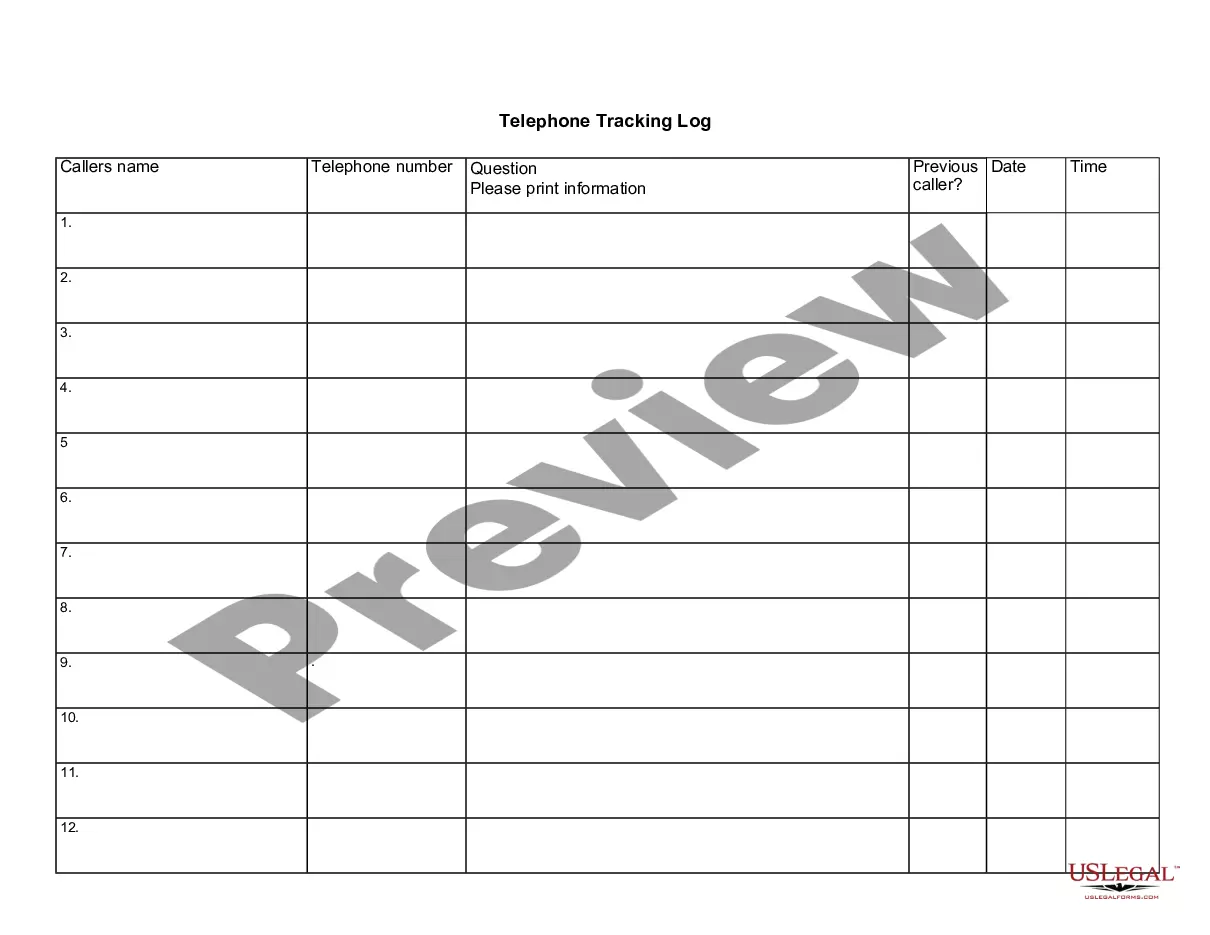

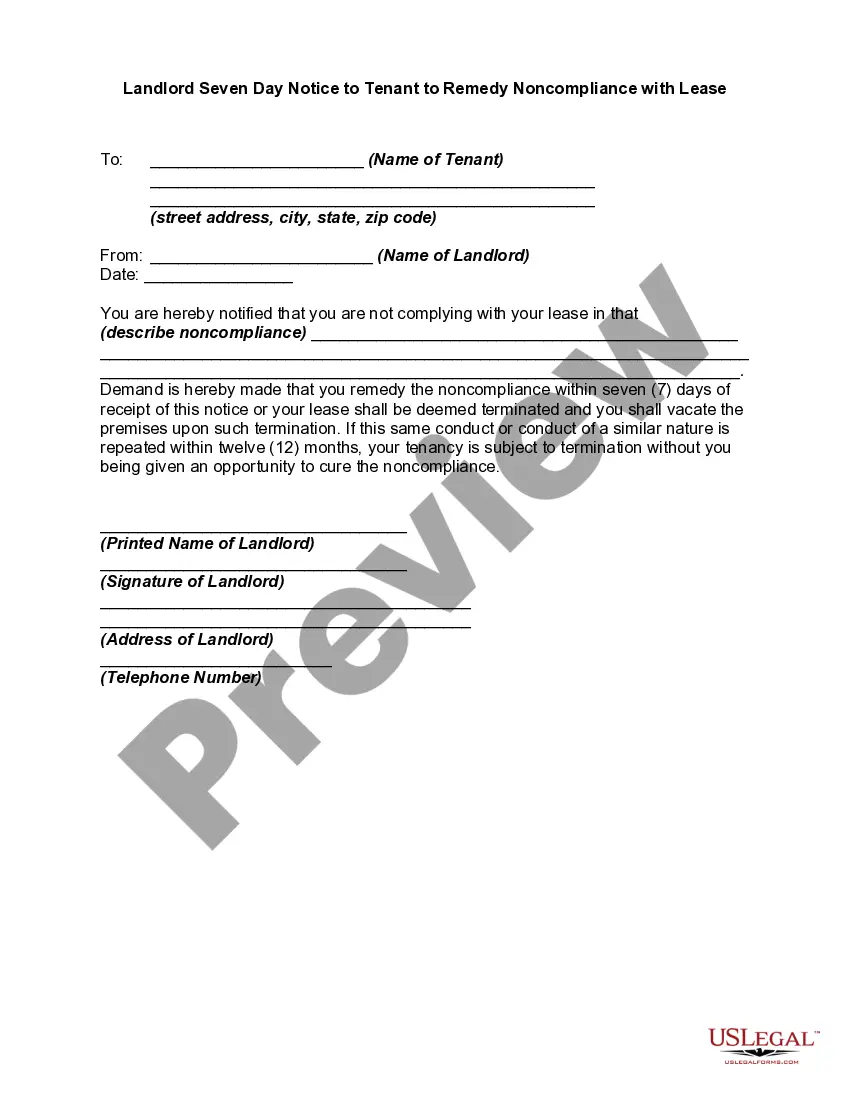

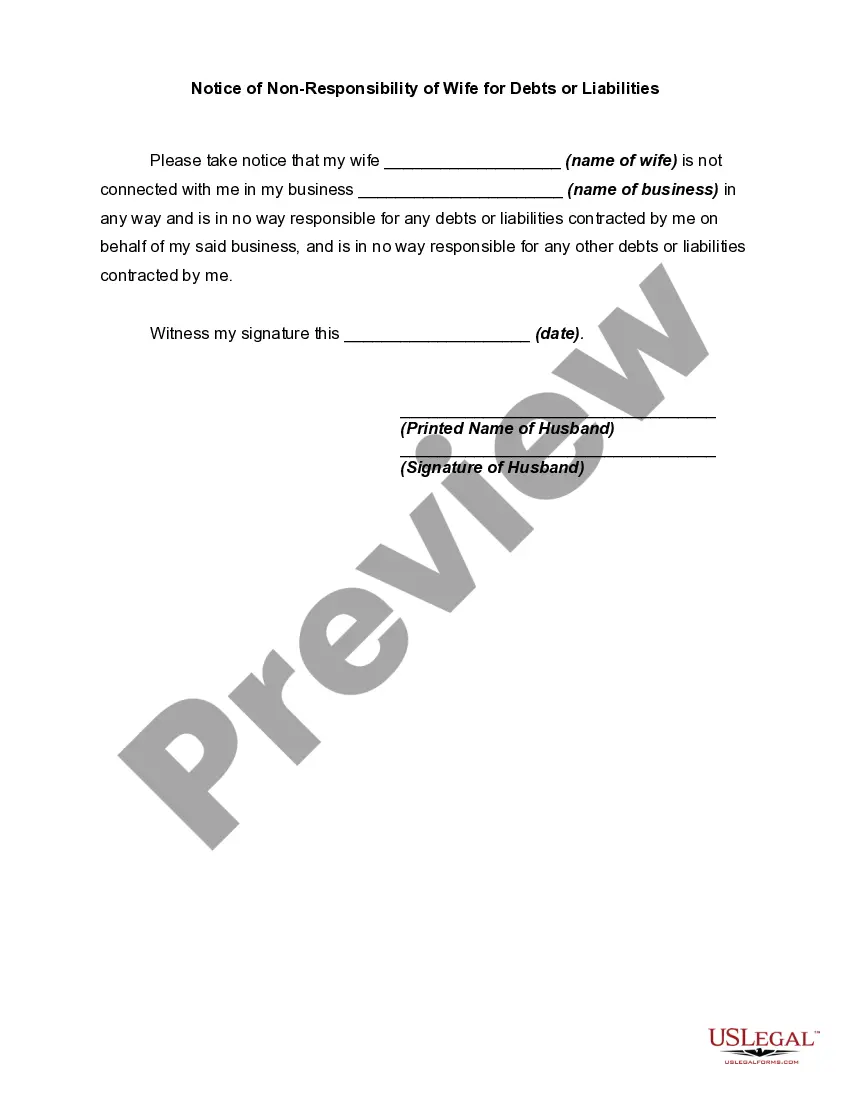

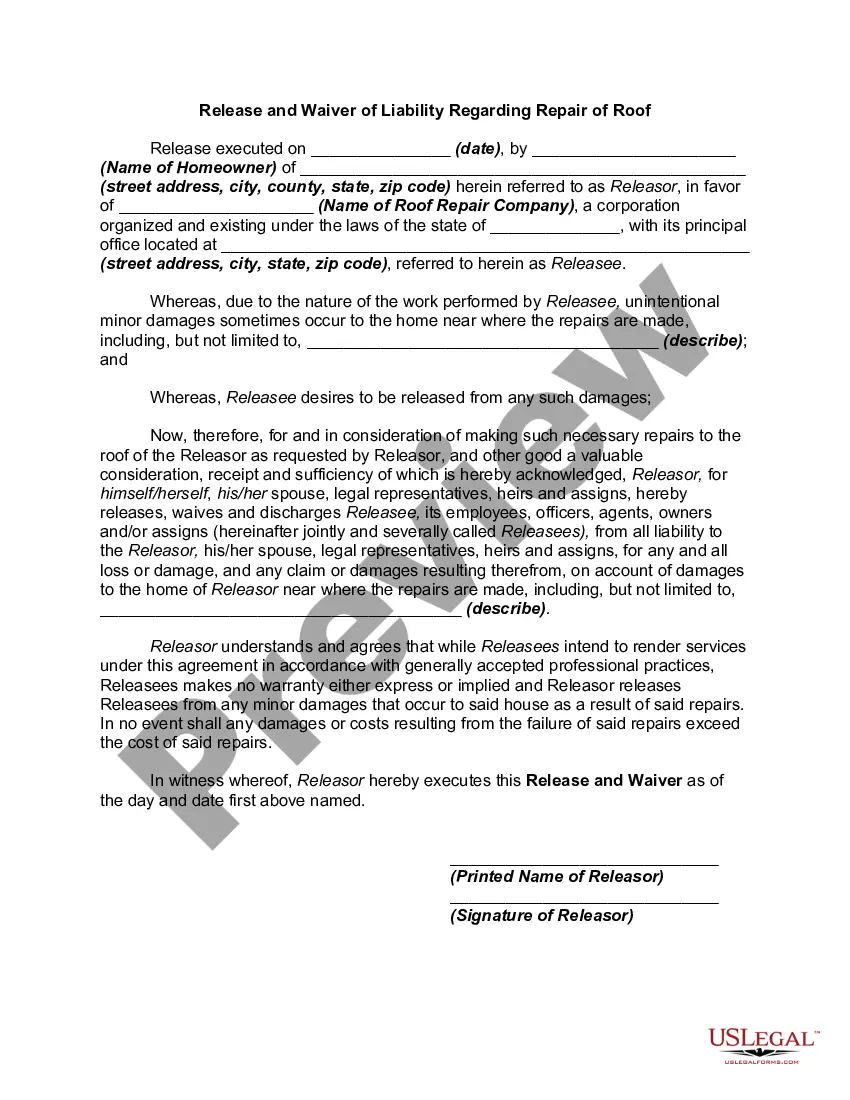

Mecklenburg North Carolina Cash Disbursements and Receipts refer to the financial transactions involving the outgoing and incoming funds in the county of Mecklenburg, North Carolina. These monetary activities play a crucial role in managing the county's finances and ensuring transparency and accountability in the allocation and utilization of funds. Cash disbursements in Mecklenburg County involve the payments made by the county government for various expenses, services, and obligations. These disbursements include payments for employee salaries, vendor invoices, utility bills, contracted services, debt repayments, and other financial obligations. The cash disbursement process ensures that the county fulfills its monetary commitments efficiently and in a timely manner. On the other hand, cash receipts in Mecklenburg County involve the incoming funds received by the county government. These receipts encompass various sources of revenue, such as taxes, fees, fines, grants, donations, and other forms of income generated by the county. Cash receipts play a vital role in maintaining the financial sustainability of Mecklenburg County, as they contribute to its revenue stream and support the provision of necessary public services and infrastructure. Additionally, there may be different types of Mecklenburg North Carolina Cash Disbursements and Receipts, namely: 1. Payroll Disbursements: These are cash disbursements made to county employees as salaries, wages, bonuses, and benefits. 2. Vendor Disbursements: This category includes payments made to vendors and suppliers for goods and services provided to Mecklenburg County. 3. Debt Disbursements: Cash disbursements related to the repayment of loans, bonds, or other forms of debt incurred by the county. 4. Utility Disbursements: Payments made to utility companies for services such as electricity, water, gas, and communication. 5. Contracted Services Disbursements: Cash disbursements for services outsourced by the county, such as maintenance, construction, consulting, or professional services. 6. Tax Receipts: Cash receipts generated from property taxes, sales taxes, income taxes, and other levies imposed by the county to fund its operations. 7. Fee Receipts: This category includes cash receipts from various fees charged by the county, such as licensing fees, permit fees, parking fees, or registration fees. 8. Fine Receipts: Cash receipts from fines collected for violations of county ordinances, traffic violations, or other penalties imposed by the county. 9. Grant Receipts: Cash receipts from grants received by Mecklenburg County from federal, state, or private entities to support specific programs or initiatives. 10. Donation Receipts: Cash receipts resulting from charitable or voluntary contributions made to Mecklenburg County for specific causes, projects, or charitable organizations. The accurate management and recording of Mecklenburg North Carolina Cash Disbursements and Receipts support the county's financial planning, budgeting, and decision-making processes. These practices ensure that the county operates within its means, maintains fiscal responsibility, and provides essential services and infrastructure to its residents while fostering transparency and accountability in its financial operations.

Mecklenburg North Carolina Cash Disbursements and Receipts

Description

How to fill out Mecklenburg North Carolina Cash Disbursements And Receipts?

Creating forms, like Mecklenburg Cash Disbursements and Receipts, to manage your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for a variety of scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Mecklenburg Cash Disbursements and Receipts form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Mecklenburg Cash Disbursements and Receipts:

- Ensure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Mecklenburg Cash Disbursements and Receipts isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and get the form.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!