A Wayne Michigan Trust Agreement for Pension Plan with Corporate Trustee refers to a legal document designed to establish a legally binding agreement between the employer or plan sponsor and the trustee responsible for managing a pension plan in Wayne, Michigan. This agreement outlines the terms, conditions, and guidelines for the administration and operation of the pension plan, ensuring that the interests of plan participants are protected. In Wayne, Michigan, there might be various types of Trust Agreements for Pension Plans with Corporate Trustees. Some common types include: 1. Defined Benefit Trust Agreement: This type of trust agreement specifies the formula for calculating pension benefits based on factors such as an employee's salary, years of service, and age at retirement. The trustee ensures that the pension plan has sufficient funds to meet future obligations. 2. Defined Contribution Trust Agreement: This agreement outlines the contributions made by both the employer and employees to the pension plan. The trustee is responsible for investing and managing these contributions, and the individual account balances of participants in the plan fluctuate based on investment performance. 3. Hybrid Trust Agreement: A hybrid trust agreement combines characteristics of both defined benefit and defined contribution plans. It offers a combination of guaranteed benefits along with investment accounts that can accumulate additional funds based on investment performance. The Wayne Michigan Trust Agreement for Pension Plan with Corporate Trustee typically includes several key elements: a. Plan Administration: The agreement specifies how the pension plan will be managed, identifying the roles and responsibilities of the employer, trustees, and plan participants. It outlines the duties and powers of the trustee in managing plan assets and making necessary distributions. b. Funding and Contributions: This section details the funding obligations of the employer, including the timing and amounts of contributions to the pension plan. It may also address mechanisms for adjusting contributions based on plan performance and funding requirements under applicable laws. c. Vesting and Eligibility: The agreement defines the criteria for employee vesting, which determines the portion of the pension benefits that participants are entitled to upon leaving employment. It also outlines the eligibility requirements for employees to participate in the plan. d. Investment Guidelines: The agreement includes provisions on how the plan assets will be invested, specifying any restrictions or limitations on the types of investments. The trustee is entrusted with the responsibility of managing the investments in line with the agreed-upon guidelines. e. Plan Amendment and Termination: This section outlines the procedures and conditions for amending or terminating the pension plan. It may include requirements for providing notice to participants and obtaining regulatory approvals, if necessary. f. Plan Funding and Compliance: The agreement outlines the procedures for monitoring plan funding levels and complying with relevant laws and regulations governing pension plans. It ensures that the plan remains in compliance with the Employee Retirement Income Security Act (ERICA) and other applicable laws. In conclusion, a Wayne Michigan Trust Agreement for Pension Plan with Corporate Trustee is a crucial legal document that establishes the rights and obligations of the employer and trustee in managing a pension plan. It safeguards the interests of plan participants and ensures the proper administration and operation of the pension plan according to the established guidelines and regulations.

Wayne Michigan Trust Agreement for Pension Plan with Corporate Trustee

Description

How to fill out Wayne Michigan Trust Agreement For Pension Plan With Corporate Trustee?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Wayne Trust Agreement for Pension Plan with Corporate Trustee.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Wayne Trust Agreement for Pension Plan with Corporate Trustee will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Wayne Trust Agreement for Pension Plan with Corporate Trustee:

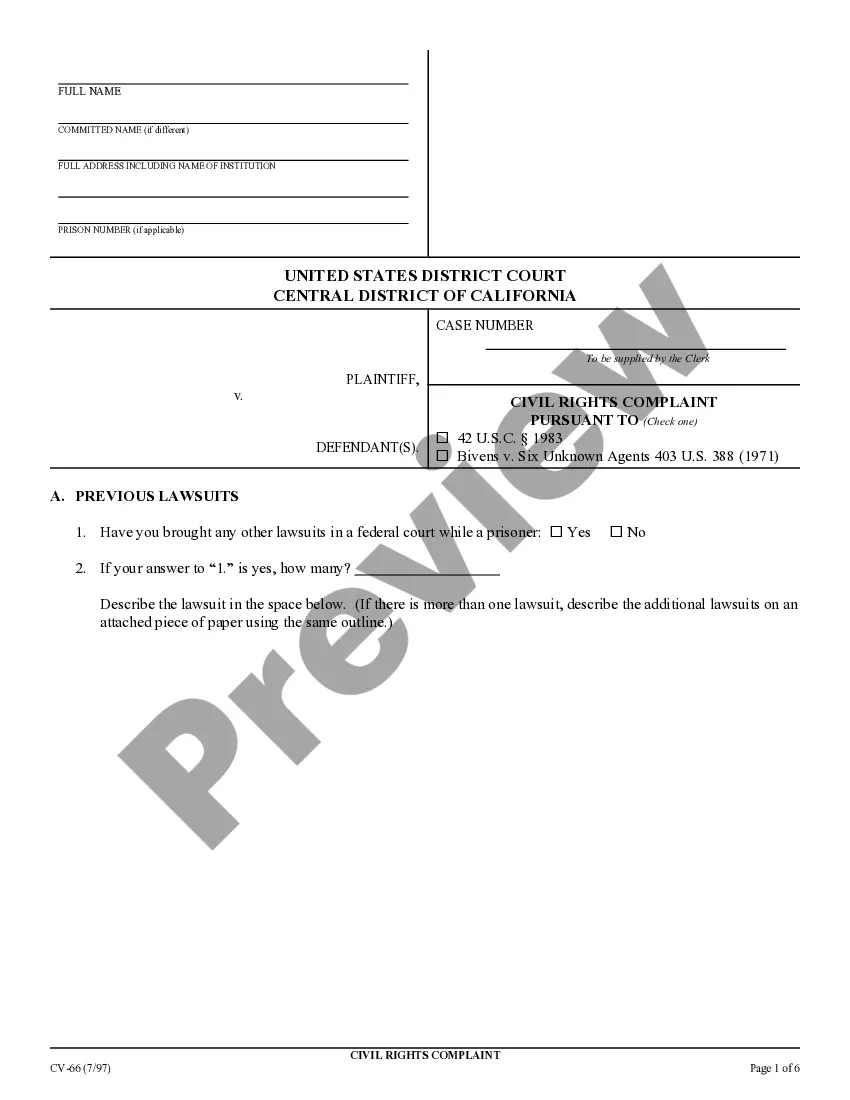

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Wayne Trust Agreement for Pension Plan with Corporate Trustee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!