Philadelphia Pennsylvania Abstract of Title

Description

How to fill out Philadelphia Pennsylvania Abstract Of Title?

Draftwing forms, like Philadelphia Abstract of Title, to manage your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for various scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Philadelphia Abstract of Title template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Philadelphia Abstract of Title:

- Ensure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Philadelphia Abstract of Title isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

Payments and Fees Certificate Of Title And Lien FeesAmountOriginal Title Issuance:$58.00Duplicate Title by Owner:$58.00Duplicate Title by Lienholder:$58.00Duplicate Title by a Registered Dealer:$58.001 more row

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

Our regular service will file your deed with any Pennsylvania county within 10 business days. Please check with us as many counties have COVID-related delays. Need it FAST? Your deed transfer will be filed the NEXT business day upon receipt of notarized deed if you choose our expedited service for an additional $300.

A seller will typically pay between one and three percent of a home's closing cost in Pennsylvania. Sellers will usually pay: Title insurance.

The cost varies depending on the provider, but current estimates range from 0.5% to 0.75% of the purchase price for your title insurance premium in Philadelphia. Title insurance protects buyers and lenders against claims on the title of your property prior to your ownership of the home.

Currently, the fee for filing the deed, which distributes the house from your Mother's estate into your own name, is $252.00. This amount is comprised of: $107 (Filing Fee), $107 (Philadelphia Housing Trust Fee), $. 50 (State Writ Tax), $2.00 (Philadelphia County Fee) and $35.50 (Access to Justice Fee).

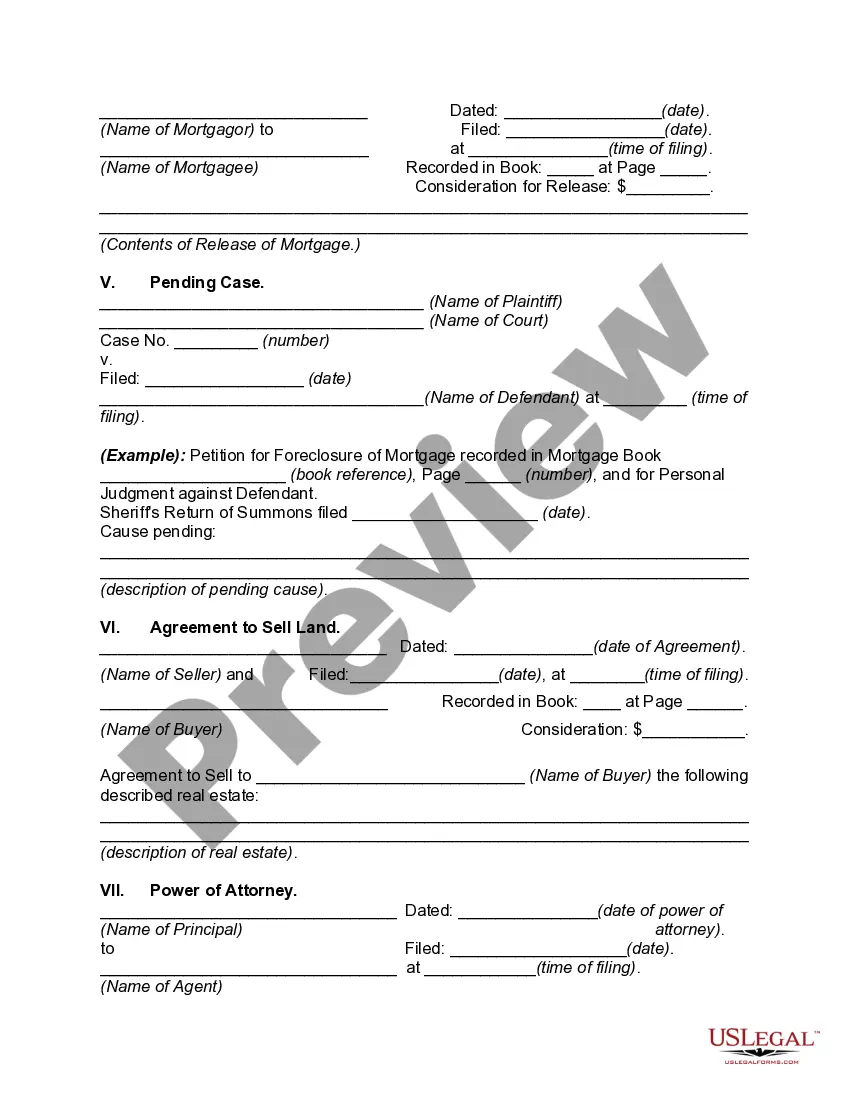

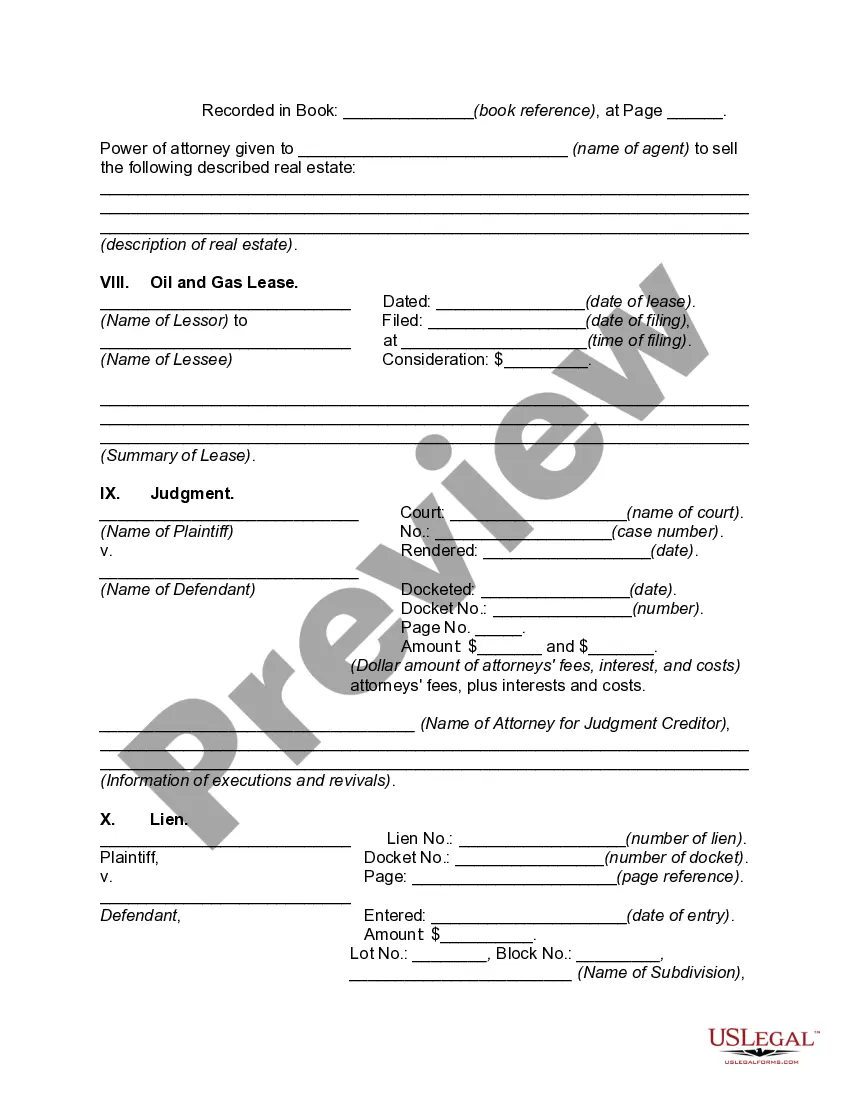

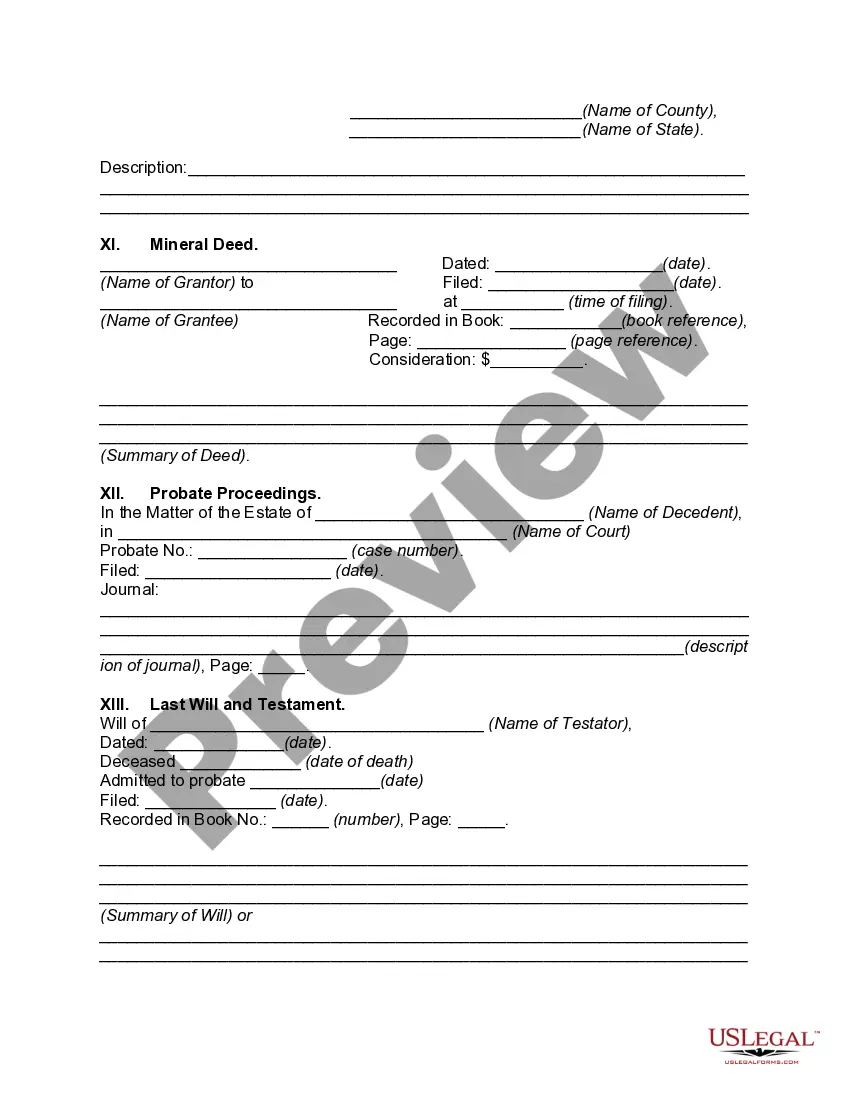

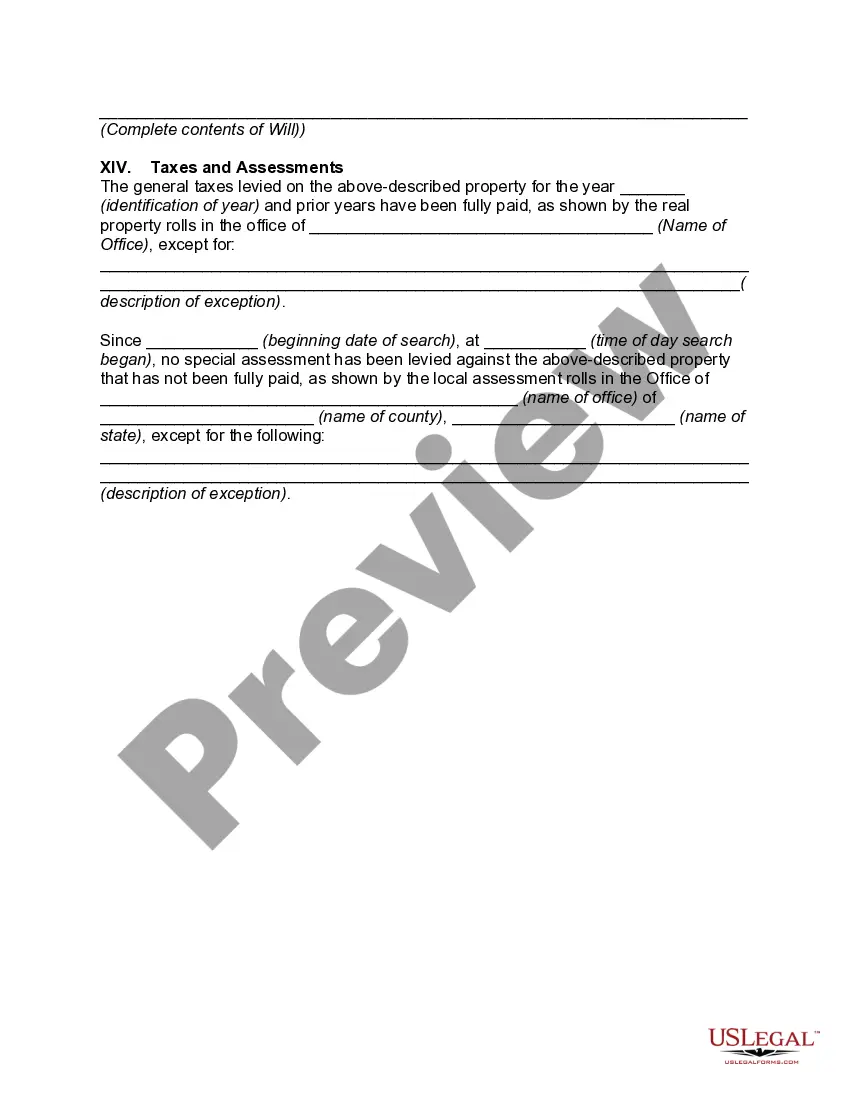

Abstracts of title are chronological descriptions of the contents of all the title deeds relating to a particular property or estate. They were normally drawn up by lawyers when the property was being sold, in order to prove the seller's title.

Transfer of property in relation to Property Settlement Agreement or Divorce Decree. deeds@phillydeeds.com. e090 Phone: (215) 989-4530. e103 Fax: (215) 701-9186.

Title Services Go Abstract is a full service title insurance company within the Keller Williams international affiliate.