Title: Understanding Fairfax Virginia's Independent Sales Representative Agreement with Developer of Computer Software to Comply with IRS's 20-Part Test for Independent Contractor Status Keywords: Fairfax Virginia, independent sales representative agreement, developer of computer software, Internal Revenue Service, 20-Part Test, independent contractor status Introduction: In Fairfax Virginia, Independent Sales Representative Agreements are crucial contracts between a developer of computer software and independent sales representatives. These agreements are designed to satisfy the Internal Revenue Service's 20-Part Test for Determining Independent Contractor Status. Let's delve into the details of these agreements and explore any potential variations. 1. Importance of Independent Sales Representative Agreement: A Fairfax Virginia Independent Sales Representative Agreement is a legally binding contract that establishes the relationship between a software developer and an independent sales representative. This agreement outlines the responsibilities, obligations, and compensation terms for both parties involved. 2. Role of the Developer of Computer Software: The developer of computer software creates and/or owns the software product that the independent sales representative will promote and sell. This could include any type of software, such as enterprise solutions, mobile applications, or specialized software for a particular industry. 3. Role of the Independent Sales Representative: The independent sales representative acts as a separate entity, offering their services to market and sell the software products. They are not considered employees of the software developer but rather independent contractors. The agreement ensures both parties understand and agree upon the representative's responsibilities and compensation structure. 4. IRS's 20-Part Test for Determining Independent Contractor Status: To comply with the Internal Revenue Service's regulations, the Fairfax Virginia Independent Sales Representative Agreements must adhere to the 20-Part Test for Determining Independent Contractor Status. This test evaluates various factors that help determine whether an individual should be classified as an independent contractor or an employee. Different Types of Fairfax Virginia Independent Sales Representative Agreements: A. Commission-Based Agreement: This agreement stipulates that the independent sales representative is compensated based on a percentage of the sales they generate. It outlines the commission structure and any specific terms related to bonuses, quotas, or sales targets. B. Geographic Territory Agreement: This agreement specifies the geographical area or territory where the independent sales representative has the exclusive right to market and sell the software products. It may also outline any restrictions or limitations applicable to the territory. C. Exclusive Representation Agreement: In this agreement, the independent sales representative is granted exclusive representation rights for the software products in a specific market or industry segment. This exclusivity ensures that no other representative can market the same products in the designated region. D. Non-Compete Agreement: A non-compete agreement prevents the independent sales representative from working with competing software developers during the contract's term and for a certain period afterward. It helps protect the developer's intellectual property and market share. In conclusion, Fairfax Virginia Independent Sales Representative Agreements with Developers of Computer Software are essential to establish a mutually beneficial relationship while complying with the IRS's 20-Part Test for Independent Contractor Status. Various types of these agreements exist, each tailored to specific requirements and circumstances to ensure a fair and compliant business relationship between the parties involved.

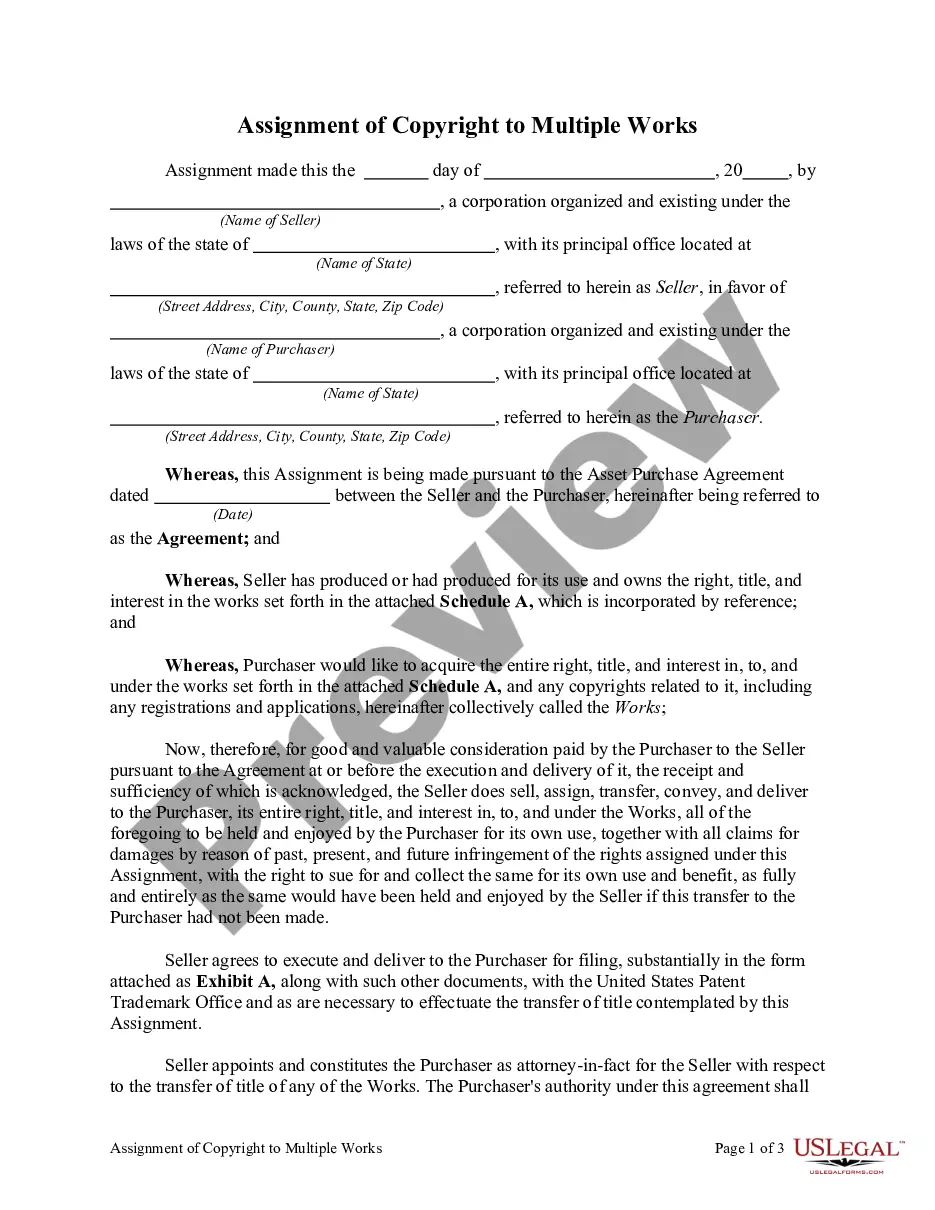

Fairfax Virginia Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Fairfax Virginia Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Fairfax Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Fairfax Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Fairfax Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!