Cuyahoga Ohio Cash Disbursements and Receipts is a financial record-keeping system used by the government of Cuyahoga County, Ohio, to maintain a detailed account of the money flowing in and out of their organization. This system is crucial for tracking and managing funds, ensuring transparency and accountability in fiscal operations. Cuyahoga Ohio Cash Disbursements refers to the outgoing money from the county government's treasury. It includes payments made to vendors, suppliers, employees' salaries and benefits, utility bills, contractual obligations, and other necessary expenditures. These disbursements are thoroughly documented with supporting invoices, receipts, and transaction records. In contrast, Cuyahoga Ohio Cash Receipts involve the inflow of funds into the county's accounts. This includes revenue generated from various sources, such as taxes, fees, fines, grants, donations, and other income streams. The county utilizes the cash receipts information to create a comprehensive picture of the financial resources available for various public services and initiatives. The subtypes or categories of Cuyahoga Ohio Cash Disbursements and Receipts may vary depending on the specific departments or divisions within the county. Some common types of disbursements and receipts found in Cuyahoga County's financial records may include: 1. General Fund Disbursements and Receipts: This category pertains to the county's primary operating fund, which covers essential services like public safety, human services, infrastructure, and administration. 2. Capital Expenditure Disbursements and Receipts: This involves cash flows related to the acquisition or improvement of long-term assets like buildings, vehicles, equipment, and infrastructure projects. 3. Special Revenue Fund Disbursements and Receipts: These are cash transactions tied to specific revenue sources designated for particular programs or initiatives, such as grants, dedicated taxes, or fees designated for a specific purpose. 4. Debt Service Disbursements and Receipts: Deals with cash activities related to servicing outstanding debt, including interest payments, principal repayments, and bond issuance. 5. Trust Fund Disbursements and Receipts: Involves cash flows managed on behalf of others or held in trust, such as funds set aside for pensions, scholarships, or other designated purposes. 6. Enterprise Fund Disbursements and Receipts: This category accounts for financial activities of self-sustaining operations within the county, such as water utilities, airports, or public transportation services. By effectively categorizing and recording these different types of cash disbursements and receipts, Cuyahoga Ohio ensures accurate and comprehensive financial reporting, enabling informed decision-making and enhancing transparency in their governmental operations.

Cuyahoga Ohio Cash Disbursements and Receipts

Description

How to fill out Cuyahoga Ohio Cash Disbursements And Receipts?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Cuyahoga Cash Disbursements and Receipts, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Cuyahoga Cash Disbursements and Receipts from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Cuyahoga Cash Disbursements and Receipts:

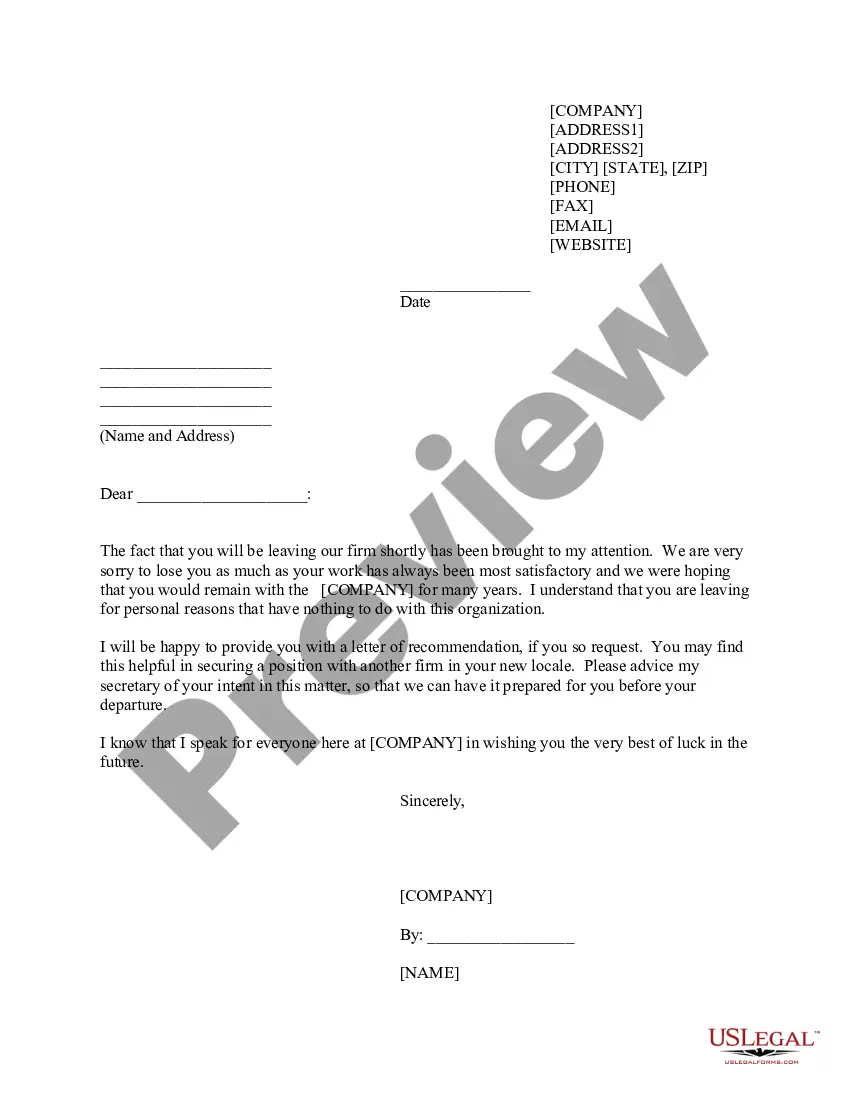

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!