Phoenix Arizona Cash Disbursements and Receipts are essential financial processes that organizations and individuals in Phoenix, Arizona, used to manage their expenses and income effectively. These processes involve the flow of money within an organization or between it and external parties. Understanding the different types of cash disbursements and receipts in Phoenix, Arizona, is crucial for establishing financial control and sustainability. Below are the key categories: 1. Non-Profit Cash Disbursements and Receipts: Non-profit organizations in Phoenix, Arizona, often handle cash disbursements and receipts associated with their operations. This includes expenses for programs, salaries, overhead costs, and donations received. Proper management of cash inflows and outflows is vital for non-profits to fulfill their missions effectively. 2. Business Cash Disbursements and Receipts: In the bustling entrepreneurial environment of Phoenix, Arizona, businesses engage in various cash disbursement and receipt activities. These may involve payments for operational expenses like rent, utilities, inventory, employee wages, insurance, and taxes. On the receipt side, businesses record cash inflows from sales, services rendered, loans, and investments. 3. Government Agency Cash Disbursements and Receipts: Government agencies in Phoenix, Arizona, handle significant cash disbursements and receipts related to public services and administration. These include payments for infrastructure development, public employee salaries, government programs, social welfare, and tax collections. Accurately tracking these transactions is crucial for ensuring accountable use of public funds. 4. Personal Cash Disbursements and Receipts: Cash disbursements and receipts are also integral to individuals' financial management in Phoenix, Arizona. Personal cash disbursements typically include expenses such as mortgage or rent payments, groceries, utilities, healthcare, transportation, and entertainment. On the receipt side, individuals may include income from employment, investments, rental properties, and any other sources. By implementing effective systems for cash disbursements and receipts, organizations and individuals in Phoenix, Arizona, can maintain financial transparency, accuracy, and stability. It is crucial to employ proper accounting practices, use reliable tools and software, and adhere to established financial regulations. Regular monitoring and reconciliation of cash transactions are vital for achieving financial goals and avoiding any potential issues related to mismanagement or fraud.

Phoenix Arizona Cash Disbursements and Receipts

Description

How to fill out Phoenix Arizona Cash Disbursements And Receipts?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Phoenix Cash Disbursements and Receipts, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Phoenix Cash Disbursements and Receipts from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Phoenix Cash Disbursements and Receipts:

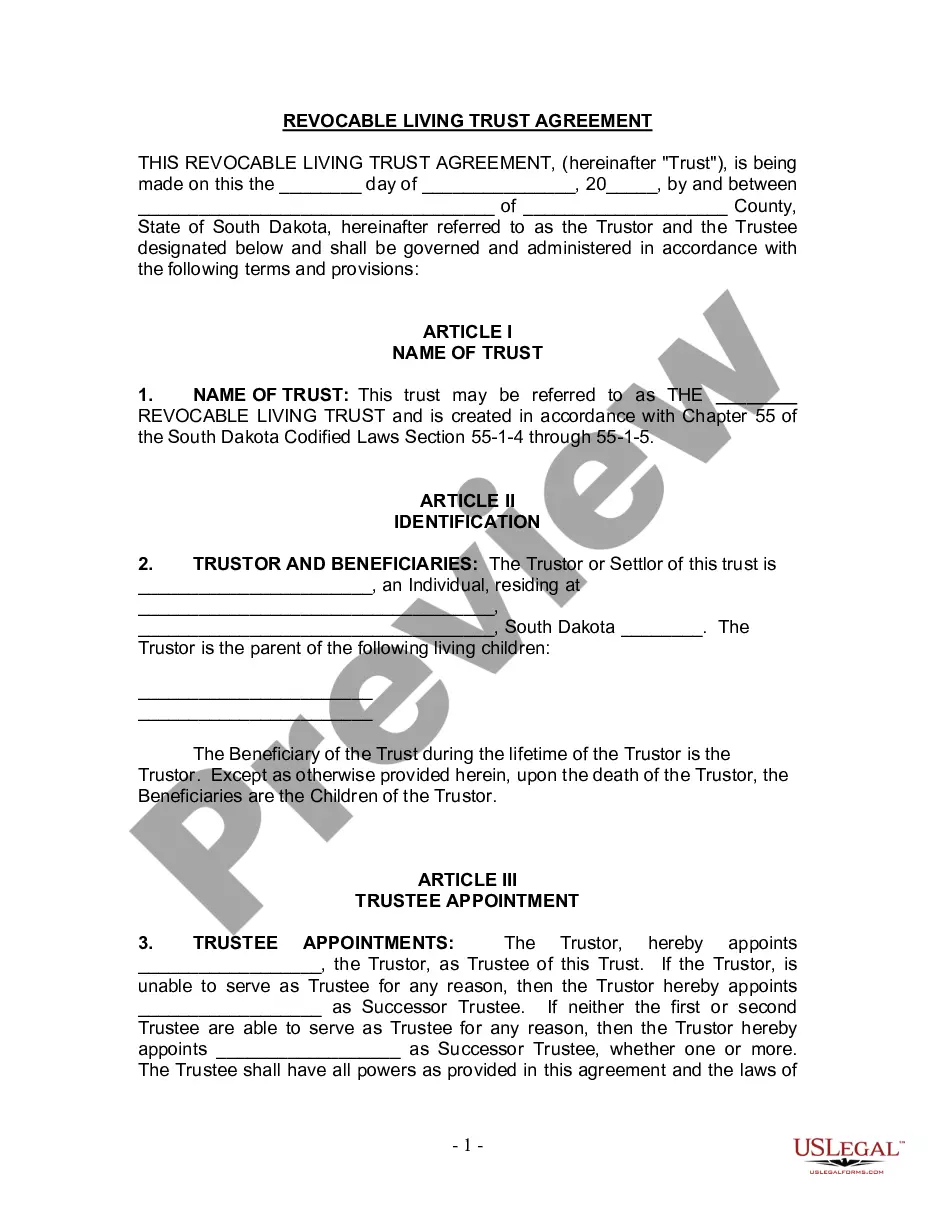

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!