San Diego California Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that outlines the terms and conditions for managing and administering pension funds for employees in the San Diego region. This agreement is established between a pension plan sponsor, such as a company or organization, and a corporate trustee, which could be a financial institution or a professional trustee service. The San Diego California Trust Agreement for Pension Plan with Corporate Trustee serves as a safeguard for the pension plan assets and provides guidelines for the trustee to effectively manage these funds in accordance with applicable laws and regulations. The agreement ensures that the trustee acts in the best interest of the plan beneficiaries and fulfills its fiduciary duties. The main purpose of this trust agreement is to address various aspects related to the administration of the pension plan. It includes provisions regarding the establishment of the trust, the appointment and responsibilities of the corporate trustee, investment guidelines and strategies, contribution requirements, distribution rules, and the resolution of any potential disputes. In San Diego, there may be different types of trust agreements for pension plans with corporate trustees based on the specific needs and preferences of the plan sponsor. Some possible variations of these agreements include: 1. Defined Benefit Pension Plan Trust Agreement: This type of agreement is commonly used by employers who offer traditional pension plans where the retirement benefits are predetermined based on a formula considering factors like employees' salary history, years of service, and age. 2. Defined Contribution Pension Plan Trust Agreement: These agreements are frequently utilized for pension plans such as 401(k) plans, where the employer and employee make contributions to individual accounts. The ultimate retirement benefit is determined by the investment performance of these accounts. 3. Hybrid Pension Plan Trust Agreement: Some employers in San Diego may choose to offer hybrid pension plans that combine elements of both defined benefit and defined contribution plans. The terms of this trust agreement would be tailored to accommodate the unique features of the hybrid plan. 4. Union Pension Plan Trust Agreement: If the pension plan is established and maintained by a labor union on behalf of its members, a specialized trust agreement may be required to address the particular requirements and regulations applicable to these types of plans. The specific provisions and details within each trust agreement will vary based on the type of pension plan, the goals and objectives of the plan sponsor, and the legal and regulatory framework. It is essential to consult with a qualified legal professional experienced in pension law to ensure compliance and the protection of the interests of both plan beneficiaries and trustees.

San Diego California Trust Agreement for Pension Plan with Corporate Trustee

Description

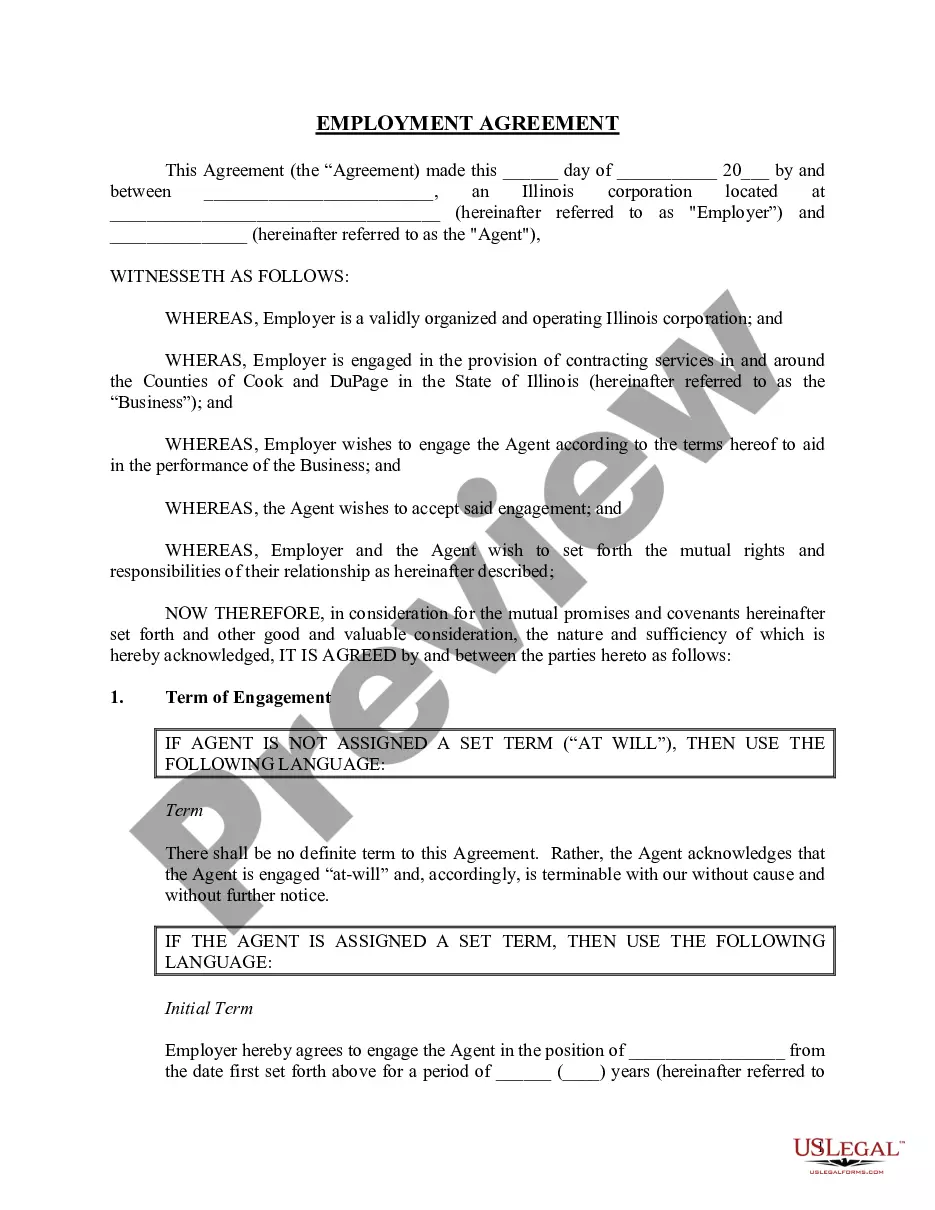

How to fill out San Diego California Trust Agreement For Pension Plan With Corporate Trustee?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Trust Agreement for Pension Plan with Corporate Trustee, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the latest version of the San Diego Trust Agreement for Pension Plan with Corporate Trustee, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Trust Agreement for Pension Plan with Corporate Trustee:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your San Diego Trust Agreement for Pension Plan with Corporate Trustee and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A pension plan is designed to help employees build retirement income over time and then withdraw it in the form of annuity payments for life. It is perhaps the best-known form of an employee trust fund.

When you retire, you will receive lifetime monthly retirement income from UCRP calculated as a percentage of your average eligible annual pay, or HAPC (highest average plan compensation), up to the PEPRA maximum. The percentage is based on your service credit and age at retirement.

It remains possible to make the beneficiary of a retirement account a trust, but that trust cannot be an eligible designated beneficiary. A trust beneficiary will either be subject to the 10-year distribution requirement, or an even more limited 5-year rule.

We provide a variety of healthcare plan options and benefits designed to achieve a work-life balance as well as help you plan for your financial future including a generous pension plan.

The California Public Employees Retirement System (CalPERS) offers a defined benefit retirement plan. It provides benefits based on members years of service, age, and final compensation. In addition, benefits are provided for disability death, and payments to survivors or beneficiaries of eligible members.

2 - Compensation Ordinance) The San Diego County Employees Retirement Association (SDCERA) provides a defined benefit pension plan. Permanent employees automatically become members and contribute to their benefit from each biweekly paycheck.

A trustee is a person or company, acting separately from the employer, who holds assets in the trust for the beneficiaries of the scheme. Trustees are responsible for ensuring that the pension scheme is run properly and that members' benefits are secure.

Accountability The governing body should be accountable to the pension plan members and beneficiaries, its supervisory board (where relevant) and the competent authorities.

A pension plan is designed to help employees build retirement income over time and then withdraw it in the form of annuity payments for life. It is perhaps the best-known form of an employee trust fund.

The City of San Diego officially reopened its pension plan to all non-police employees hired by the City on or after July 10, 2021 - almost exactly nine years from Proposition B's effective date.