The Kings New York Trust Agreement for Pension Plan with Corporate Trustee is a legal document that outlines the terms and conditions governing a pension plan in Kings County, New York. This agreement is specific to pension plans and involves a corporate trustee, which is responsible for managing and safeguarding the assets of the plan. The Kings New York Trust Agreement for Pension Plan with Corporate Trustee may have various types based on the design and features that cater to the specific needs of the pension plan and its participants. Some of these types include: 1. Defined Benefit Trust Agreement: This type of trust agreement outlines the specifics of a pension plan where the retirement benefit is calculated based on a predetermined formula, usually considering factors such as salary, years of service, and age. The corporate trustee has the responsibility of ensuring that the pension plan assets are appropriately invested and that the plan can sustain the promised benefits. 2. Defined Contribution Trust Agreement: This type of trust agreement focuses on pension plans where the employer and/or employees contribute a predetermined amount or percentage of the employee's salary to the plan. The corporate trustee manages and invests these contributions, and the eventual retirement benefit is based on the performance of the investments. 3. Individual Retirement Account (IRA) Trust Agreement: This variant of the Kings New York Trust Agreement for Pension Plan with Corporate Trustee is designed for individuals to establish and manage their own retirement savings accounts. The corporate trustee acts as a custodian for the IRA assets and handles investment transactions on behalf of the account holder. The Kings New York Trust Agreement for Pension Plan with Corporate Trustee typically includes key provisions such as the purpose and objectives of the pension plan, the roles and responsibilities of the trustee, the contribution and benefit formulas, vesting schedules, distribution rules, investment guidelines, and dispute resolution mechanisms. In summary, the Kings New York Trust Agreement for Pension Plan with Corporate Trustee is a crucial legal instrument that governs the management and operations of a pension plan. With various types catering to different pension plan structures, this agreement ensures that the retirement benefits are administered and safeguarded in accordance with the specific requirements and regulations governing such plans in Kings County, New York.

Kings New York Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Kings New York Trust Agreement For Pension Plan With Corporate Trustee?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Trust Agreement for Pension Plan with Corporate Trustee, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the current version of the Kings Trust Agreement for Pension Plan with Corporate Trustee, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Trust Agreement for Pension Plan with Corporate Trustee:

- Look through the page and verify there is a sample for your region.

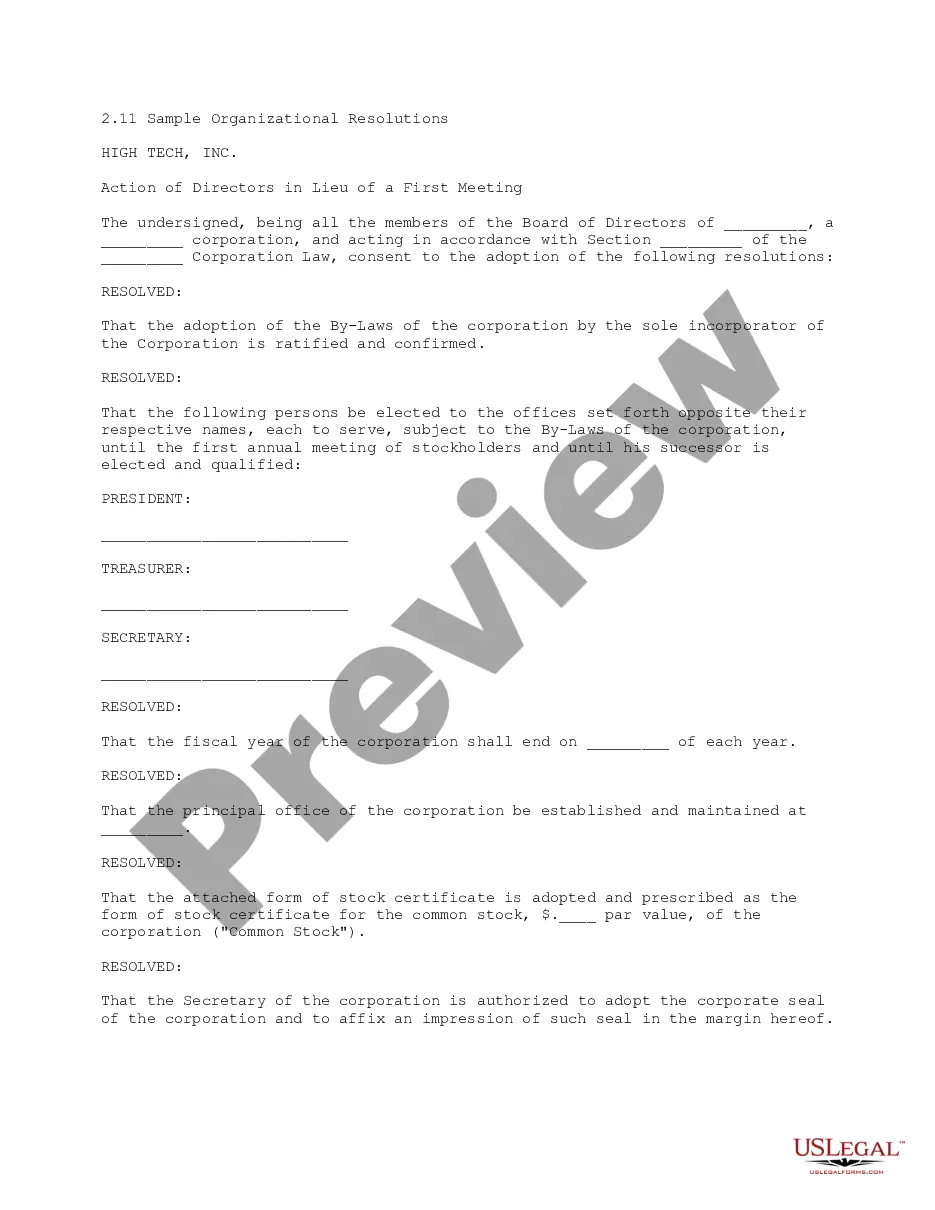

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Kings Trust Agreement for Pension Plan with Corporate Trustee and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!