Miami-Dade Florida Revenue Sharing Agreement is a legal contract that outlines the terms and conditions regarding the distribution of income generated from licensing and custom modification of software. This agreement enables parties involved, such as the software developers and the county of Miami-Dade, to collaborate and share the profits obtained from software licensing and customization activities. The revenue sharing agreement ensures a fair and transparent distribution of income between the parties. It governs the rights and obligations of each participant, establishing guidelines for revenue calculation, payment schedules, and dispute resolution mechanisms. This legal document serves as a blueprint for a mutually beneficial partnership between software developers and the county. Keywords: Miami-Dade Florida, revenue sharing agreement, income, licensing, custom modification, software, legal contract, terms and conditions, distribution, profits, collaboration, software developers, county, fair, transparent, partnership. Different types of Miami-Dade Florida Revenue Sharing Agreements related to income from the licensing and custom modification of software can include: 1. Exclusive Revenue Sharing Agreement: This type of agreement grants exclusive rights to a software developer to license and customize their software exclusively for the county of Miami-Dade. In exchange, the developer shares a certain percentage of the income derived from these activities with the county. 2. Non-Exclusive Revenue Sharing Agreement: In this scenario, multiple software developers can enter into separate agreements with the county of Miami-Dade to license and modify their software. Each developer shares a certain portion of the income generated from their specific software with the county. 3. Revenue Sharing and Support Agreement: This type of agreement not only encompasses the sharing of income but also includes provisions for technical support, maintenance, and updates. It ensures that the software remains functional and up-to-date during the licensing and customization process. 4. Licensing and Royalty Agreement: Although not strictly categorized as a revenue sharing agreement, this type of agreement can be relevant in the context of software licensing in Miami-Dade. It governs the payment of royalties to the software developer for each license sold or used by the county. 5. Customization and Services Agreement: This agreement focuses mainly on the custom modification of software to fit the specific needs of the county of Miami-Dade. It outlines the scope of customization, payment terms, and any additional services required by the county. By carefully drafting and signing a Miami-Dade Florida Revenue Sharing Agreement, software developers and the county can ensure a seamless and mutually beneficial relationship while maximizing their earnings from software licensing and customization efforts.

Miami-Dade Florida Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-13066BG

Format:

Word;

Rich Text

Instant download

Description

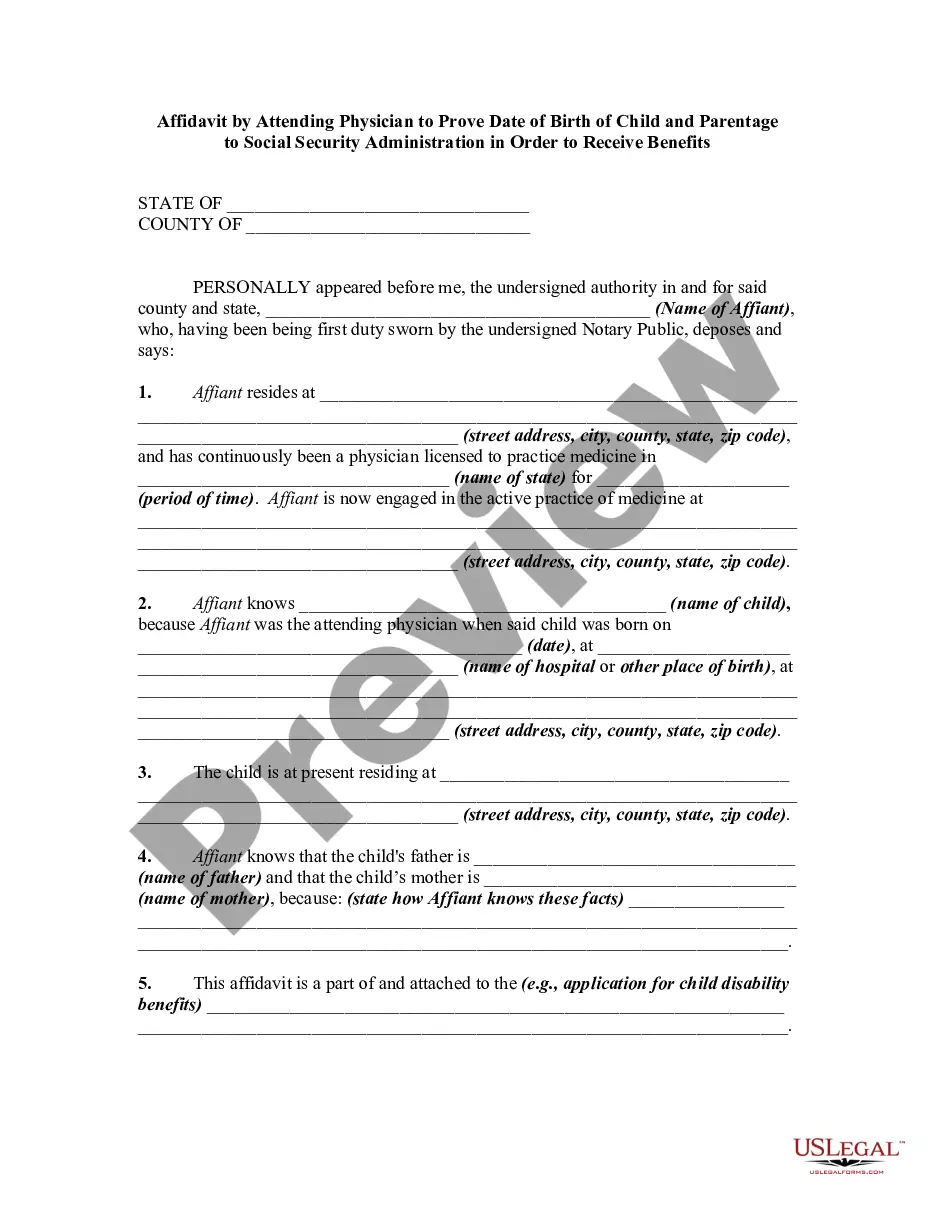

This sample form is for use in the software industry.

Miami-Dade Florida Revenue Sharing Agreement is a legal contract that outlines the terms and conditions regarding the distribution of income generated from licensing and custom modification of software. This agreement enables parties involved, such as the software developers and the county of Miami-Dade, to collaborate and share the profits obtained from software licensing and customization activities. The revenue sharing agreement ensures a fair and transparent distribution of income between the parties. It governs the rights and obligations of each participant, establishing guidelines for revenue calculation, payment schedules, and dispute resolution mechanisms. This legal document serves as a blueprint for a mutually beneficial partnership between software developers and the county. Keywords: Miami-Dade Florida, revenue sharing agreement, income, licensing, custom modification, software, legal contract, terms and conditions, distribution, profits, collaboration, software developers, county, fair, transparent, partnership. Different types of Miami-Dade Florida Revenue Sharing Agreements related to income from the licensing and custom modification of software can include: 1. Exclusive Revenue Sharing Agreement: This type of agreement grants exclusive rights to a software developer to license and customize their software exclusively for the county of Miami-Dade. In exchange, the developer shares a certain percentage of the income derived from these activities with the county. 2. Non-Exclusive Revenue Sharing Agreement: In this scenario, multiple software developers can enter into separate agreements with the county of Miami-Dade to license and modify their software. Each developer shares a certain portion of the income generated from their specific software with the county. 3. Revenue Sharing and Support Agreement: This type of agreement not only encompasses the sharing of income but also includes provisions for technical support, maintenance, and updates. It ensures that the software remains functional and up-to-date during the licensing and customization process. 4. Licensing and Royalty Agreement: Although not strictly categorized as a revenue sharing agreement, this type of agreement can be relevant in the context of software licensing in Miami-Dade. It governs the payment of royalties to the software developer for each license sold or used by the county. 5. Customization and Services Agreement: This agreement focuses mainly on the custom modification of software to fit the specific needs of the county of Miami-Dade. It outlines the scope of customization, payment terms, and any additional services required by the county. By carefully drafting and signing a Miami-Dade Florida Revenue Sharing Agreement, software developers and the county can ensure a seamless and mutually beneficial relationship while maximizing their earnings from software licensing and customization efforts.

Free preview