The Maricopa Arizona Cooperative Loan Recognition Agreement is a legal document that outlines the terms and conditions of a loan facility extended to a cooperative in Maricopa, Arizona. This agreement serves as a tool to establish a formal understanding between the lender and the cooperative, ensuring a transparent and lawful borrowing process. The primary objective of this agreement is to recognize the cooperative's responsibility to repay the loan amount, along with any accrued interest, within the agreed-upon timeframe. It specifies the loan amount, interest rate, repayment schedule, and any other applicable charges or fees. Keywords: Maricopa Arizona, cooperative, loan recognition agreement, legal document, terms and conditions, loan facility, lender, borrowing process, repayment schedule, interest rate, charges, fees. Types of Maricopa Arizona Cooperative Loan Recognition Agreements: 1. Basic Cooperative Loan Recognition Agreement: This type of agreement outlines the fundamental elements of the loan, including the loan amount, interest rate, and repayment schedule. It does not include any specific clauses or additional provisions. 2. Modified Cooperative Loan Recognition Agreement: This agreement includes additional clauses to accommodate specific circumstances or requirements of the cooperative. These modifications may include grace periods, early repayment options, or special conditions based on the cooperative's financial situation. 3. Secured Cooperative Loan Recognition Agreement: This type of agreement includes collateral pledged by the cooperative to secure the loan. The collateral can be in the form of real estate, equipment, or any other valuable assets owned by the cooperative. This provides the lender with a sense of security in case of default by the cooperative. 4. Unsecured Cooperative Loan Recognition Agreement: In contrast to a secured agreement, an unsecured agreement does not require collateral. The cooperative's creditworthiness and ability to repay the loan are the main factors considered by the lender. Interest rates on unsecured agreements tend to be higher due to the increased risk for the lender. 5. Rural Cooperative Loan Recognition Agreement: This type of agreement caters specifically to cooperatives located in rural areas of Maricopa, Arizona. It may include provisions that align with the unique challenges and opportunities faced by rural cooperatives, such as agricultural or community-based projects. 6. Startup Cooperative Loan Recognition Agreement: This agreement targets newly formed cooperatives seeking financial assistance to establish their operations. It may offer certain concessions or flexible terms to support the cooperative during its early stages. The agreement might incorporate business plans, market analysis, and detailed projections to assess the cooperative's potential for success. Keywords: basic, modified, secured, unsecured, rural, startup, cooperative, loan recognition agreement, collateral, creditworthiness, grace periods, repayment options, default, interest rates, rural areas, challenges, opportunities, newly formed cooperatives, operations, concession, business plans, market analysis, projections.

Maricopa Arizona Cooperative Loan Recognition Agreement

Description

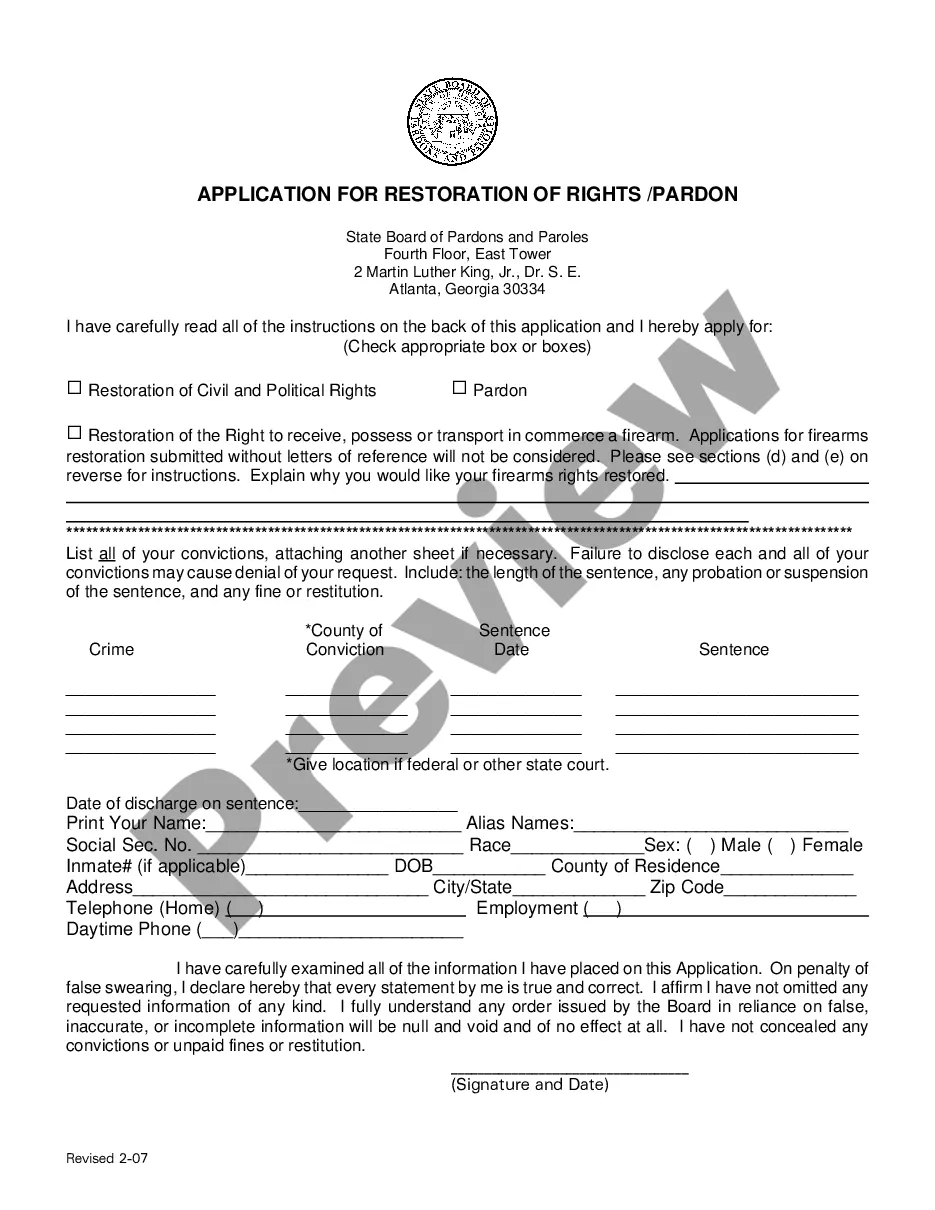

How to fill out Maricopa Arizona Cooperative Loan Recognition Agreement?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Maricopa Cooperative Loan Recognition Agreement, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the current version of the Maricopa Cooperative Loan Recognition Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Cooperative Loan Recognition Agreement:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Maricopa Cooperative Loan Recognition Agreement and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!