The Harris Texas Trust Agreement for Pension Plan with Corporate Trustee is a legal document that establishes a trust relationship between a pension plan and a corporate trustee in Harris, Texas. This agreement outlines the terms and conditions under which the trustee will hold, manage, and distribute the pension plan's assets in accordance with the plan's objectives and applicable laws and regulations. The trust agreement is designed to ensure the financial security and long-term sustainability of the pension plan. By appointing a corporate trustee, the plan sponsor aims to benefit from their expertise in managing investment portfolios, following fiduciary duties, and complying with legal requirements. There are different types of Harris Texas Trust Agreement for Pension Plan with Corporate Trustee, depending on the specific needs and characteristics of the pension plan. Some common types include: 1. Defined Benefit Trust Agreement: This agreement is used when the pension plan promises a specific amount of benefits to the participants upon retirement. The trustee is responsible for managing the plan's investments to ensure it has sufficient assets to meet the defined benefit obligations. 2. Defined Contribution Trust Agreement: This type of agreement is applicable when the pension plan specifies the contribution amounts made by the employer and/or employees, typically through individual accounts. The trustee oversees the investment of these contributions on behalf of the plan participants, who bear the investment risks. 3. Cash Balance Trust Agreement: In a cash balance plan, the trustee manages the investments of a hypothetical account established for each participant. This account grows from employer contributions and accumulated interest credits, rather than directly based on the investment performance of underlying assets. 4. Hybrid Trust Agreement: A hybrid plan combines elements of both defined benefit and defined contribution plans. The trustee in this case handles the investment management and distribution of benefits based on the hybrid plan's specific provisions. 5. Multiple Employer Trust Agreement: This type of trust agreement is utilized when multiple employers participate in a single pension plan. The corporate trustee serves as an impartial intermediary, managing the pooled assets of all participating employers and ensuring compliance with applicable laws and regulations. These various types of Harris Texas Trust Agreements for Pension Plan with Corporate Trustee reflect the flexibility and customization available to meet the specific needs of different pension plans while fostering transparency, accountability, and legal compliance.

Harris Texas Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Harris Texas Trust Agreement For Pension Plan With Corporate Trustee?

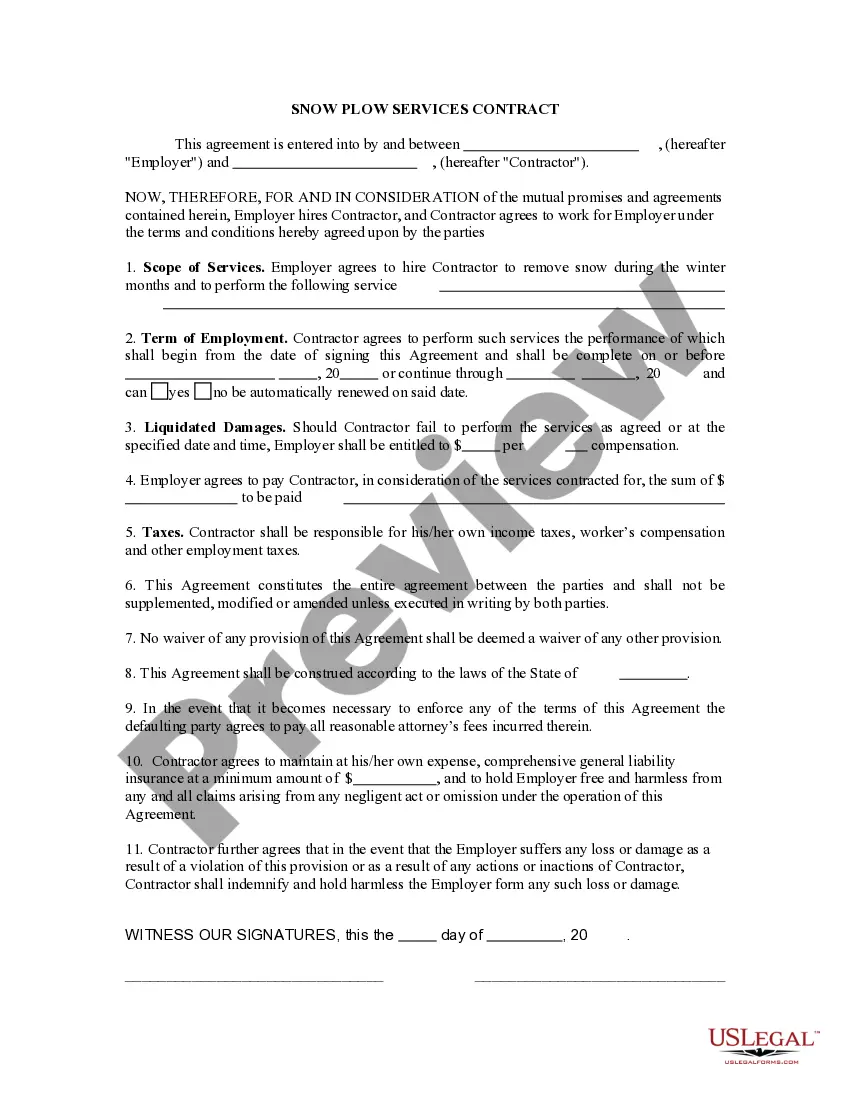

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Harris Trust Agreement for Pension Plan with Corporate Trustee, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the current version of the Harris Trust Agreement for Pension Plan with Corporate Trustee, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Trust Agreement for Pension Plan with Corporate Trustee:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Harris Trust Agreement for Pension Plan with Corporate Trustee and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!