Salt Lake Utah Cooperative Loan Recognition Agreement, also known as the Salt Lake Cooperative Loan Recognition Agreement (SLC ERA), is a legally binding document that outlines the terms and conditions of a cooperative loan in Salt Lake City, Utah. This agreement is typically entered into by a cooperative organization, such as a housing cooperative or a cooperative business, and a financial institution. The SLC ERA establishes the relationship between the cooperative and the lender, outlining the rights and obligations of both parties involved in the loan. It ensures clarity and transparency in the borrowing process, protecting the interests of both the cooperative and the lender. Some key components covered in the Salt Lake Utah Cooperative Loan Recognition Agreement include: 1. Loan Amount and Repayment: The agreement specifies the exact amount of the loan provided by the lender to the cooperative and outlines the repayment terms, including interest rates, installment schedules, and any penalties for late payments. 2. Loan Purpose: It describes the purpose of the loan, whether it is for capital improvements, property acquisition, operating expenses, or any other specific cooperative-related project. 3. Collateral and Security: The agreement may detail the collateral pledged by the cooperative to secure the loan, such as real estate assets, shares, or any other valuable cooperative-owned property. It also defines the conditions under which the lender can enforce their security interests in case of default. 4. Covenants and Restrictions: The SLC ERA includes various covenants and restrictions that the cooperative must adhere to, such as maintaining adequate insurance coverage, providing financial statements periodically, and obtaining lender consent for significant changes in the cooperative's operations or structure. 5. Default and Remedies: The agreement outlines the consequences of default, including potential remedies available to the lender, such as accelerating the loan, imposing additional fees, or initiating legal action. There may be different types or variations of Salt Lake Utah Cooperative Loan Recognition Agreement, depending on the specific purpose or unique requirements of the cooperative. These may include: 1. Construction Loan Recognition Agreement: If the loan is intended for the construction or renovation of cooperative-owned properties or facilities, a specific agreement may be drafted to address the unique considerations related to the construction process. 2. Bridge Loan Recognition Agreement: In cases where a cooperative requires short-term financing to bridge the gap between the purchase of a new property and the sale of an existing one, a bridge loan agreement may be executed. It outlines the terms and conditions for a temporary loan, typically with higher interest rates, until permanent financing is secured. 3. Refinance Loan Recognition Agreement: If a cooperative seeks to refinance an existing loan with improved terms or to consolidate multiple debts, a refinancing agreement may be used to document the new loan terms and repayment arrangements. In conclusion, the Salt Lake Utah Cooperative Loan Recognition Agreement is a comprehensive legal document that establishes the terms and conditions of a cooperative loan in Salt Lake City, Utah. It addresses various aspects including loan amount, repayment terms, collateral, covenants, default provisions, and remedies. Different variations of this agreement may exist to cater to specific cooperative loan purposes or circumstances.

Salt Lake Utah Cooperative Loan Recognition Agreement

Description

How to fill out Salt Lake Utah Cooperative Loan Recognition Agreement?

If you need to find a trustworthy legal form provider to get the Salt Lake Cooperative Loan Recognition Agreement, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to find and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Salt Lake Cooperative Loan Recognition Agreement, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

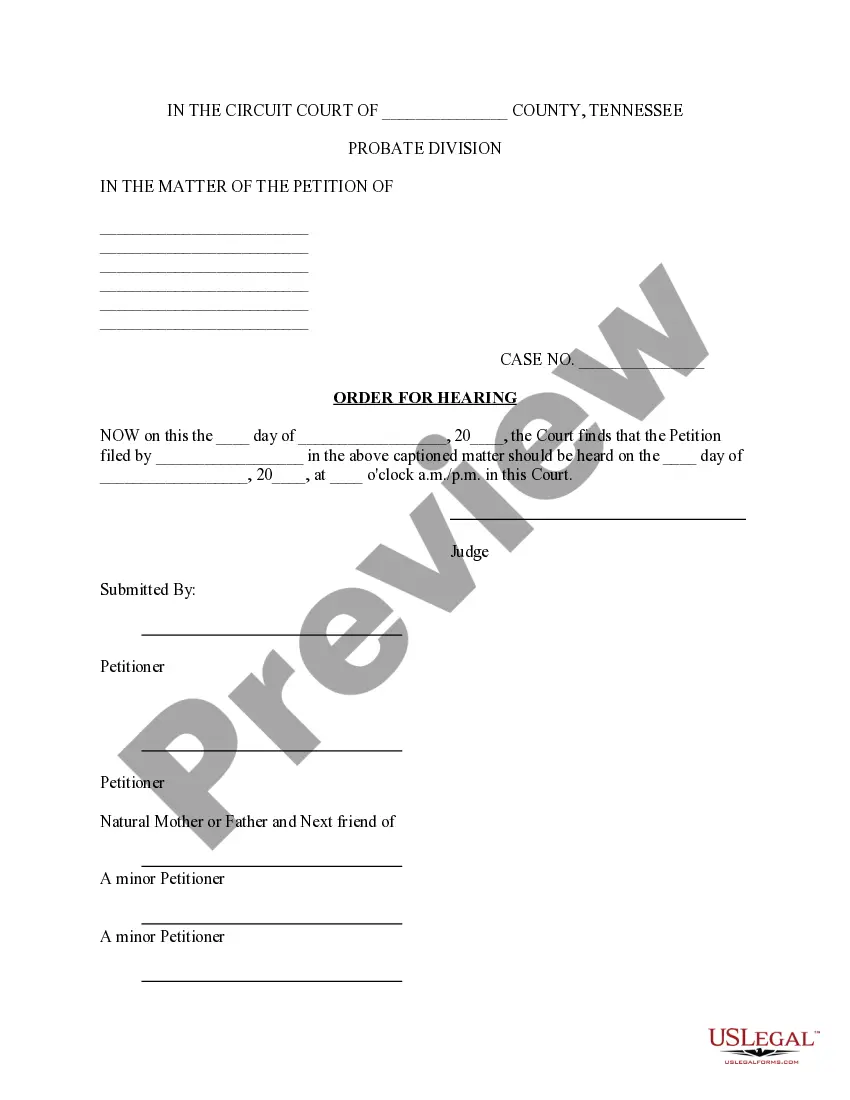

Don't have an account? It's effortless to start! Simply find the Salt Lake Cooperative Loan Recognition Agreement template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Salt Lake Cooperative Loan Recognition Agreement - all from the comfort of your home.

Sign up for US Legal Forms now!