The Maricopa Arizona Revenue Sharing Agreement is a contractual arrangement that outlines the terms and conditions for sharing revenue generated from the licensing and custom modification of software in Maricopa, Arizona. This agreement is designed to provide a fair distribution of income between the parties involved, typically the software owner or developer and the licensee. One type of Maricopa Arizona Revenue Sharing Agreement is a licensing agreement. This agreement grants the licensee the right to use the software for a fee or royalty payment. The revenue generated from the licensing of the software is shared between the software owner and the licensee, as per the terms specified in the agreement. This type of agreement is commonly used when a software owner wants to monetize their intellectual property by granting others the right to use it. Another type of Maricopa Arizona Revenue Sharing Agreement is a custom modification agreement. In this scenario, the software owner allows the licensee to modify the software to meet their specific needs or requirements. The revenue generated from the custom modifications is shared between the software owner and the licensee based on the agreed sharing terms. This type of agreement is often used when businesses require tailored software solutions but do not have the expertise or resources to develop them from scratch. The Maricopa Arizona Revenue Sharing Agreement ensures that both parties are fairly compensated for their contributions to the software's commercial success. It typically specifies the percentage or formula for revenue division, payment schedules, conditions for termination, and any other relevant terms and conditions. It may also include provisions for dispute resolution, intellectual property rights, confidentiality, and non-competition. By entering into a Maricopa Arizona Revenue Sharing Agreement, both the software owner and the licensee can benefit from the success of the licensed software. The software owner receives revenue for granting usage rights or allowing custom modifications, while the licensee gains access to valuable software solutions without the need for extensive development efforts. This type of agreement fosters collaboration and mutually beneficial partnerships in the software industry, driving innovation and economic growth.

Maricopa Arizona Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

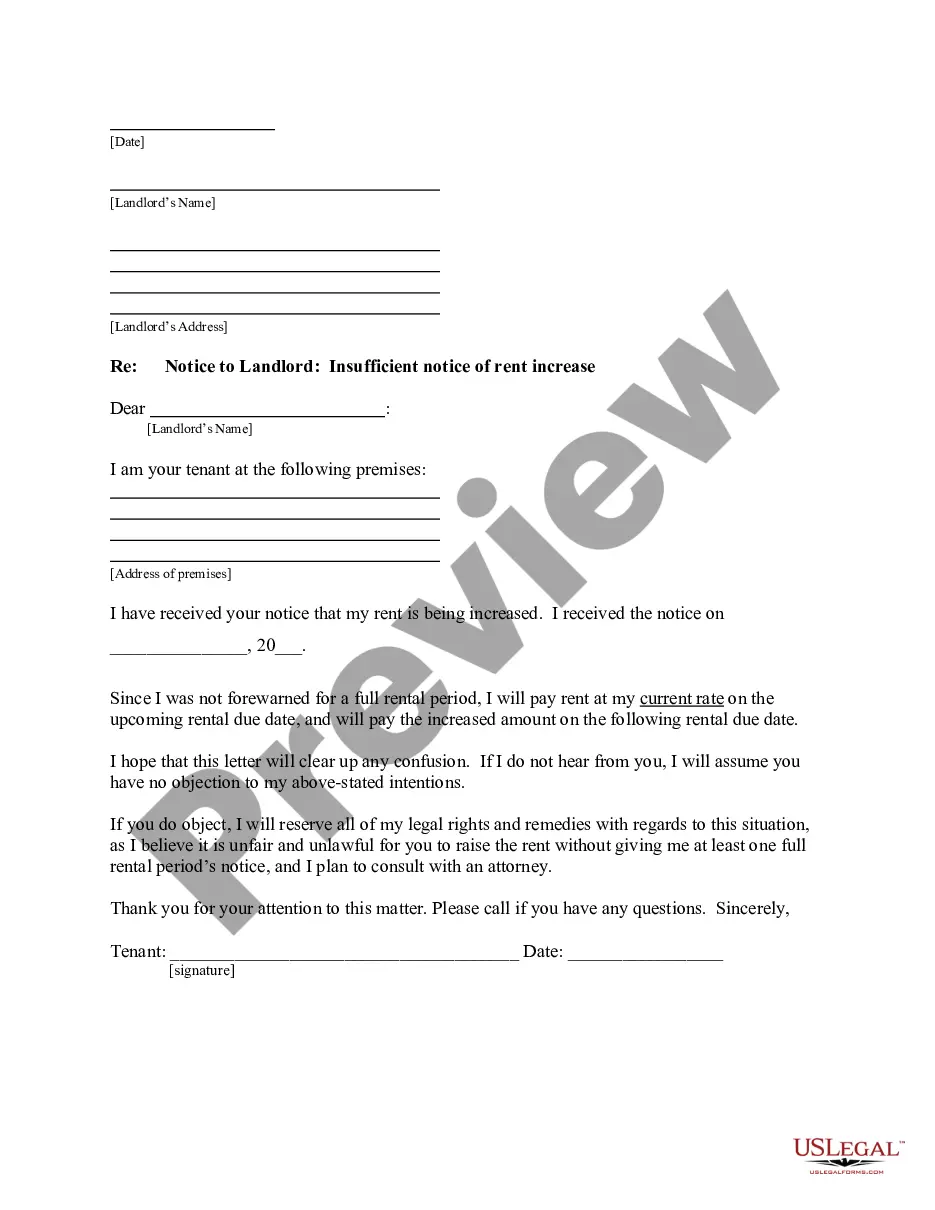

How to fill out Maricopa Arizona Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Maricopa Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Maricopa Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Maricopa Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Maricopa Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Sales of custom software - downloaded are exempt from the sales tax in Arizona. In the state of Arizona, the charges for the modification of any sort of prewritten software intended for the use of an individual customer are considered to be exempt so long as the are separately stated on the sales invoice and records.

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.

In the state of Arizona, the agreement is required to be sold as a separate and distinct item and separately stated on sales invoice. Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in Arizona.

Arizona broadly defines tangible personal property. Digital goods are considered included in that definition by Arizona DOR and are taxable in Arizona as tangible personal property.

A revenue sharing agreement is a legal document between two parties where one party has to pay a percentage of profits or revenues received to the other for the rights to use something.

Arizona generally requires sales tax on Software-as-a-Service.

Taxpayer's proceeds from software maintenance is subject to tax under A.R.S. § 42-5061 unless an exemption applies.

Arizona does impose sales and use tax on SaaS and cloud computing. Prewritten computer software or canned software, which includes software that may have originally been written for one specific customer but becomes available to others, are also taxable and considered sales of tangible personal property.

Sales of custom software - downloaded are exempt from the sales tax in Arizona. In the state of Arizona, the charges for the modification of any sort of prewritten software intended for the use of an individual customer are considered to be exempt so long as the are separately stated on the sales invoice and records.

Interesting Questions

More info

MoneyGram is not a credit union. It is a money transfer business. In order to offer service to consumers and business customers alike, MoneyGram has established a rigorous anti-money laundering program. MoneyGram is not affiliated with the Better Business Bureau and the Financial Industry Regulatory Authority.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.