San Jose California Balance Sheet Notes Payable refers to a section in the financial statement of an organization operating in San Jose, California, which outlines the details of the company's debts and obligations recorded in the form of notes payable. These notes represent the amounts owed by the organization to its creditors and can include various types of loan agreements, bonds, or promissory notes that have been issued and need to be repaid within a specified period. Here are some different types of San Jose California Balance Sheet Notes Payable that can be found in a company's financial statement: 1. Short-term Notes Payable: These are obligations that are due within one year or less from the date of the balance sheet. Often, these notes are associated with financing working capital needs, such as accounts payable, accrued expenses, or bank loans. 2. Long-term Notes Payable: This category includes obligations that extend beyond one year from the date of the balance sheet. It comprises long-term debt instruments, such as bonds, mortgages, or loans with extended payment terms, which are typically used for significant investments, acquisitions, or capital expenditures. 3. Capital Lease Obligations: A company may have entered into lease agreements to acquire assets, such as real estate or equipment, where the lease constitutes a financing arrangement. In such cases, the present value of the lease payments is recorded as a liability on the balance sheet under the notes payable section. 4. Convertible Notes Payable: These are debt instruments that include an option for the creditor to convert the loan into company equity at a predetermined conversion ratio. Convertible notes payable are common among startups or companies undergoing significant growth, which allow creditors to potentially benefit from future success. 5. Contingent Notes Payable: These represent obligations contingent upon the occurrence of specific events, such as the company achieving certain performance goals or milestones. Contingent notes payable are typically disclosed in the balance sheet notes as potential liabilities based on the likelihood of the triggering event occurring. Balancing a company's balance sheet notes payable is crucial for understanding its financial health, cash flow, and ability to manage debt. By analyzing these notes, investors, creditors, and stakeholders gain insights into the financial leverage, repayment obligations, and potential risks associated with the organization's debt structure in San Jose, California.

San Jose California Balance Sheet Notes Payable

Description

How to fill out San Jose California Balance Sheet Notes Payable?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a San Jose Balance Sheet Notes Payable suiting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the San Jose Balance Sheet Notes Payable, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your San Jose Balance Sheet Notes Payable:

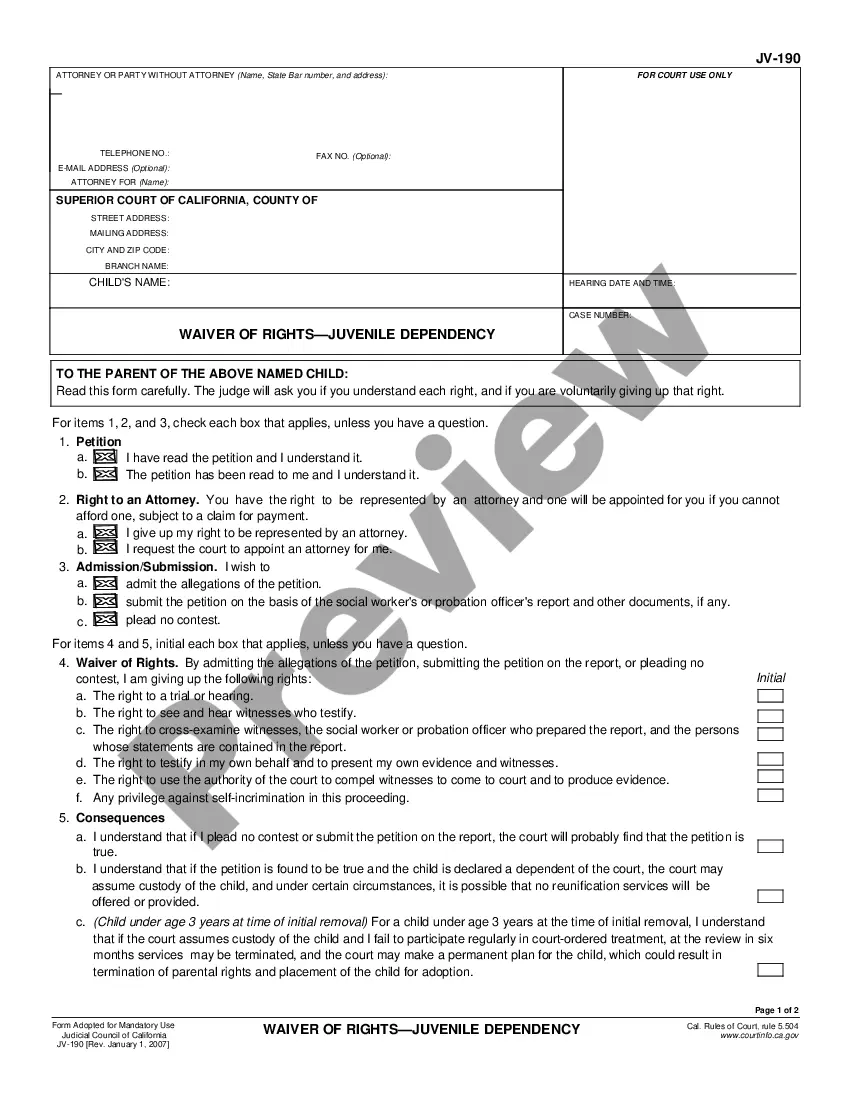

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Jose Balance Sheet Notes Payable.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!