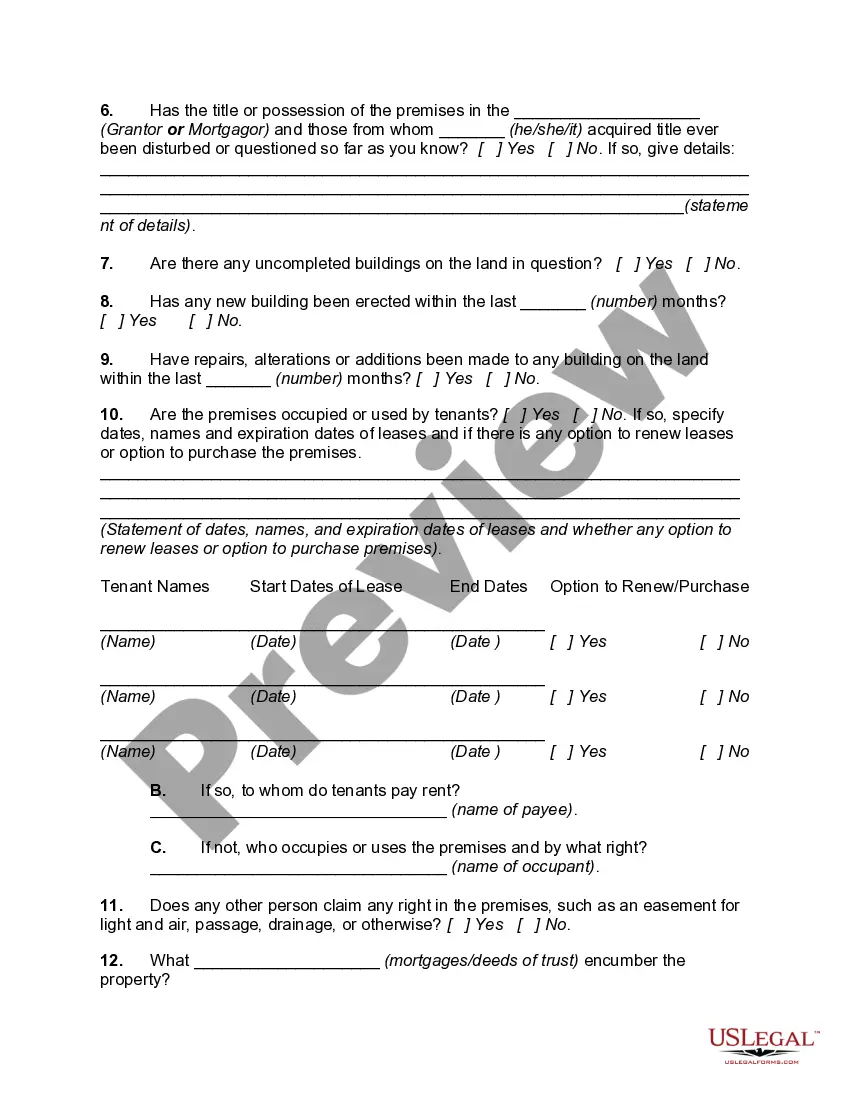

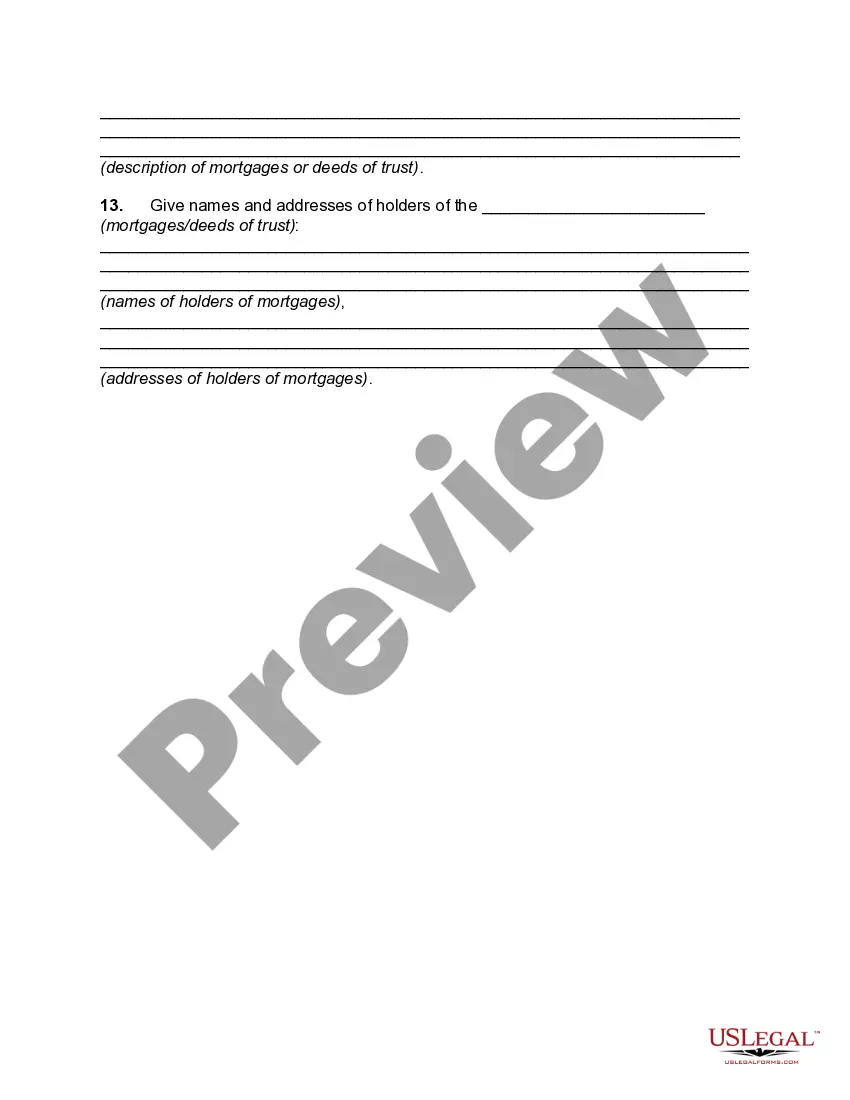

Travis Texas Questionnaire to Secure Initial Data for Title Search is a crucial document used in real estate transactions to gather essential information for conducting a thorough title search in Travis County, Texas. This questionnaire aims to collect pertinent details about the property and parties involved to ensure that the title is free of any encumbrances, liens, or potential legal issues. By using relevant keywords, let's delve into this topic further: 1. Purpose: The purpose of the Travis Texas Questionnaire to Secure Initial Data for Title Search is to acquire comprehensive information necessary for conducting a title search in Travis County, Texas. 2. Importance of Title Search: A title search is a crucial step in real estate transactions to verify the legal ownership of a property, check for any outstanding liens or claims, and ensure a smooth transfer of the deed. 3. Key Components: The Travis Texas Questionnaire collects the following significant data points: — Property Information: Including the property's address, legal description, and the type of property (residential, commercial, vacant land). — Property Ownership: Identifying the current owner(s) of the property, their contact information, and their intended use of the property. — Encumbrances and Liens: Gathering details about any existing mortgages, liens, easements, or other encumbrances that may affect the property's title. — Legal Descriptions: Acquiring accurate legal descriptions of the property according to official surveys, subdivision plats, metes and bounds descriptions, or abstracts of title. — Tax Information: Gathering data regarding current and past property taxes paid, tax identification numbers, and any pending tax assessments. — Relevant Documents: Identifying and attaching supporting documents such as deeds, contracts, leases, or any legal agreements associated with the property. 4. Types of Travis Texas Questionnaire: While there may not be different types of Travis Texas Questionnaires, variations can occur based on the nature of the property and the specific requirements of the title search. Some specialized questionnaires may be created for complex commercial properties, vacant land, or properties involved in legal disputes or probate proceedings. Overall, the Travis Texas Questionnaire to Secure Initial Data for Title Search is an important tool for gathering comprehensive information required to perform a thorough title search in Travis County, Texas. By utilizing this questionnaire and focusing on relevant keywords, title professionals can ensure a smooth and secure transfer of property ownership in the region.

Travis Texas Questionnaire to Secure Initial Data for Title Search

Description

How to fill out Travis Texas Questionnaire To Secure Initial Data For Title Search?

Draftwing documents, like Travis Questionnaire to Secure Initial Data for Title Search, to take care of your legal affairs is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Travis Questionnaire to Secure Initial Data for Title Search template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Travis Questionnaire to Secure Initial Data for Title Search:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Travis Questionnaire to Secure Initial Data for Title Search isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

To calculate property taxes in Travis County, property value must first be assessed by the county. The tax is based on the taxable value of the property, which is the assessed value minus any deductions or exemptions. Each county has a central authority that is responsible for appraising the value of property.

First, fill out the application specific to your County Appraisal District, then mail all of the documents to the Appraisal District for your County. FILL OUT THE RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION FOR YOUR COUNTY. DOWNLOAD RESIDENCE HOMESTEAD FORMS.INCLUDE A COPY OF YOUR DRIVER'S LICENSE OR IDENTIFICATION CARD.

You can eRecord your documents online through Simplifile right now in Travis County. You don't have to leave the office, use the mail, or stand in line saving you time and money. If you have a PC, high-speed internet access, and a scanner, you have what you need to start eRecording in Travis County.

These values are determined by the appraisal district: Market Value: What the property would sell for. Assessed Value: The limited property value after exemptions are applied. Taxable Value: The property value you pay taxes on.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

So how can you easily find out if you have a homestead exemption? At the Harris County Appraisal District website of you can look up your account and see which if any exemptions have been applied to your account.

Texas Homestead Exemption Explained - How to Fill- YouTube YouTube Start of suggested clip End of suggested clip So you would start with google.com. You go in the search bar and you're going to put hcad dot orgMoreSo you would start with google.com. You go in the search bar and you're going to put hcad dot org hcad means harris county appraisal district. So you click on that.

In Texas, the taxable value of a residential property is 100% of its "market value"basically, what it would sell for on the open market. The 100% figure is also known as the assessment ratio. The taxing authorities multiply the taxable value of your property by the tax rate to arrive at the tax you'll owe.

How to Fill Out Homestead Exemption Form Texas - YouTube YouTube Start of suggested clip End of suggested clip For which you are seeking this residence homestead exemption say yes click that and in section oneMoreFor which you are seeking this residence homestead exemption say yes click that and in section one all you need to fill out here is usually the jet the general residence homestead exemption.

Do I apply for a homestead exemption annually? Only a one-time application is required, unless by written notice, the Chief Appraiser requests the property owner to file a new application. However, a new application is required when a property owner's residence homestead is changed.