Maricopa, Arizona Cash Disbursements and Receipts Maricopa, Arizona, has a well-established financial system that efficiently manages cash disbursements and receipts within the city. Cash disbursements and receipts refer to the movement of money within an organization or municipality, involving both expenditure and revenue transactions. In Maricopa, various types of cash disbursements and receipts are handled to ensure proper financial management. Let's delve into some of these categories: 1. Government Expenditures: Maricopa, being a city, incurs numerous governmental expenditures to provide essential services to its residents. These disbursements include payroll for public employees, funding for infrastructure and maintenance projects, procurement of goods and services, and payments towards debts and utilities. 2. Public Revenue and Receipts: Maricopa receives revenue through various channels, such as taxes, fees, grants, and intergovernmental transfers. These receipts can be related to sales tax, property tax, utility fees, development impact fees, permits, fines, and licenses. Proper recording and management of these receipts are vital to maintain transparency, track fiscal health, and allocate funds to different city departments effectively. 3. Cash Handling Procedures: Maricopa follows stringent cash handling procedures to ensure the safety and accuracy of cash disbursements and receipts. This includes maintaining proper controls, such as separation of duties, verification processes, and regular audits, to prevent fraudulent activities and minimize errors. 4. Budgeting and Financial Planning: Maricopa's cash disbursements and receipts are closely tied to the city's budgeting and financial planning process. By projecting and allocating resources, the city ensures that expenditures are in line with available funds and revenue projections. This helps maintain financial stability and avoid overspending. 5. Accounting Software and Technology: Maricopa leverages modern accounting software and technology to streamline cash disbursement and receipt processes. These tools facilitate efficient record-keeping, automate transaction entries, generate reports, and provide real-time financial data analysis. The city's financial department utilizes these resources to maintain accurate financial records and ensure accountability. 6. Reporting and Compliance: Maricopa is committed to maintaining transparency in its financial operations and adhering to regulatory guidelines. Regular financial reporting allows for external scrutiny and helps city officials make informed decisions. Compliance with accounting standards, tax regulations, and auditing requirements is maintained to safeguard public funds and ensure proper utilization. Proper management of cash disbursements and receipts is crucial for any municipality, including Maricopa, Arizona. By maintaining accurate records, utilizing modern technology, and adhering to financial controls, the city efficiently handles its financial transactions while ensuring transparency and accountability.

Maricopa Arizona Cash Disbursements and Receipts

Description

How to fill out Maricopa Arizona Cash Disbursements And Receipts?

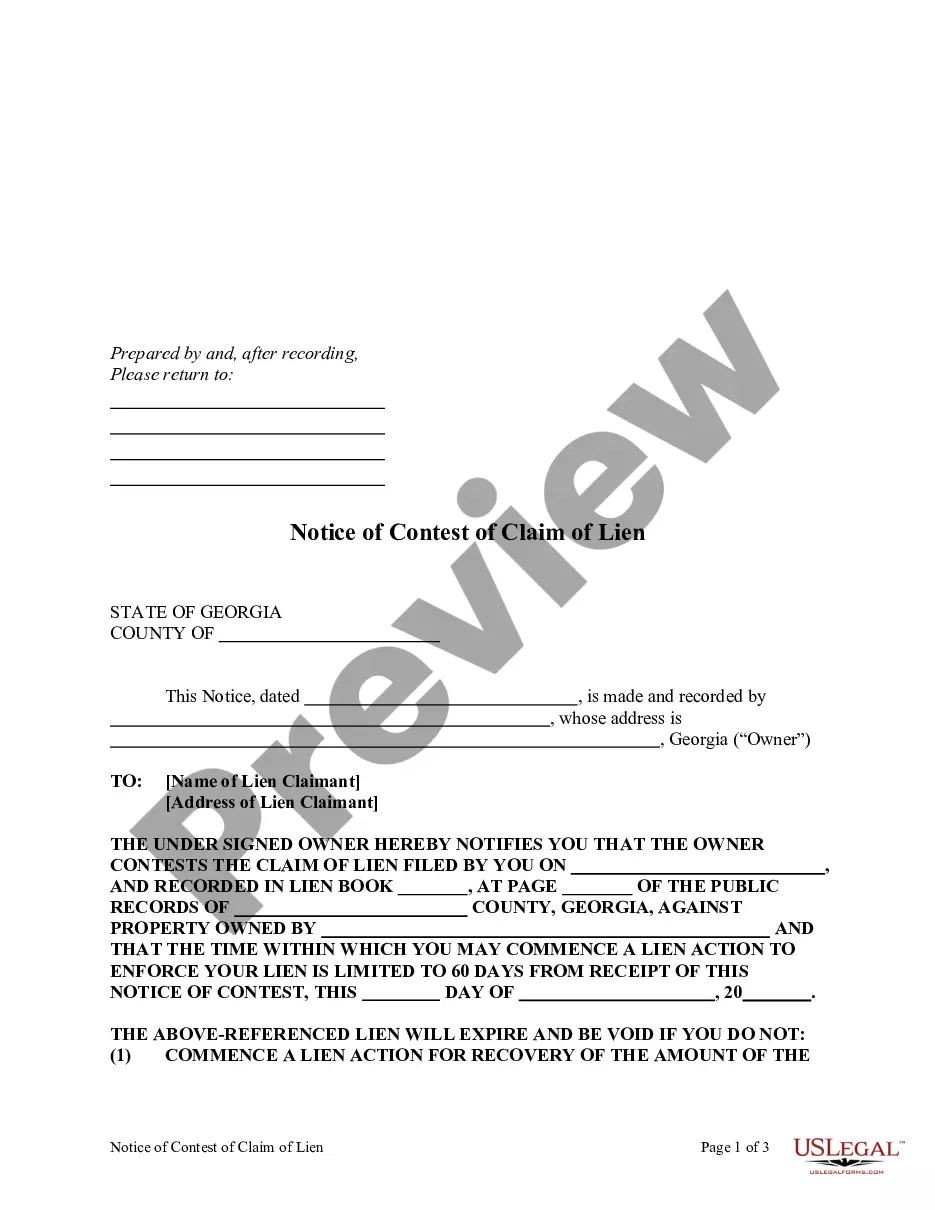

Are you looking to quickly create a legally-binding Maricopa Cash Disbursements and Receipts or maybe any other document to handle your personal or business affairs? You can go with two options: hire a professional to draft a valid document for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Maricopa Cash Disbursements and Receipts and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, double-check if the Maricopa Cash Disbursements and Receipts is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Maricopa Cash Disbursements and Receipts template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the documents we offer are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!