The Orange California Trust Agreement for Pension Plan with Corporate Trustee is a legal document that outlines the terms and conditions of a pension plan managed by a corporate trustee in Orange, California. This agreement serves as a binding contract between the plan sponsor (such as a company or organization) and the trustee responsible for administering the pension plan. In this trust agreement, the corporate trustee assumes the fiduciary duty of managing and safeguarding the pension plan assets on behalf of the plan participants. The trustee is required to act in the best interests of the plan and its beneficiaries, ensuring compliance with all applicable laws and regulations governing pension plans. The Orange California Trust Agreement for Pension Plan with Corporate Trustee typically includes provisions related to the investment of plan assets, the distribution of benefits to eligible participants, and the administration and reporting requirements. It outlines the roles and responsibilities of the plan sponsor and the trustee, establishing their respective rights and obligations. This type of trust agreement may also include various subtypes or variations based on the specific needs and characteristics of the pension plan. Some of these variations may include: 1. Defined Benefit Trust Agreement: This type of trust agreement is designed for pension plans that provide a fixed, predetermined benefit amount to eligible participants upon retirement. The trustee is responsible for managing the plan assets to ensure there are sufficient funds to fulfill the future benefit obligations. 2. Defined Contribution Trust Agreement: In this case, the trust agreement is tailored to pension plans where the employer and/or employees make contributions to individual participant accounts. The trustee oversees the investment of these contributions and facilitates their distribution to participants upon retirement or termination. 3. Hybrid Trust Agreement: This type of trust agreement combines elements of both defined benefit and defined contribution plans. It may offer certain guaranteed benefits while also allowing participants to contribute to individual accounts. The trustee manages the plan assets to fulfill both the defined benefit and defined contribution aspects. 4. Frozen Trust Agreement: A frozen trust agreement is used when an employer freezes or terminates a pension plan, preventing new participants from joining. The trustee's role in a frozen trust is to manage and distribute the existing assets among the eligible participants in accordance with the plan's rules and regulations. 5. Cash Balance Plan Trust Agreement: This trust agreement is specific to cash balance pension plans, which are a type of defined benefit plan. The trustee ensures that the plan maintains the account balance of each participant, including any interest credits or investment gains. By implementing an Orange California Trust Agreement for Pension Plan with Corporate Trustee, employers and plan participants can establish a clear framework for the effective management and administration of pension benefits. This legally-binding document protects the interests of all parties involved and ensures compliance with relevant laws and regulations.

Orange California Trust Agreement for Pension Plan with Corporate Trustee

Description

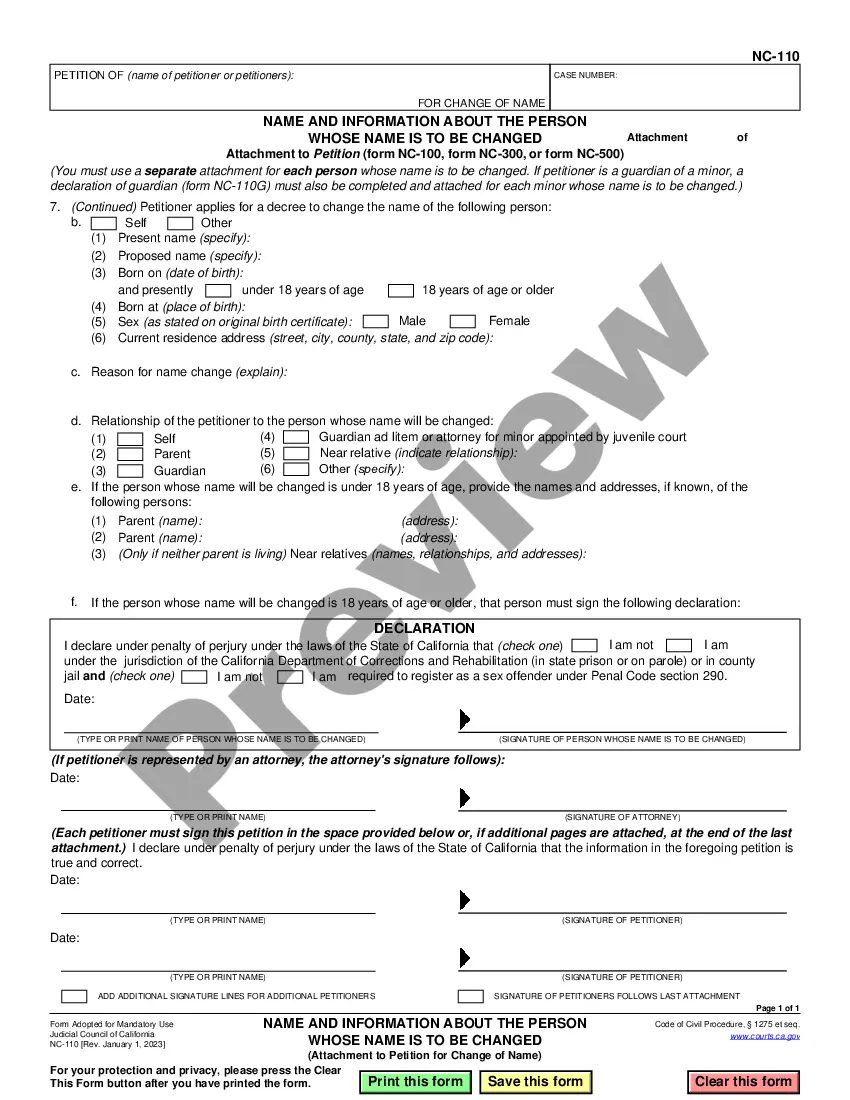

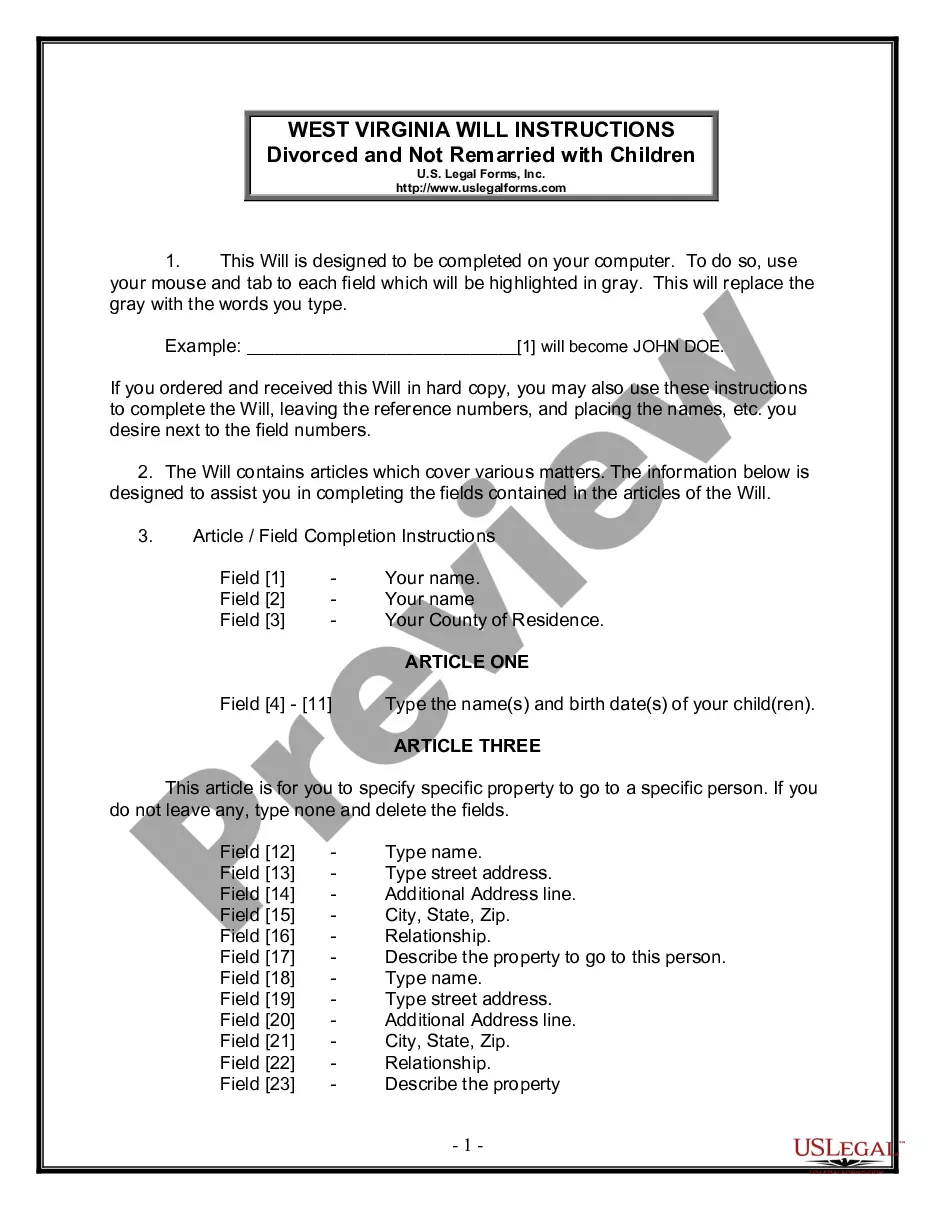

How to fill out Orange California Trust Agreement For Pension Plan With Corporate Trustee?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

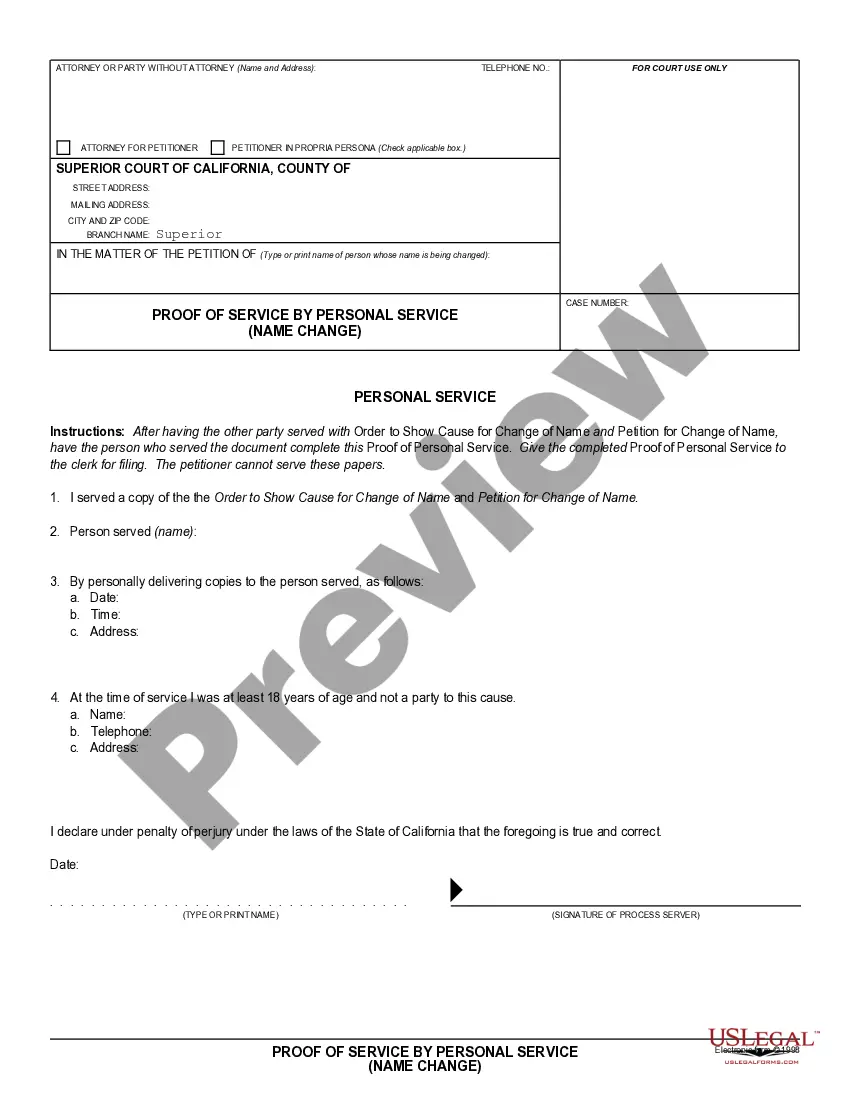

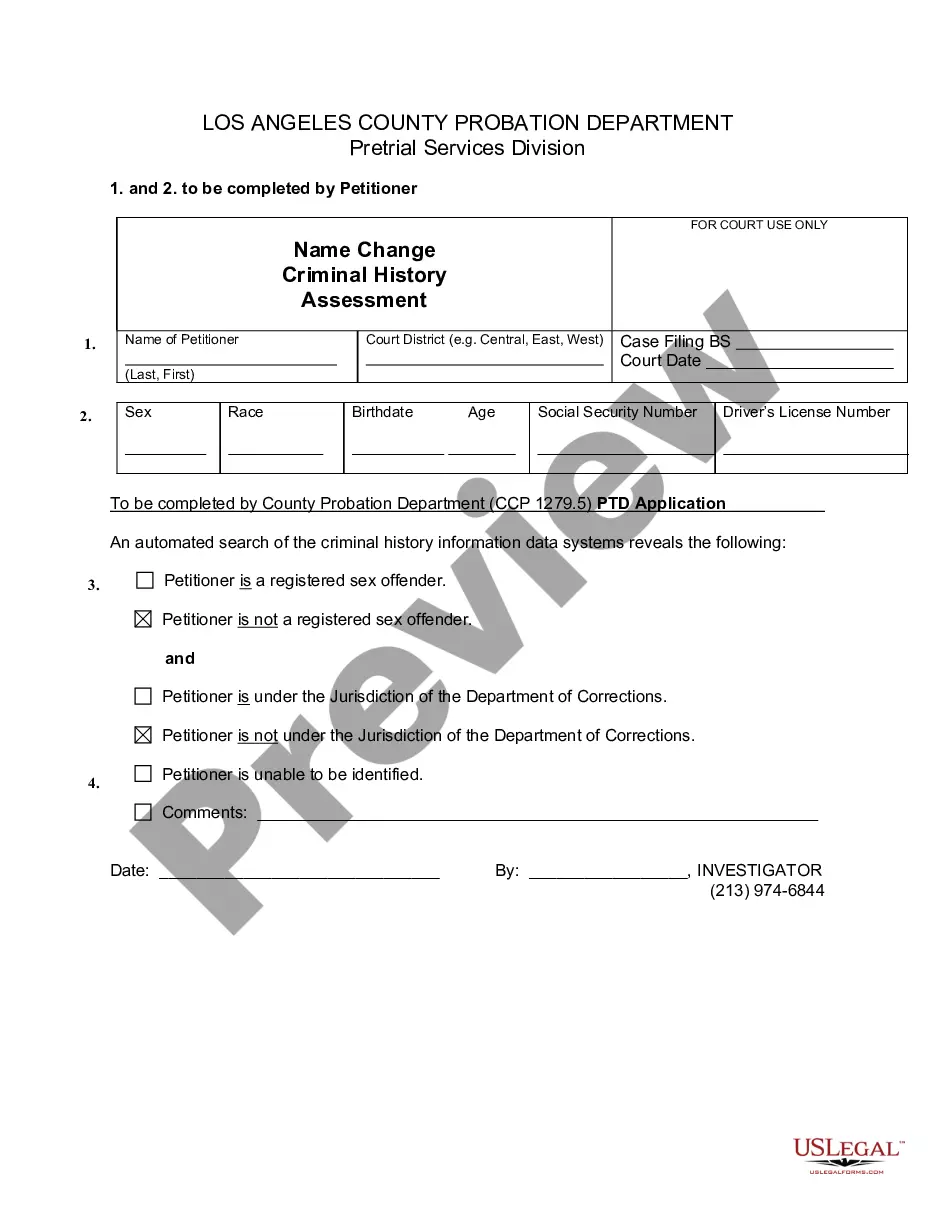

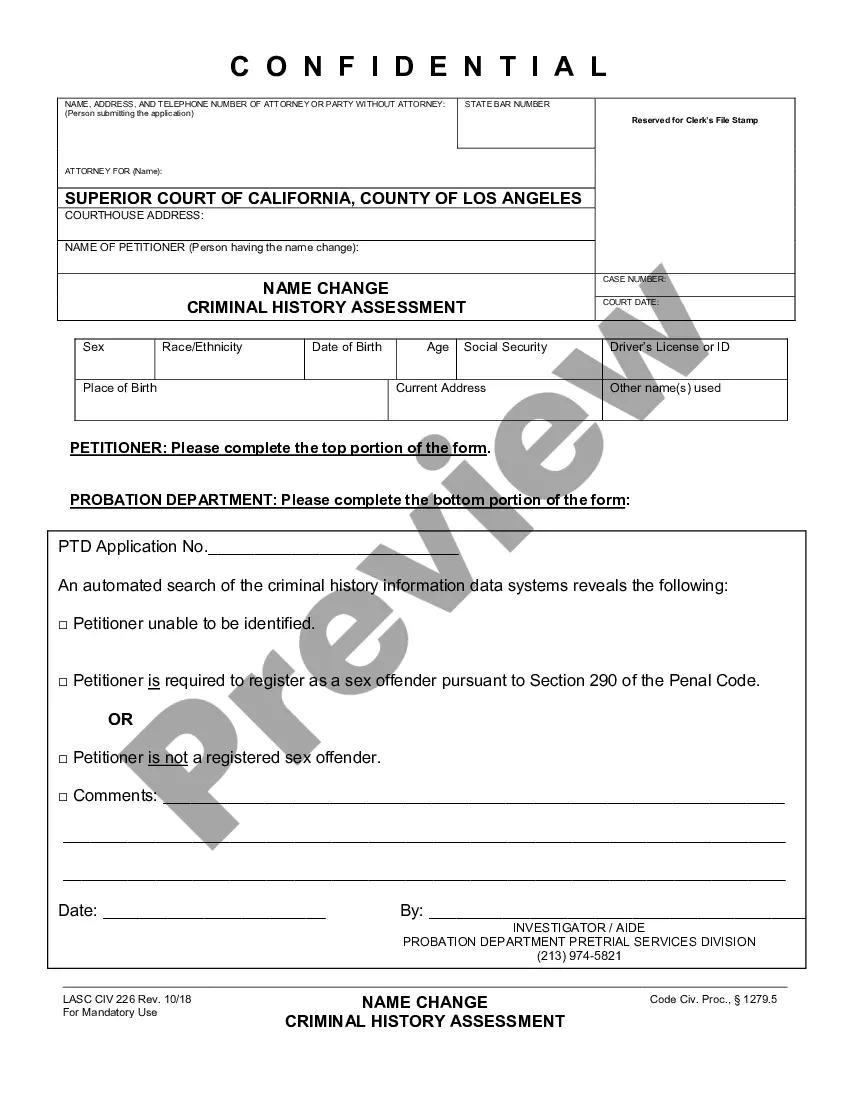

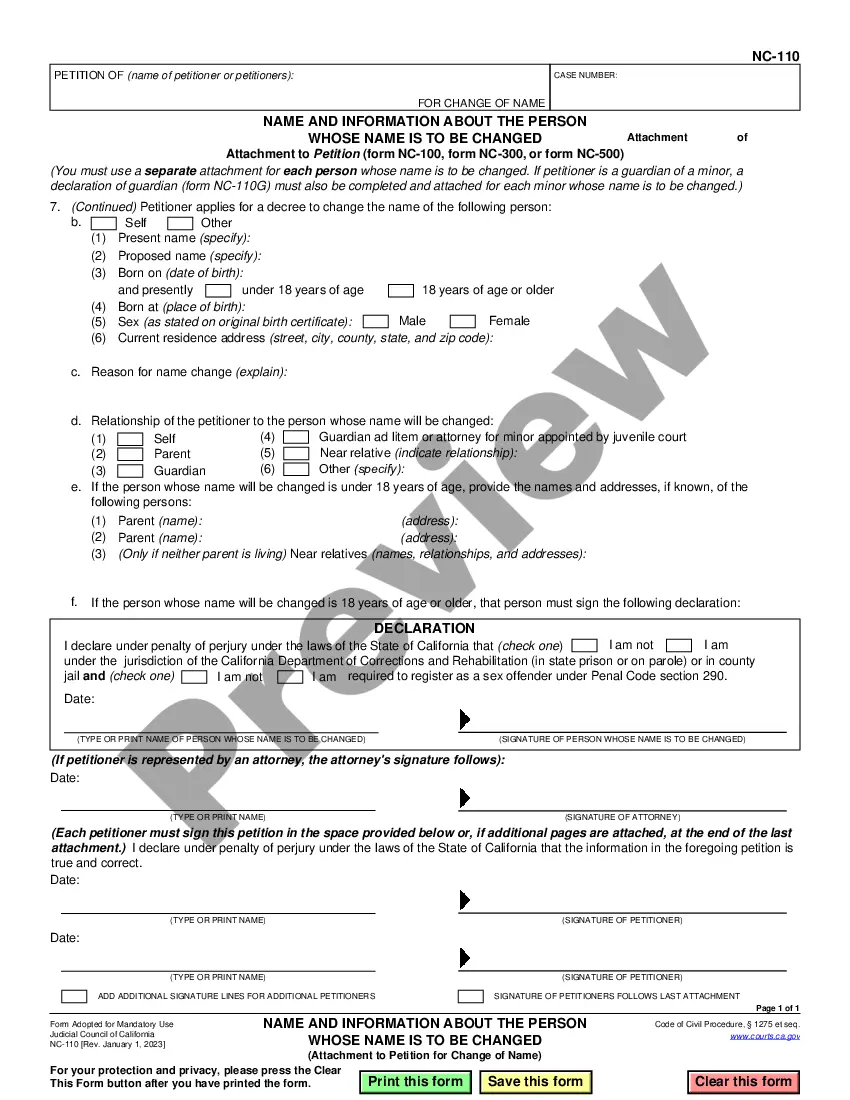

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Orange Trust Agreement for Pension Plan with Corporate Trustee is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Orange Trust Agreement for Pension Plan with Corporate Trustee. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Trust Agreement for Pension Plan with Corporate Trustee in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!