Collin Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legal contract that outlines the terms and conditions of employment for individuals employed in Collin, Texas. This type of agreement is specifically designed to incorporate a nonqualified retirement plan that is funded with life insurance. One type of Collin Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is the Defined Benefit Plan. This plan provides employees with a fixed income during their retirement based on a predetermined formula, which takes into account factors such as years of service, salary history, and age. Another type is the Cash Balance Plan. This plan operates similarly to a traditional pension plan, but the benefits are displayed as a hypothetical account balance instead of an annual payment. This balance increases each year with an employer contribution and a predetermined interest rate. The Collin Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance often includes a separate life insurance policy. This policy serves as a funding mechanism for the retirement plan, providing a death benefit to the employee’s beneficiaries in the event of the employee's death before retirement. The employer typically pays the premiums for this life insurance policy. This agreement also outlines vesting schedules, which determine when employees become entitled to the benefits of the retirement plan, and whether these benefits are fully or partially portable if the employee changes jobs within the same company or industry. Additionally, the agreement may specify the eligibility criteria for participating in the plan, such as minimum years of service or a certain position within the company. The Collin Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance aligns with relevant keywords such as retirement plan, life insurance, nonqualified plan, employment agreement, vesting schedule, defined benefit plan, cash balance plan, and eligibility criteria.

Collin Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

How to fill out Collin Texas Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Preparing paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Collin Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance without professional assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Collin Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Collin Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance:

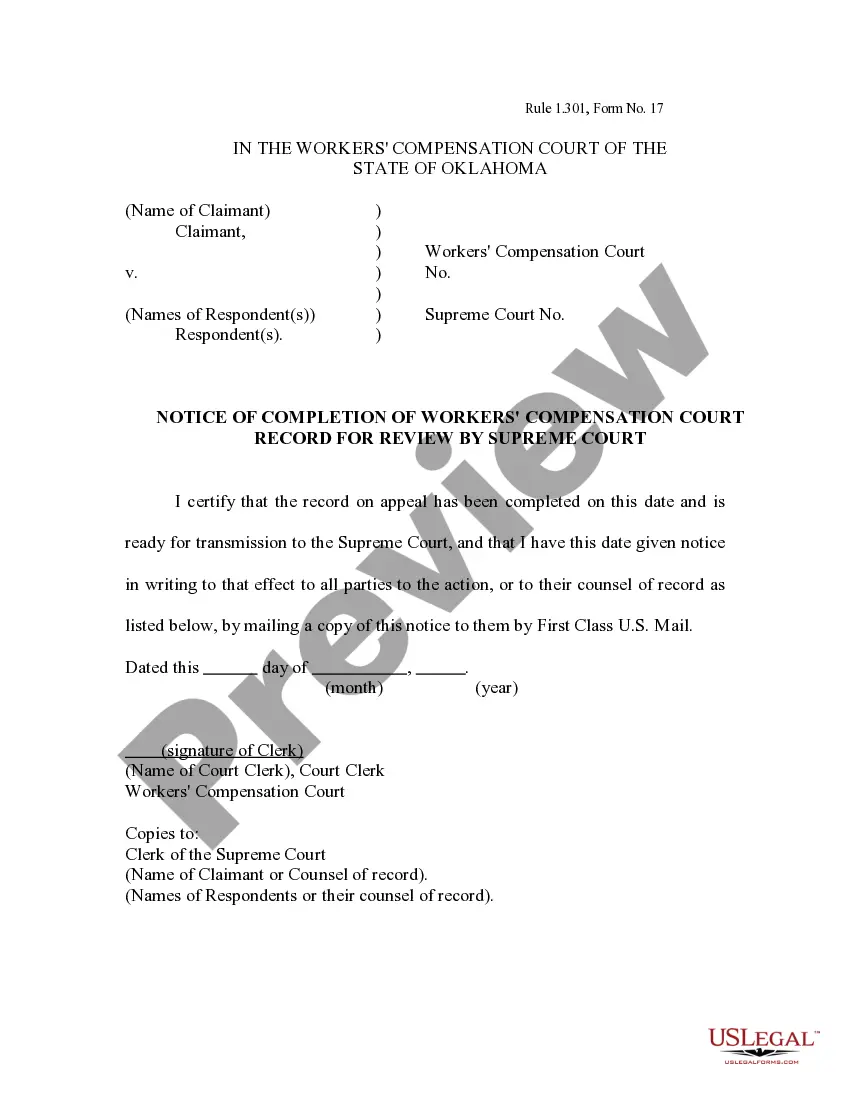

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!