Travis Texas Trust Agreement for Pension Plan with Corporate Trustee refers to a legal instrument that establishes the structure and guidelines for managing pension plans in the Travis Texas area, specifically those with a corporate trustee. In the realm of pension plans, a trust agreement is a vital document that outlines the rights and obligations of both the plan sponsor and the participants. It serves as a binding contract, safeguarding the pension assets and ensuring their proper administration. In regard to the Travis Texas Trust Agreement for Pension Plan, there may be various types available that cater to different needs and circumstances. Some of these types could include: 1. Defined Benefit Trust Agreement: This type of trust agreement outlines the specific benefits that participants are entitled to receive upon retirement. It establishes how benefits will be calculated based on factors such as salary, years of service, and age, providing a predetermined retirement income stream. 2. Defined Contribution Trust Agreement: Unlike the defined benefit plan, a defined contribution trust agreement does not guarantee a specific retirement benefit. Instead, it defines the contributions made by both the employer and the employee. The agreement outlines the investment options available for those contributions and how the funds grow over time. 3. Cash Balance Trust Agreement: A cash balance trust agreement is a hybrid pension plan that combines elements of both defined benefit and defined contribution plans. It allows participants to accumulate benefits in an account, similar to a defined contribution plan, but at the same time, it guarantees a specific benefit similar to a defined benefit plan. Regardless of the specific type of Travis Texas Trust Agreement for Pension Plan, the involvement of a corporate trustee is a crucial aspect. The corporate trustee, often a bank or another financial institution, acts as the fiduciary for the pension plan. They are responsible for managing the plan's assets, ensuring compliance with relevant laws and regulations, and making investment decisions in the best interest of the plan participants. In conclusion, the Travis Texas Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that establishes the rules, benefits, and responsibilities concerning pension plans in the Travis Texas area. This agreement may take different forms, such as defined benefit, defined contribution, or cash balance trust agreements. The involvement of a corporate trustee is essential to ensure the proper management and administration of the pension plan's assets.

Travis Texas Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Travis Texas Trust Agreement For Pension Plan With Corporate Trustee?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Travis Trust Agreement for Pension Plan with Corporate Trustee without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Travis Trust Agreement for Pension Plan with Corporate Trustee by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Travis Trust Agreement for Pension Plan with Corporate Trustee:

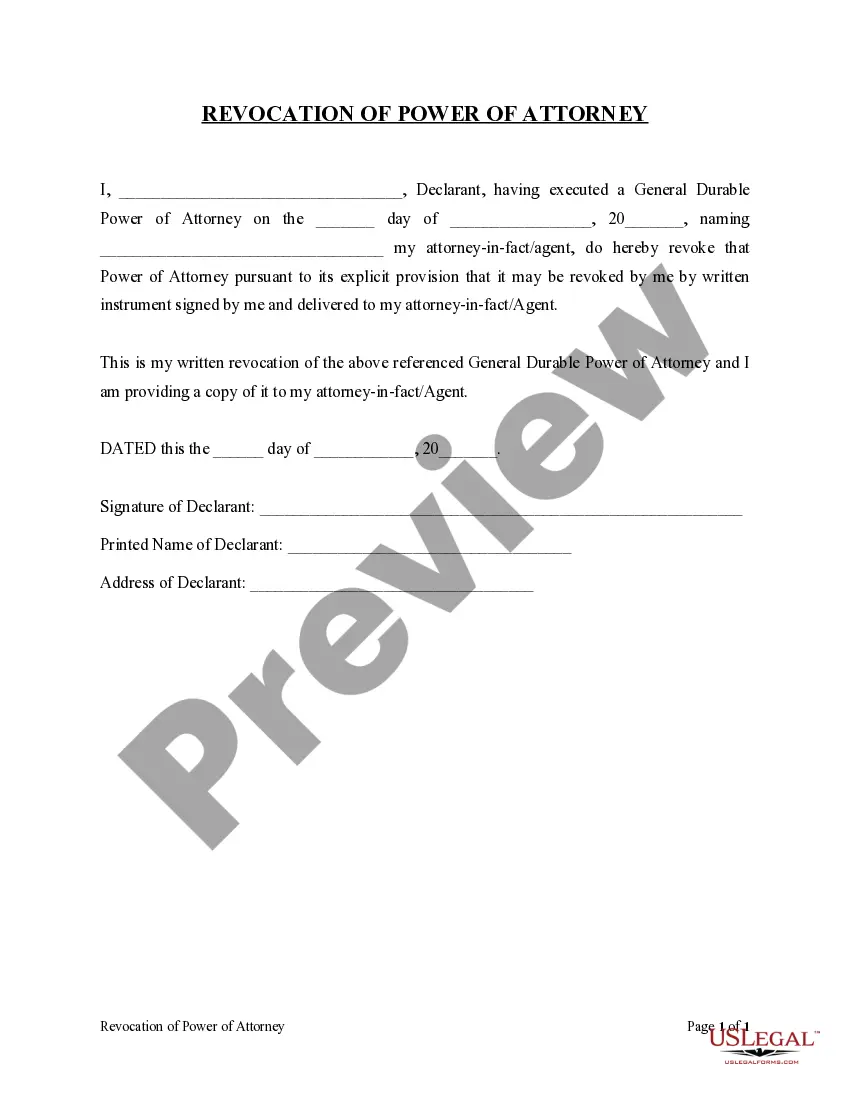

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!