Harris Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a comprehensive employment contract that includes provisions for a retirement plan funded through life insurance policies. This arrangement is specifically designed for employees in Harris County, Texas. The Harris Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance offers a unique opportunity for employees to receive retirement benefits through a nonqualified plan, meaning it exceeds the limits set by the Qualified Retirement Plans outlined in the Internal Revenue Code. By utilizing life insurance policies as a funding mechanism, employees can maximize their retirement savings while also providing financial security for their beneficiaries. This type of employment agreement provides various benefits and features, including: 1. Life Insurance Policies: Under this agreement, employees are entitled to receive one or more life insurance policies. These policies serve as the funding source for the nonqualified retirement plan, ensuring the growth of the plan's assets over time. 2. Retirement Income: Upon reaching the retirement age specified in the agreement, employees become eligible to receive a steady stream of income from the nonqualified retirement plan. The specific amount and duration of the payments are clearly outlined in the agreement. 3. Beneficiary Designation: Employees have the right to designate one or more beneficiaries who will receive the remaining balance of the retirement plan in the event of their death. This feature ensures that loved ones are financially protected after the employee's passing. 4. Portability: The Harris Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance may provide employees with the option to transfer their retirement plan to another employer, if allowed under the agreement terms. This portability feature allows for greater flexibility and control over retirement savings. 5. Vesting Schedule: The agreement may include a vesting schedule that determines the employee's ownership rights to the nonqualified retirement plan. This means that the employee may need to work for a certain period of time before becoming fully vested in the plan and entitled to all its benefits. 6. Tax Implications: While nonqualified retirement plans funded with life insurance provide certain advantages, it is important to note that they may have different tax implications compared to qualified retirement plans. Employees are encouraged to consult with a tax advisor to fully understand the tax consequences associated with this type of retirement arrangement. Different types or variations of the Harris Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance may exist, tailored to meet the specific needs of different employee groups or organizations within Harris County, Texas.

Harris Texas Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

How to fill out Harris Texas Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life sphere, locating a Harris Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Harris Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Harris Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance:

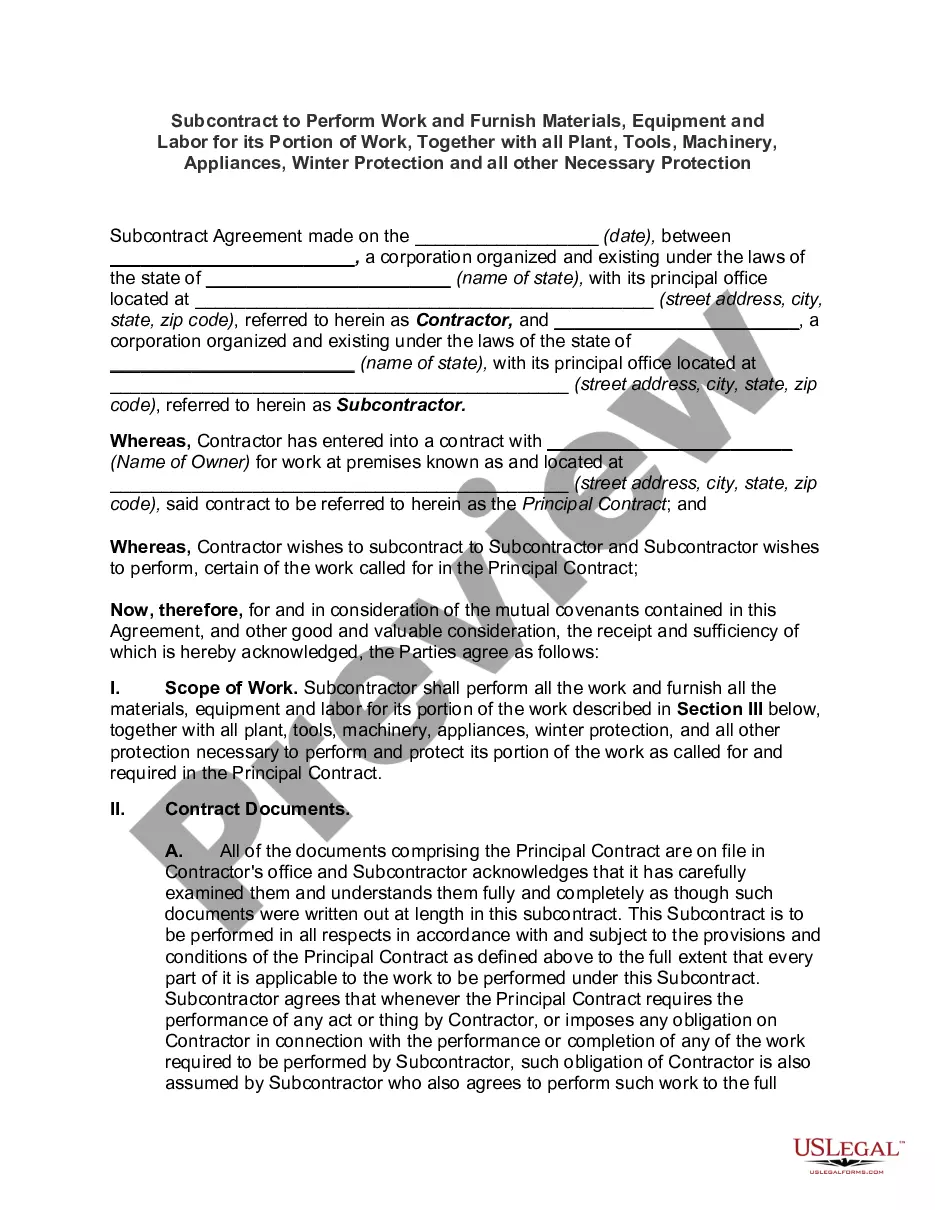

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!