San Diego California Cooperative Loan Recognition Agreement is a legally binding contract that outlines the terms and conditions between a cooperative and a lending institution. This agreement serves as recognition by the cooperative to support the loan application of its members, ensuring a smooth borrowing process. The recognition agreement is crucial in providing the lending institution with the necessary assurance that the cooperative will cooperate with loan repayment obligations if a member defaults. It establishes a working relationship between the cooperative and the lender, creating a sense of trust and lowering the risk associated with cooperative loans. This agreement typically includes several key provisions, such as: 1. Loan Recognition: The agreement clearly acknowledges the lending institution's loan terms and the cooperative's commitment to support its members in obtaining loans. 2. Default Responsibility: It outlines the cooperative's responsibility in managing any loan default situations, such as notifying the lender promptly and potentially facilitating loan repayment on behalf of the member. 3. Member Eligibility: The agreement may specify eligibility criteria for cooperative members to access loans, ensuring compliance with relevant regulations and cooperative bylaws. 4. Confidentiality: It emphasizes the importance of maintaining the confidentiality of member information shared with the lending institution, safeguarding their privacy rights. 5. Termination Clause: This clause defines the conditions under which the agreement can be terminated, such as non-compliance with the agreed terms or changes in the cooperative's bylaws. Different types of San Diego California Cooperative Loan Recognition Agreements may include variations based on the nature of the cooperative and the lending institution. Some specific types could include: 1. Agricultural Cooperative Loan Recognition Agreement: Tailored for agricultural cooperatives, this type of agreement acknowledges the unique financing needs of farmers and agricultural businesses. 2. Housing Cooperative Loan Recognition Agreement: Designed for housing cooperatives, this agreement takes into account the specific requirements and regulations related to cooperative housing projects. 3. Worker Cooperative Loan Recognition Agreement: This type of agreement addresses the distinct financing needs of worker-owned cooperatives, ensuring that the cooperative's members receive equitable access to loans in support of their cooperative enterprise. 4. Consumer Cooperative Loan Recognition Agreement: Tailored for consumer cooperatives, this agreement focuses on cooperative financing for goods and services provided by the cooperative to its members, ensuring beneficial loan terms. In summary, the San Diego California Cooperative Loan Recognition Agreement is an essential document that establishes a mutually beneficial relationship between a cooperative and a lending institution. It provides confidence to lenders by outlining the cooperative's commitment to support its members' loan applications, ultimately enabling cooperative members to access necessary financial resources.

San Diego California Cooperative Loan Recognition Agreement

Description

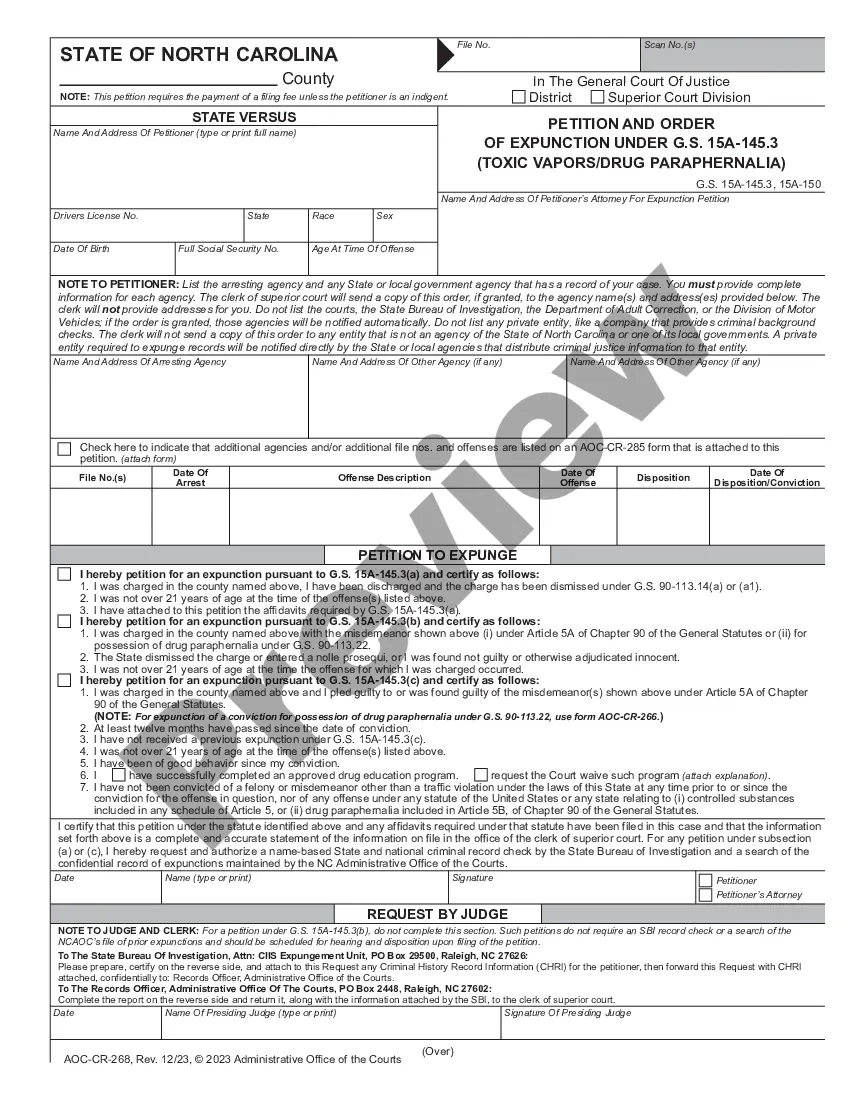

How to fill out San Diego California Cooperative Loan Recognition Agreement?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the San Diego Cooperative Loan Recognition Agreement.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the San Diego Cooperative Loan Recognition Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the San Diego Cooperative Loan Recognition Agreement:

- Ensure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the San Diego Cooperative Loan Recognition Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Your lender will provide you with three originals of the Aztech Recognition Agreement for you to fill out. The bank will have already signed them, so after you sign and complete them, you will submit the forms with your co-op application to the board. Thereafter, a member of the co-op board will sign the agreement.

An Aztec form is an agreement between three parties: the bank, the co-op and the shareholder. It is primarily an understanding between the co-op corporation and the bank lender which is signed and acknowledged by the shareholder.

Recognition Agreement means, an agreement among a Co-op Corporation, a lender and a Mortgagor with respect to a Co-op Loan whereby such parties (i) acknowledge that such lender may make, or intends to make, such Co-op Loan, and (ii) make certain agreements with respect to such Co-op Loan.

Recognition Agreement . An agreement whereby a Cooperative and a lender with respect to a Cooperative Loan (i) acknowledge that such lender may make, or intends to make, such Cooperative Loan, and (ii) make certain agreements with respect to such Cooperative Loan.

Did you know that it's possible to refinance your co-op mortgage? Most co-op owners never even consider this possibility, but it's one that could potentially save you money with a lower interest rate, or allow you to pull out cash in order to achieve some other goals such as education or other investments.

Review your co-op's bylaws.Draft a letter of intent to drop your membership and leave the co-op.Sign your letter of intent in front of a notary.Meet with co-op officials within a week of your move out date.Pack your belongings ahead of time.

An "Aztech Recognition Agreement" or "Aztec Form" is an agreement between you, your lender and the co-op and establishes what happens if you stop making maintenance and/or mortgage payments. It is required when financing the purchase of a co-op. While you do sign the Aztec, it's really just an acknowledgement.

A recognition agreement names the union or unions who have rights to represent and negotiate on behalf of employees in that workplace. It will make clear whether a particular union has sole negotiating rights for a bargaining group, or whether the employer recognises two or more unions jointly.

Like banks, co-ops set rules about how much shareholders can borrow, often tying the loan to the value of the apartment and your debt-to-income ratio. But, most co-ops do allow cash-out refinances or HELOCs.

An Aztech Recognition Agreement or an Aztech form is a tri-lateral contract between the buyer of a co-op, the buyer's bank and the co-op corporation that is required if a buyer wishes to purchase a coop apartment with financing.