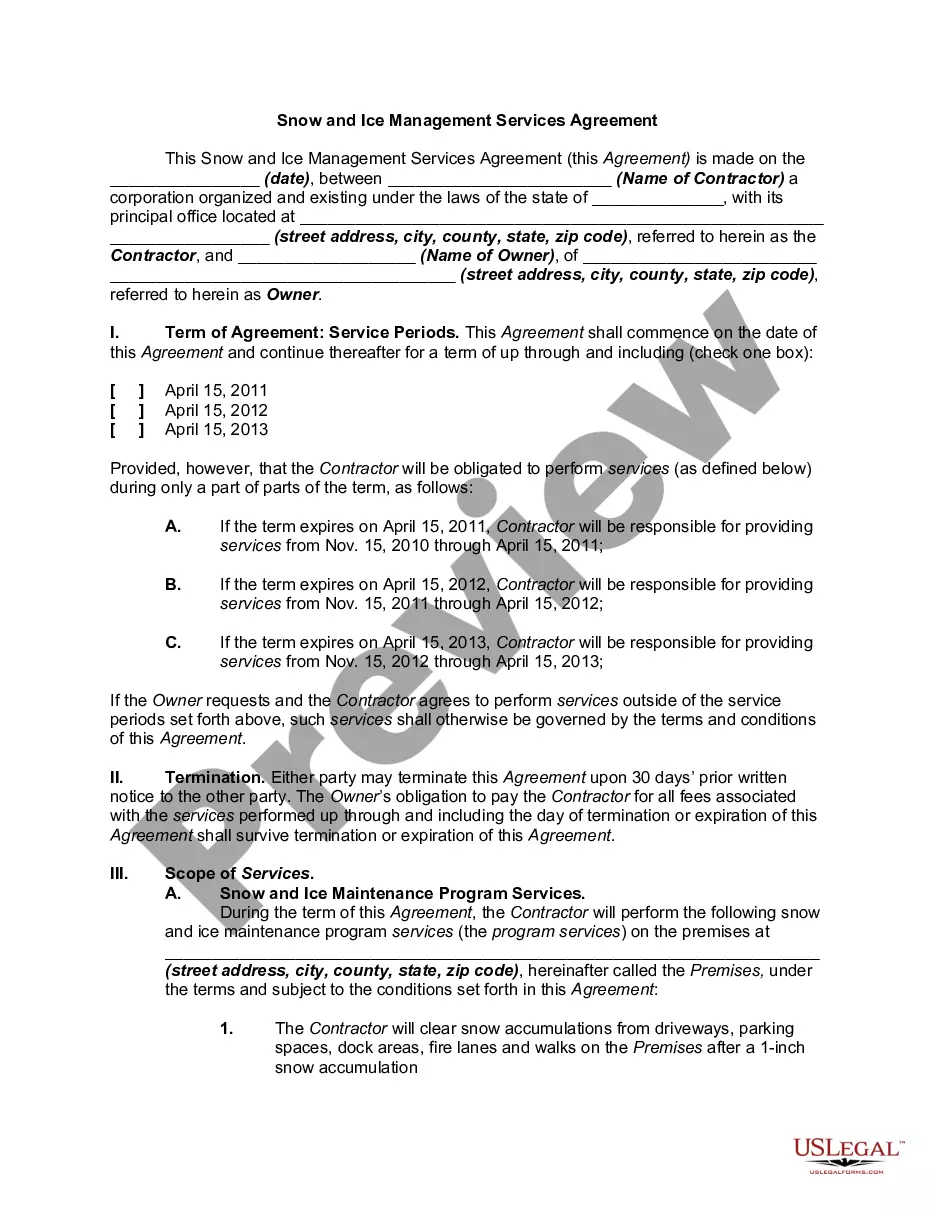

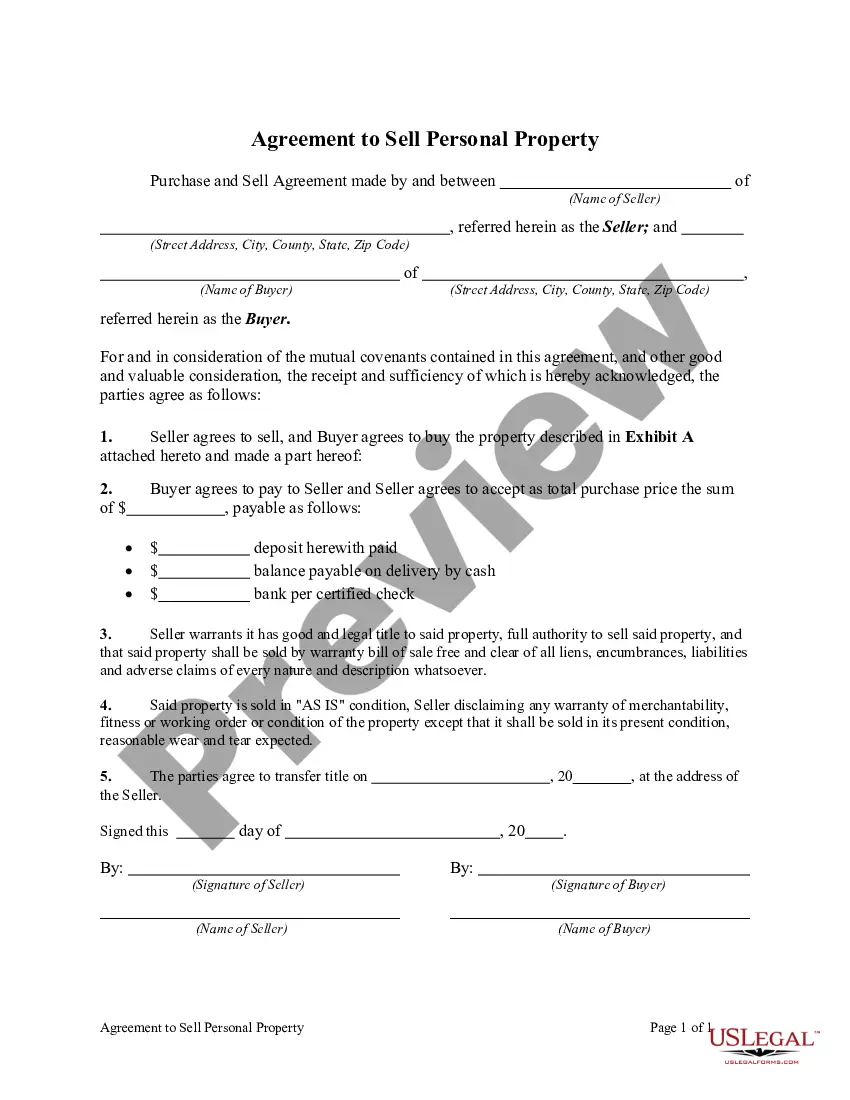

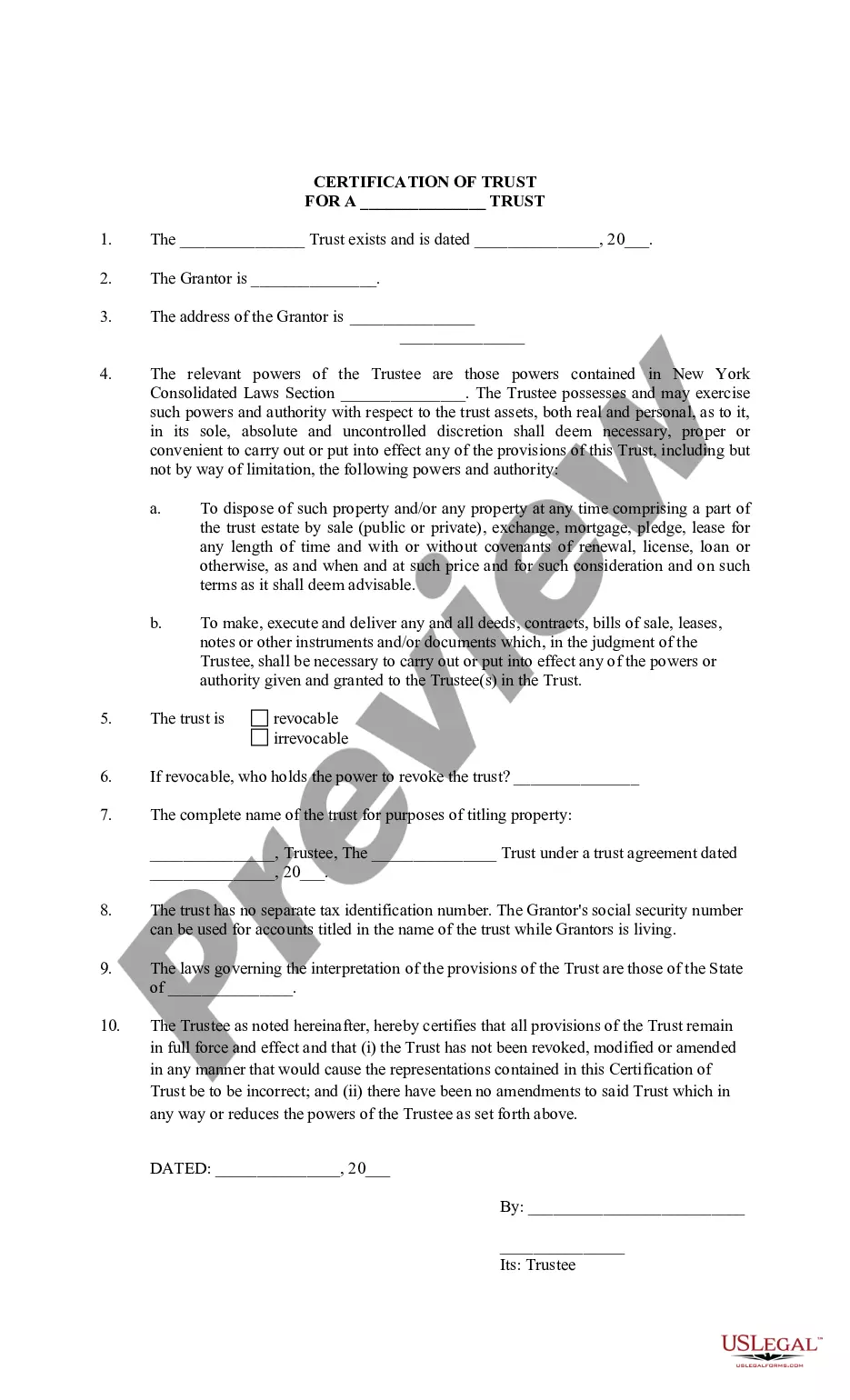

- Take a look at the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!