Nassau County, located in the state of New York, handles various financial transactions, including cash disbursements and receipts. These transactions play a crucial role in maintaining the county's financial stability and ensuring the smooth functioning of its operations. Cash disbursements refer to the outflow of funds from Nassau County, wherein payments are made to suppliers, contractors, employees, or other entities for goods, services, and obligations. These disbursements are meticulously recorded and managed to maintain transparency and accountability in Nassau County's financial activities. Similarly, cash receipts involve the inflow of funds to Nassau County, primarily through sources such as taxes, fees, fines, grants, and revenues derived from county-provided services. Receipts can also include reimbursements or returns related to previous disbursements made by the county. Considering the diverse nature of financial activities in Nassau County, there are different types of cash disbursements and receipts. Some key variations include: 1. Vendor Payments: Nassau County makes cash disbursements to numerous vendors who supply goods or services required for county operations, such as office supplies, equipment, maintenance services, or professional services. 2. Payroll Disbursements: Cash disbursements are made to county employees as salaries, wages, benefits, or reimbursements for work-related expenses. 3. Debt Payments: Nassau County may have outstanding debts, loans, or bonds that require regular disbursements, including principal and interest payments. 4. Grants and Aid: Cash disbursements are made to individuals, organizations, or local governments as grants or aid for various purposes, such as social services, infrastructure development, education, or emergency assistance. 5. Tax and Fee Receipts: Nassau County receives cash payments from residents and businesses in the form of property taxes, sales taxes, income taxes, permits, licenses, and various fees associated with county services. 6. State and Federal Funding: Cash receipts are obtained in the form of grants, reimbursements, or funding from state and federal sources to support specific programs or initiatives within Nassau County. 7. Court-Ordered Payments: Cash receipts can also include fines, penalties, or restitution payments ordered by the courts, which are collected and managed by the county. Accurate tracking and management of these various cash disbursements and receipts are crucial for Nassau County's financial health, budgeting processes, and financial reporting. This ensures that funds are allocated appropriately, financial obligations are met, and the county can effectively provide essential services and meet the needs of its residents and employees.

Nassau New York Cash Disbursements and Receipts

Description

How to fill out Nassau New York Cash Disbursements And Receipts?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Nassau Cash Disbursements and Receipts without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Nassau Cash Disbursements and Receipts on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Nassau Cash Disbursements and Receipts:

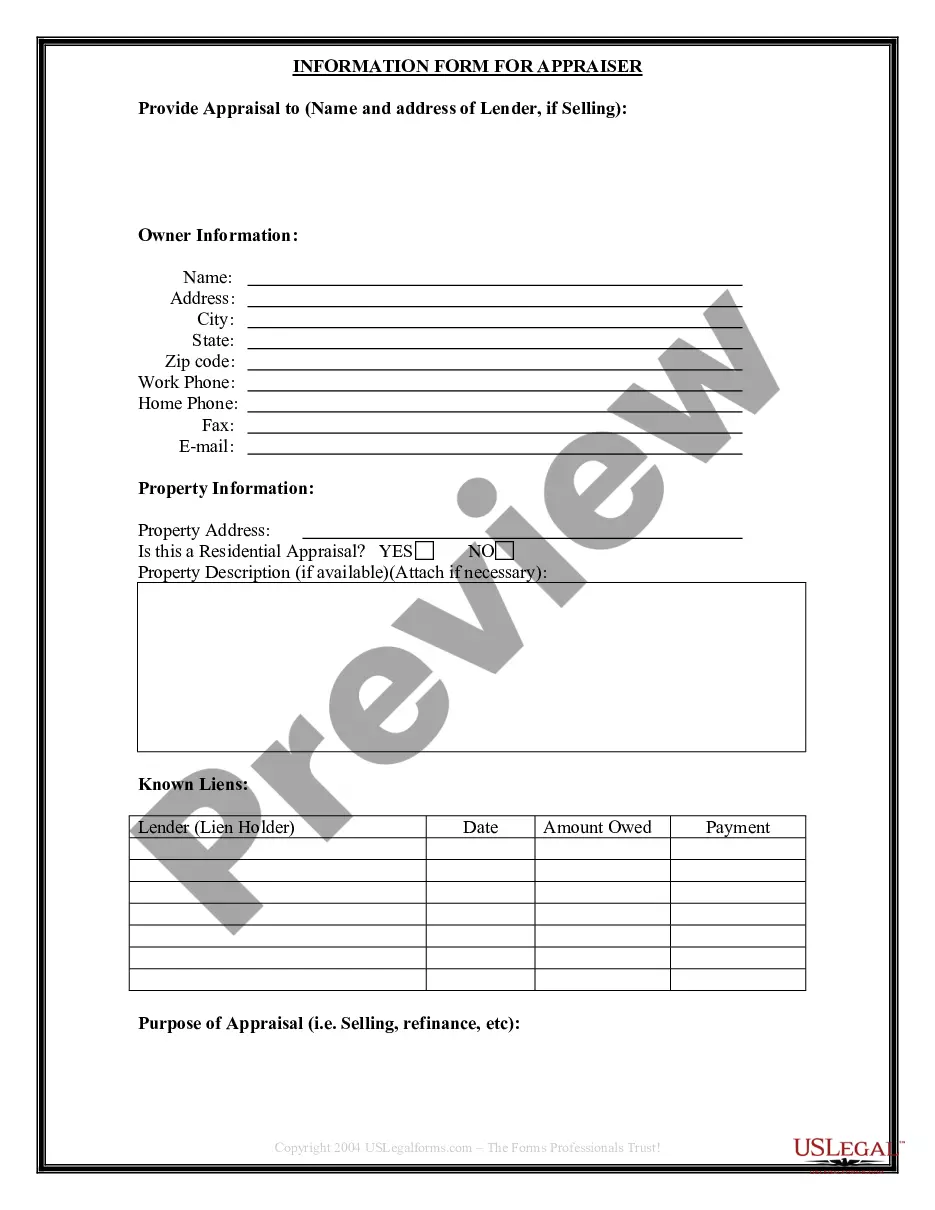

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!