Suffolk New York Agreement to Make Improvements to Leased Property

Description

How to fill out Suffolk New York Agreement To Make Improvements To Leased Property?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Suffolk Agreement to Make Improvements to Leased Property.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Suffolk Agreement to Make Improvements to Leased Property will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Suffolk Agreement to Make Improvements to Leased Property:

- Make sure you have opened the correct page with your local form.

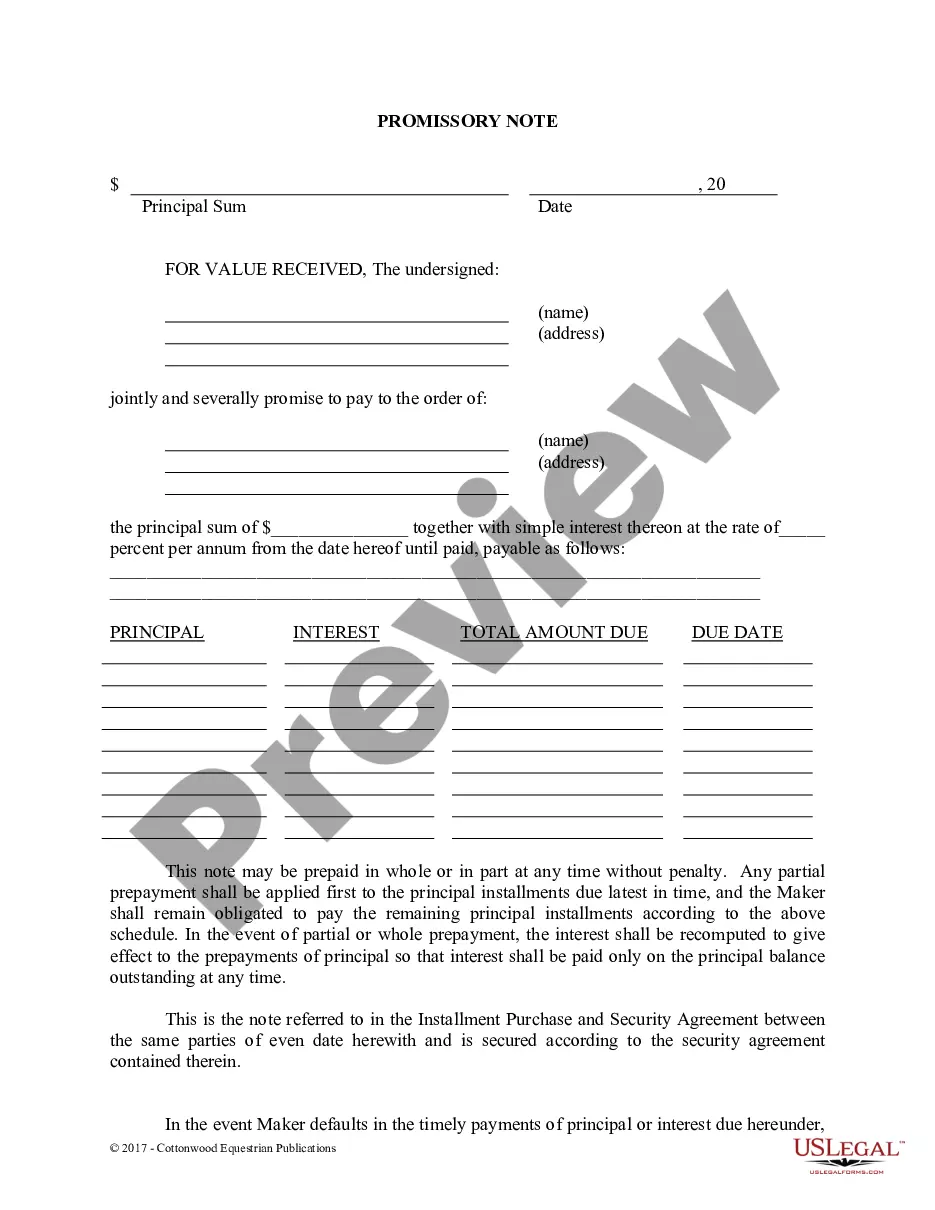

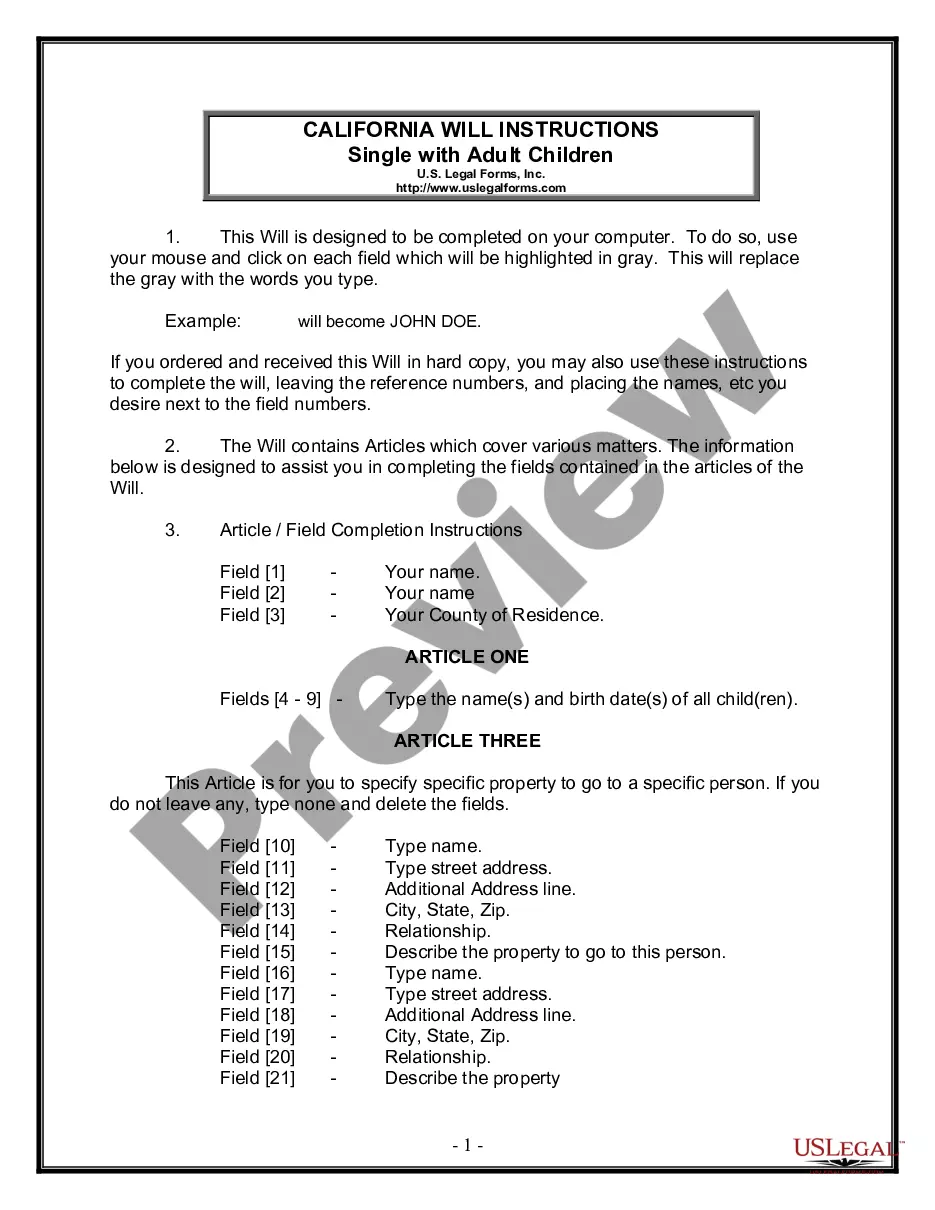

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Suffolk Agreement to Make Improvements to Leased Property on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Leasehold improvements provided by the landlord would be depreciated in the same way other assets are. However, leasehold improvements completed by a tenant would be amortized rather than depreciated. Because the landlord technically owns the improvements, the tenant only has rights to the improvements.

The cost of leasehold improvements over the capitalization threshold of $50k should be capitalized. Examples of costs that would be included as parts of a leasehold improvement include: Interior partitions made up of drywall, glass and metal. Miscellaneous millwork, carpentry, lumber, metals, steel, and paint.

No limit on how much your landlord can increase your rent. However, your landlord must give you advanced written notice before they can raise your rent 5% or more.

Leasehold improvements are improvements made by the lessee (for example, new buildings or improvements to existing structures, etc.). These improvements will revert to the lessor at the expiration of the lease.

When you pay for leasehold improvements, capitalize them if they exceed the corporate capitalization limit. If not, charge them to expense in the period incurred. If you capitalize these expenditures, then amortize them over the shorter of their useful life or the remaining term of the lease.

You can't deduct leasehold improvements. But the IRS does allow building owners to account for their depreciation because any improvements made are considered to be part of the building.

Leasehold Improvement Depreciation or Amortization? For purposes of accounting, the costs of leasehold improvements are capitalized as a fixed asset and then amortized rather than depreciated.

A leasehold improvement is a change made to a rental property to customize it for the particular needs of a tenant. The IRS does not allow deductions for leasehold improvements. But because improvements are considered part of the building, they are subject to depreciation.

If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter.

Thus, landlords must continue to depreciate the remaining basis even after the improvements were demolished; but tenants can write off incurred improvements abandoned at the end of the lease if they hold no continuing interest in the improvements.