Phoenix, Arizona is a prominent city known for its thriving business and employment opportunities. One notable aspect of employment agreements in this region is the inclusion of a Nonqualified Retirement Plan Funded with Life Insurance. This plan serves as an additional benefit offered by employers to attract and retain top talent. A Phoenix Arizona Employment Agreement with a Nonqualified Retirement Plan Funded with Life Insurance is a contractual agreement between an employer and employee that outlines the terms and conditions of the retirement plan. This retirement plan is typically separate from the traditional qualified retirement plans such as 401(k) or pension plans. It provides a way for high-earning employees or key executives to supplement their retirement savings beyond the limits set by qualified plans. The nonqualified retirement plan in Phoenix is funded with life insurance, which means employers allocate a portion of the employee's compensation towards a life insurance policy. This policy is owned by the employer and covers the employee's life. Upon the employee's retirement, the accumulated cash value of the life insurance policy is used to fund the retirement benefits. There are different types of Phoenix Arizona Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance, each designed to cater to specific employee needs and employer goals: 1. Executive Bonus Plans: These agreements are specifically targeted towards high-ranking executives within an organization. Employers provide bonuses to executives, which are then used to fund the life insurance policy that will contribute to their retirement benefits. 2. Split-dollar Life Insurance Plans: In this type of agreement, the cost of the life insurance policy is shared between the employer and the employee. Both parties contribute premiums, and the death benefit is split between them according to a predetermined ratio. This plan allows the employee to accumulate cash value and enjoy tax benefits. 3. Deferred Compensation Plans: These agreements allow employees to defer a portion of their salary or bonus into a life insurance policy. The accumulated cash value and death benefit serve as a supplemental retirement fund. Additionally, these plans may offer vesting schedules to incentivize long-term commitment to the employer. 4. Supplemental Executive Retirement Plans: Also known as SERPs, these agreements are offered to key employees or executives who play a significant role in the organization. Employers promise future retirement benefits beyond traditional plans, and the funding is achieved through life insurance policies. In summary, a Phoenix Arizona Employment Agreement with a Nonqualified Retirement Plan Funded with Life Insurance is a beneficial arrangement for employees seeking enhanced retirement benefits beyond traditional plans. With various types of agreements available, employers can tailor their offerings to attract and retain top talent in this competitive job market.

Phoenix Arizona Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

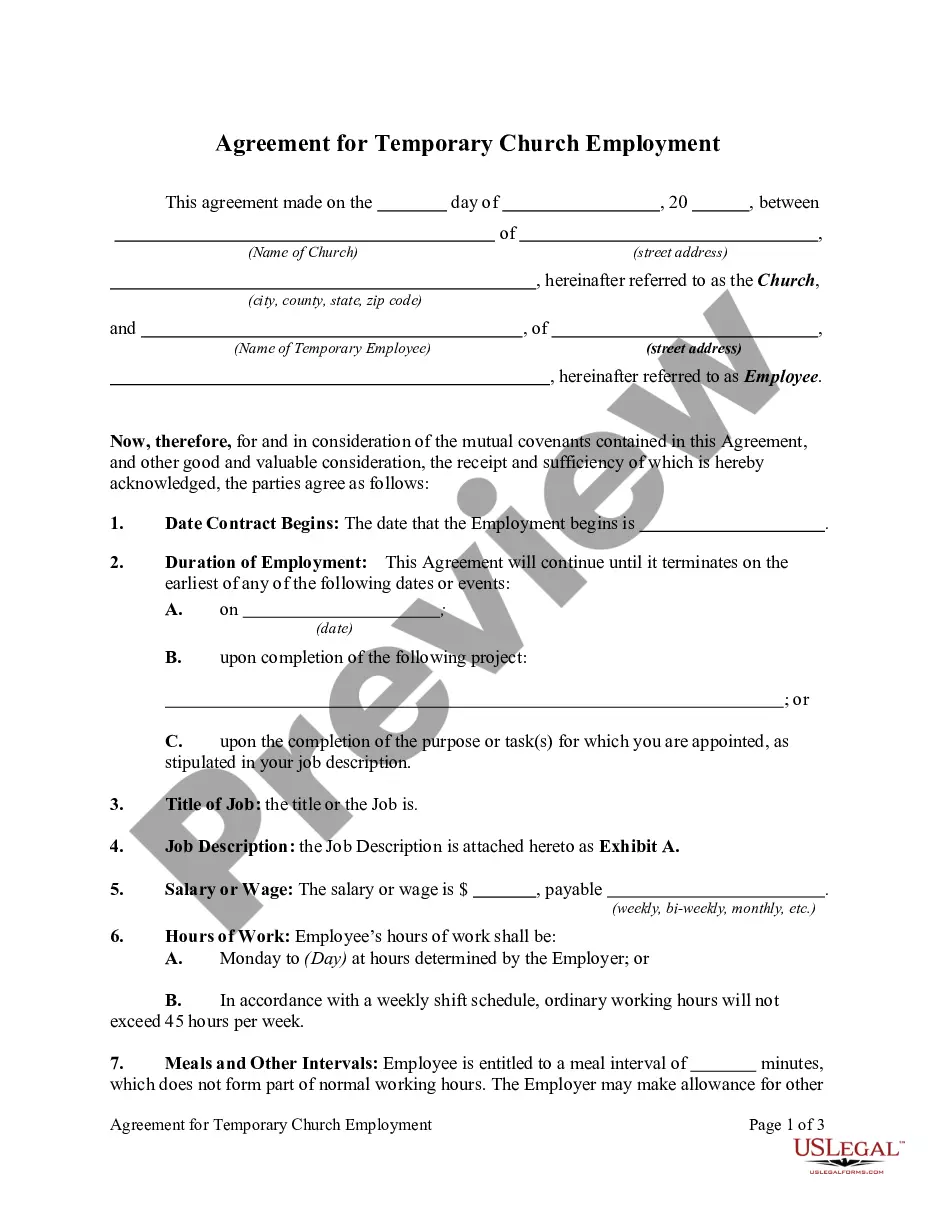

How to fill out Phoenix Arizona Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Phoenix Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Phoenix Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Phoenix Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance:

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!